CA Claim for Exemption from Transient Occupancy Tax City Form

What is the CA Claim For Exemption From Transient Occupancy Tax City

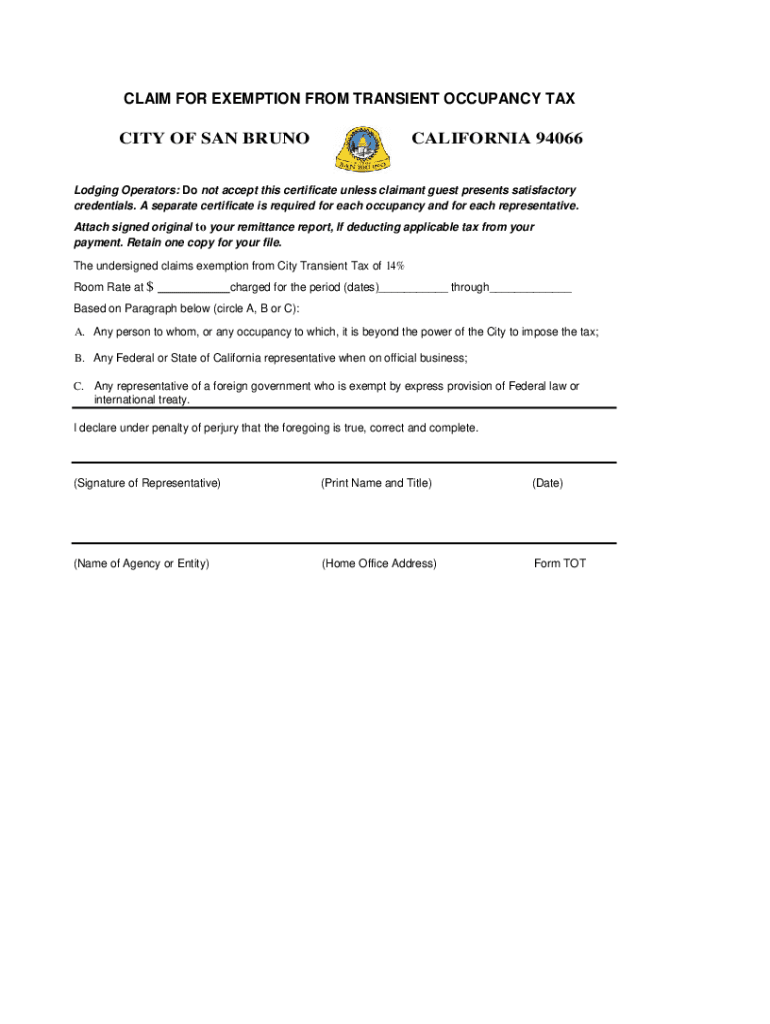

The CA Claim For Exemption From Transient Occupancy Tax City form is a legal document that allows certain individuals or entities to request an exemption from paying transient occupancy taxes. These taxes are typically levied on short-term rentals, such as hotels or vacation rentals. The exemption may apply to specific situations, such as government employees on official business or certain nonprofit organizations. Understanding the criteria for eligibility is crucial for those seeking to utilize this form effectively.

Steps to Complete the CA Claim For Exemption From Transient Occupancy Tax City

Completing the CA Claim For Exemption From Transient Occupancy Tax City involves several key steps:

- Gather necessary information, including identification and proof of eligibility for the exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate city or county office, following their submission guidelines.

Each step is essential to ensure that the claim is processed smoothly and efficiently.

Eligibility Criteria

To qualify for the exemption under the CA Claim For Exemption From Transient Occupancy Tax City, applicants must meet specific eligibility criteria. Generally, exemptions are available for:

- Government employees traveling for official purposes.

- Nonprofit organizations providing services to the community.

- Individuals staying in a facility for a long-term period, often defined by local regulations.

It is important for applicants to verify their eligibility based on local laws and regulations, as these can vary by city.

How to Use the CA Claim For Exemption From Transient Occupancy Tax City

Using the CA Claim For Exemption From Transient Occupancy Tax City form involves understanding its purpose and the process for submission. Once the form is completed, it should be presented to the lodging provider at the time of check-in. This action informs the provider of the exemption claim, allowing them to adjust the billing accordingly. It is advisable to keep a copy of the submitted form for personal records and future reference.

Legal Use of the CA Claim For Exemption From Transient Occupancy Tax City

The CA Claim For Exemption From Transient Occupancy Tax City form must be used in accordance with applicable laws and regulations. Misuse of the form, such as submitting false information or claiming an exemption without meeting the criteria, can result in penalties. Legal compliance ensures that the form serves its intended purpose and protects the rights of both the claimant and the taxing authority.

Form Submission Methods

The CA Claim For Exemption From Transient Occupancy Tax City can typically be submitted through various methods, depending on local guidelines. Common submission methods include:

- Online submission through the city or county's official website.

- Mailing the completed form to the appropriate office.

- In-person submission at designated locations, such as city hall or tax offices.

Each method may have its own requirements and processing times, so it is advisable to check local regulations for specifics.

Quick guide on how to complete ca claim for exemption from transient occupancy tax city

Complete CA Claim For Exemption From Transient Occupancy Tax City effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Handle CA Claim For Exemption From Transient Occupancy Tax City on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign CA Claim For Exemption From Transient Occupancy Tax City effortlessly

- Find CA Claim For Exemption From Transient Occupancy Tax City and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to preserve your updates.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign CA Claim For Exemption From Transient Occupancy Tax City and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA Claim For Exemption From Transient Occupancy Tax City?

A CA Claim For Exemption From Transient Occupancy Tax City allows qualifying individuals or entities to avoid paying the transient occupancy tax typically levied on short-term rentals. This claim can signNowly reduce expenses for property owners and short-term rental hosts. Understanding how to properly file this claim is essential for compliance and tax savings.

-

How can airSlate SignNow help with my CA Claim For Exemption From Transient Occupancy Tax City?

airSlate SignNow streamlines the process of preparing and eSigning your CA Claim For Exemption From Transient Occupancy Tax City. The platform enables secure and efficient document management, ensuring that your claim is filed accurately and on time. This reduces the risk of errors and helps you stay focused on your business.

-

What features does airSlate SignNow offer for managing CA Claim For Exemption From Transient Occupancy Tax City?

airSlate SignNow offers features like document templates, easy eSigning, and secure cloud storage, all tailored for managing your CA Claim For Exemption From Transient Occupancy Tax City. These tools enhance productivity by simplifying the document preparation and signing process. You can also track the status of your claims easily within the platform.

-

Is airSlate SignNow a cost-effective solution for filing my CA Claim For Exemption From Transient Occupancy Tax City?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses filing their CA Claim For Exemption From Transient Occupancy Tax City. With affordable pricing plans, you can efficiently manage your documentation without draining your budget. This allows you to focus your resources where they matter most in your business.

-

How secure is airSlate SignNow for handling my CA Claim For Exemption From Transient Occupancy Tax City?

airSlate SignNow prioritizes security, employing advanced encryption to protect your documents, including your CA Claim For Exemption From Transient Occupancy Tax City. The platform complies with industry standards to ensure your sensitive information remains confidential. You can trust that your claims are safe and the signing process is secure.

-

Can I integrate airSlate SignNow with other software for managing my CA Claim For Exemption From Transient Occupancy Tax City?

Yes, airSlate SignNow seamlessly integrates with a variety of software tools, allowing for an efficient workflow in managing your CA Claim For Exemption From Transient Occupancy Tax City. This integration helps streamline processes across platforms, making document management more cohesive. You can easily connect it with your existing business applications for enhanced functionality.

-

What are the benefits of using airSlate SignNow for my CA Claim For Exemption From Transient Occupancy Tax City?

Using airSlate SignNow for your CA Claim For Exemption From Transient Occupancy Tax City offers numerous benefits, including time savings, accuracy, and enhanced compliance. The platform's intuitive interface makes the process easier for users at all levels. Additionally, the ability to access and manage documents from anywhere adds convenience to your workflow.

Get more for CA Claim For Exemption From Transient Occupancy Tax City

- Application form for enrolment as member

- Missouri form 126

- Vehicle inspection report form

- Channel access request form

- Tdec inspection form 410791351

- Address change form merit energy company

- Senior yard sign order form

- 3 ways to address royalty wikihow16 cfr681 2 duties of card issuers regarding changes address fraud what it is and how to avoid form

Find out other CA Claim For Exemption From Transient Occupancy Tax City

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast