Ohio Medicaid Qualified Income Trust Form

What is the Ohio Medicaid Qualified Income Trust

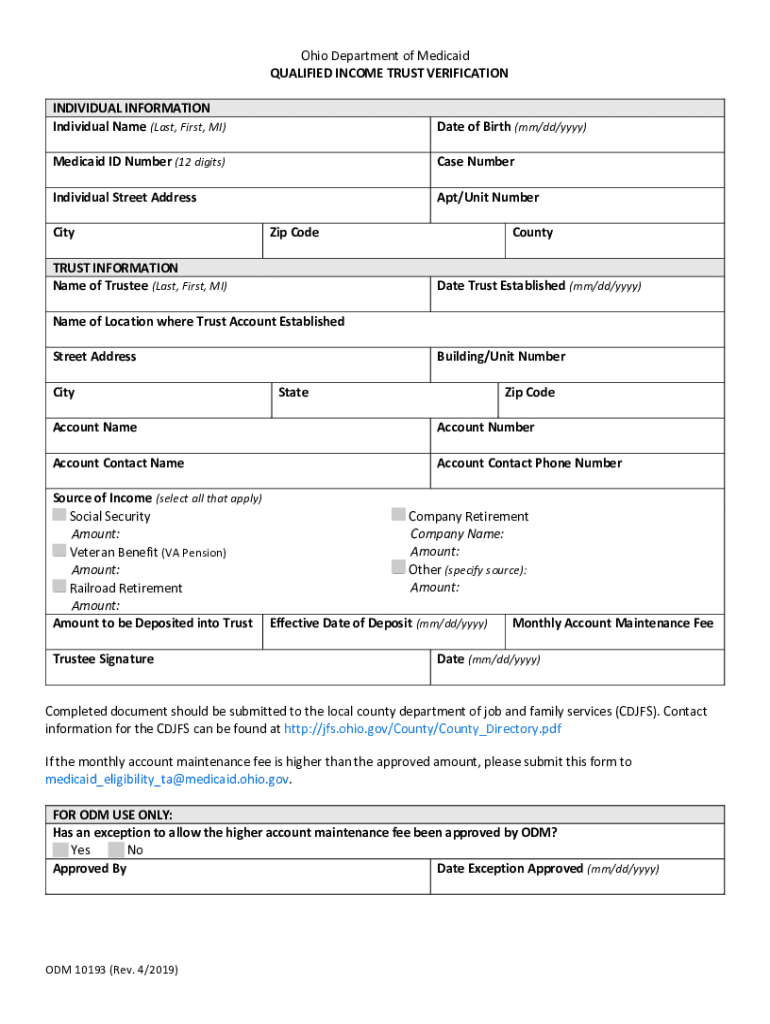

The Ohio Medicaid Qualified Income Trust is a legal arrangement designed to help individuals qualify for Medicaid benefits while maintaining a higher income level than typically allowed. This trust allows income that exceeds the Medicaid eligibility limit to be deposited into it, thereby reducing the individual's countable income. The funds in this trust can be used for specific expenses, such as medical care, ensuring that individuals can receive necessary services without losing their eligibility for Medicaid support.

How to use the Ohio Medicaid Qualified Income Trust

Using the Ohio Medicaid Qualified Income Trust involves several steps. First, individuals must establish the trust by creating a legal document that outlines its terms and conditions. Next, they should transfer any excess income into the trust each month. The trust must be managed according to state regulations, ensuring that the funds are used solely for allowable expenses, such as medical bills and long-term care costs. Proper documentation and record-keeping are essential to demonstrate compliance with Medicaid requirements.

Steps to complete the Ohio Medicaid Qualified Income Trust

Completing the Ohio Medicaid Qualified Income Trust involves a systematic approach:

- Consult with a legal professional to draft the trust document, ensuring it meets state requirements.

- Open a separate bank account for the trust to hold the income deposited.

- Transfer any excess income into the trust account monthly.

- Keep detailed records of all transactions, including receipts for expenses paid from the trust.

- Review the trust regularly to ensure compliance with Medicaid regulations and make adjustments as needed.

Eligibility Criteria

To be eligible for the Ohio Medicaid Qualified Income Trust, individuals must meet specific criteria. They must be a resident of Ohio and have income that exceeds the Medicaid income limits. Additionally, the individual must require long-term care services, either in a nursing home or through home and community-based services. It's important to note that the trust must be irrevocable, meaning once established, the terms cannot be changed, and the funds cannot be withdrawn for personal use.

Required Documents

Establishing the Ohio Medicaid Qualified Income Trust requires several key documents:

- A completed trust agreement that outlines the terms and conditions.

- Proof of income, including pay stubs or bank statements.

- Documentation of any expenses that will be covered by the trust.

- Identification documents for the trust creator and beneficiaries.

Form Submission Methods

Submitting the necessary forms for the Ohio Medicaid Qualified Income Trust can be done through various methods. Individuals can complete the required paperwork online through the Ohio Medicaid website or submit it via mail to their local Medicaid office. In-person submissions may also be possible at designated state offices. It is essential to ensure that all forms are filled out accurately and completely to avoid delays in processing.

Quick guide on how to complete ohio medicaid qualified income trust

Easily prepare Ohio Medicaid Qualified Income Trust on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly option to traditional printed and signed papers, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ohio Medicaid Qualified Income Trust on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

The easiest method to modify and eSign Ohio Medicaid Qualified Income Trust effortlessly

- Locate Ohio Medicaid Qualified Income Trust and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow accommodates all your needs in document management with just a few clicks from your preferred device. Edit and eSign Ohio Medicaid Qualified Income Trust to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ODM10193 Medicaid form and its purpose?

The ODM10193 Medicaid form is a critical document used for applying for Medicaid benefits in Ohio. It collects essential information about the applicant's financial and medical situation to determine eligibility for the program.

-

How can airSlate SignNow help with the ODM10193 Medicaid form?

airSlate SignNow allows users to easily eSign and send the ODM10193 Medicaid form electronically. This streamlines the application process, ensuring that your documents are completed accurately and submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the ODM10193 Medicaid form?

Yes, airSlate SignNow offers several pricing plans that accommodate different business needs. We provide a cost-effective solution for managing documents like the ODM10193 Medicaid form, ensuring you get the best value.

-

What features does airSlate SignNow offer for filling out the ODM10193 Medicaid form?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure cloud storage for documents. These features make filling out the ODM10193 Medicaid form efficient and straightforward.

-

Can I integrate other tools with airSlate SignNow for the ODM10193 Medicaid form?

Absolutely! airSlate SignNow supports various integrations with popular applications, making it easier to manage your workflow when handling the ODM10193 Medicaid form. You can connect with tools like Google Drive, Dropbox, and more.

-

What are the benefits of using airSlate SignNow for the ODM10193 Medicaid form?

Using airSlate SignNow for the ODM10193 Medicaid form offers signNow benefits such as increased efficiency, improved accuracy, and enhanced security for sensitive documents. The user-friendly interface simplifies the application process.

-

How secure is the airSlate SignNow platform for the ODM10193 Medicaid form?

Security is a top priority for airSlate SignNow. The platform uses encryption and complies with industry standards to ensure that your ODM10193 Medicaid form and other sensitive documents are protected against unauthorized access.

Get more for Ohio Medicaid Qualified Income Trust

- Contingency removal form 14945013

- Solicitud de inscripcion impuesto sobre los ingresos brutos y aportes sociales ley 5110 como llenarlo form

- Mot certificate pdf form

- Records inventory form

- Marymount hospital medical records form

- Blank trust certification form california

- Stoichiometry practice worksheet form

- Mini 1003 form

Find out other Ohio Medicaid Qualified Income Trust

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer