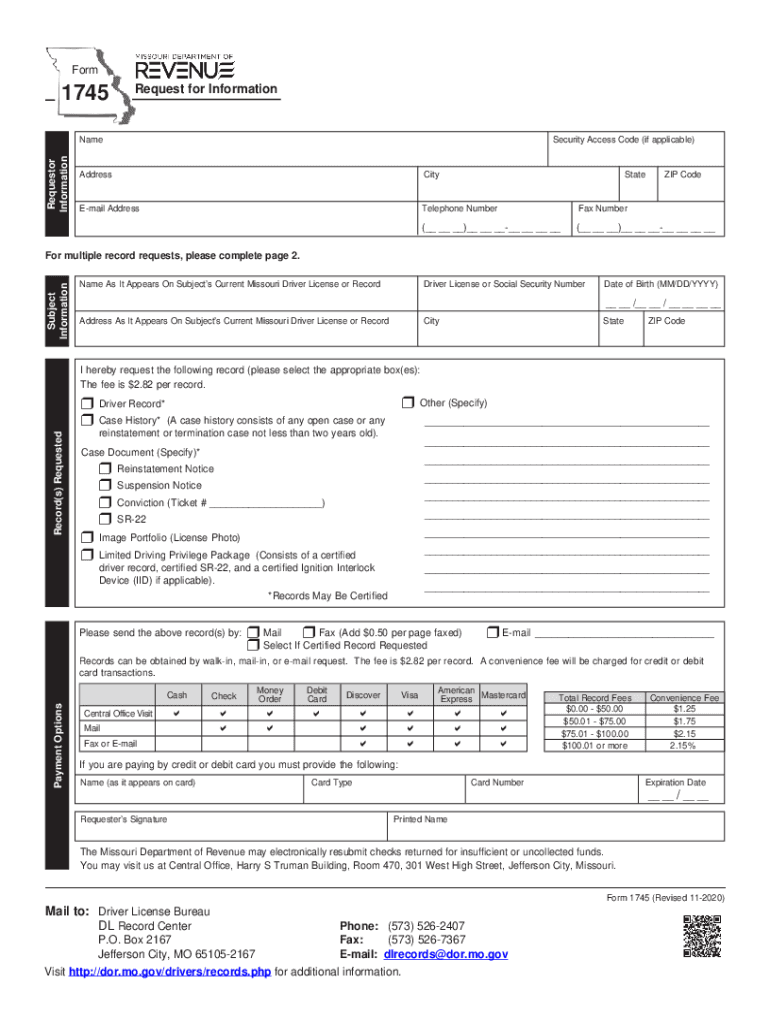

Form 1745 Missouri Department of Revenue 2020

What is the Form 1745 Missouri Department Of Revenue

The Form 1745 is a document issued by the Missouri Department of Revenue, specifically designed for vehicle owners in the state. This form is primarily used for the purpose of applying for a Missouri title and registration for vehicles that are not currently titled in Missouri. It serves as a means to collect essential information about the vehicle and its owner, ensuring compliance with state regulations.

How to use the Form 1745 Missouri Department Of Revenue

Using the Form 1745 involves several key steps. First, gather all necessary information about your vehicle, including the Vehicle Identification Number (VIN), make, model, and year. Next, provide your personal details, such as your name, address, and contact information. After completing the form, you can submit it to your local Department of Revenue office, along with any required documents and fees.

Steps to complete the Form 1745 Missouri Department Of Revenue

Completing the Form 1745 requires careful attention to detail. Follow these steps:

- Obtain the form from the Missouri Department of Revenue website or your local office.

- Fill in the vehicle information, including the VIN, make, model, and year.

- Provide your personal information, ensuring accuracy.

- Sign and date the form to certify that the information is correct.

- Attach any necessary documentation, such as proof of ownership or identification.

- Submit the completed form to the appropriate office.

Required Documents

When submitting the Form 1745, several documents are typically required. These may include:

- Proof of ownership, such as a bill of sale or previous title.

- Identification, such as a driver's license or state ID.

- Any additional forms or documents as specified by the Missouri Department of Revenue.

Form Submission Methods

The Form 1745 can be submitted through various methods. You may choose to:

- Submit the form in person at your local Department of Revenue office.

- Mail the completed form and required documents to the appropriate address.

- Inquire about any online submission options that may be available.

Legal use of the Form 1745 Missouri Department Of Revenue

The Form 1745 must be used in accordance with Missouri state laws and regulations regarding vehicle registration and titling. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal complications or penalties. Understanding the legal implications of this form can help vehicle owners navigate the registration process smoothly.

Quick guide on how to complete form 1745 missouri department of revenue

Effortlessly Prepare Form 1745 Missouri Department Of Revenue on Any Device

The management of online documents has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and without hold-ups. Handle Form 1745 Missouri Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Form 1745 Missouri Department Of Revenue with Ease

- Obtain Form 1745 Missouri Department Of Revenue and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1745 Missouri Department Of Revenue to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1745 missouri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form 1745 missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1745 Missouri Department Of Revenue?

The Form 1745 Missouri Department Of Revenue is a tax form used for various tax-related purposes in Missouri. It is essential for businesses and individuals to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow can simplify the process of filling out and submitting this form.

-

How can airSlate SignNow help with the Form 1745 Missouri Department Of Revenue?

airSlate SignNow provides an intuitive platform for electronically signing and managing the Form 1745 Missouri Department Of Revenue. With its user-friendly interface, you can easily fill out the form, add signatures, and send it securely. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Form 1745 Missouri Department Of Revenue?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of the features provided, including eSigning and document management for forms like the Form 1745 Missouri Department Of Revenue. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 1745 Missouri Department Of Revenue?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the Form 1745 Missouri Department Of Revenue. These features enhance efficiency and ensure that all necessary steps are completed accurately. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for the Form 1745 Missouri Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Form 1745 Missouri Department Of Revenue alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity by connecting all your essential applications.

-

What are the benefits of using airSlate SignNow for the Form 1745 Missouri Department Of Revenue?

Using airSlate SignNow for the Form 1745 Missouri Department Of Revenue provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. This allows you to focus on your core business activities.

-

Is airSlate SignNow user-friendly for completing the Form 1745 Missouri Department Of Revenue?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Form 1745 Missouri Department Of Revenue. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively.

Get more for Form 1745 Missouri Department Of Revenue

- Amendment of lease package maine form

- Annual financial checkup package maine form

- Maine bill sale form

- Living wills and health care package maine form

- Last will and testament package maine form

- Subcontractors package maine form

- Protecting minors from identity theft package maine form

- Maine identity form

Find out other Form 1745 Missouri Department Of Revenue

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement