Tax Information Death Benefit Payments

What is the Tax Information Death Benefit Payments

The Tax Information Death Benefit Payments refer to the financial benefits provided to beneficiaries following the death of an individual. These payments can include life insurance proceeds or other death benefits that may be subject to taxation. Understanding the tax implications of these payments is crucial for beneficiaries to ensure compliance with IRS regulations and to avoid unexpected tax liabilities.

Eligibility Criteria

Eligibility for Tax Information Death Benefit Payments typically hinges on the relationship between the deceased and the beneficiary, as well as the specific terms outlined in the policy or benefit plan. Common eligibility criteria include:

- The beneficiary must be named in the policy or plan.

- The death must occur while the policy or benefit is active.

- Beneficiaries must provide necessary documentation, such as a death certificate.

Steps to complete the Tax Information Death Benefit Payments

Completing the process for Tax Information Death Benefit Payments involves several steps to ensure that all necessary information is accurately submitted. The following steps are generally required:

- Gather relevant documents, including the death certificate and policy details.

- Complete the required forms as specified by the issuing entity.

- Submit the forms along with any supporting documentation to the appropriate office.

- Maintain copies of all submitted materials for your records.

Required Documents

To successfully process Tax Information Death Benefit Payments, certain documents are typically required. These may include:

- A certified copy of the death certificate.

- The original policy document or benefit plan details.

- Identification of the beneficiary, such as a driver's license or Social Security number.

Legal use of the Tax Information Death Benefit Payments

The legal use of Tax Information Death Benefit Payments is governed by various regulations that dictate how these benefits can be claimed and taxed. Beneficiaries should be aware of the following legal considerations:

- Payments may be subject to federal and state income tax depending on the circumstances.

- Beneficiaries must report these payments on their tax returns if applicable.

- Understanding the legal framework helps in ensuring compliance and avoiding penalties.

Form Submission Methods (Online / Mail / In-Person)

Submitting the necessary forms for Tax Information Death Benefit Payments can typically be done through various methods. Options may include:

- Online submission through the issuing entity's secure portal.

- Mailing the completed forms to the designated address.

- In-person submission at the local office or agency handling the benefits.

Quick guide on how to complete tax information death benefit payments

Accomplish Tax Information Death Benefit Payments easily on any device

Web-based document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Tax Information Death Benefit Payments on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Tax Information Death Benefit Payments effortlessly

- Access Tax Information Death Benefit Payments and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Revise and eSign Tax Information Death Benefit Payments and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

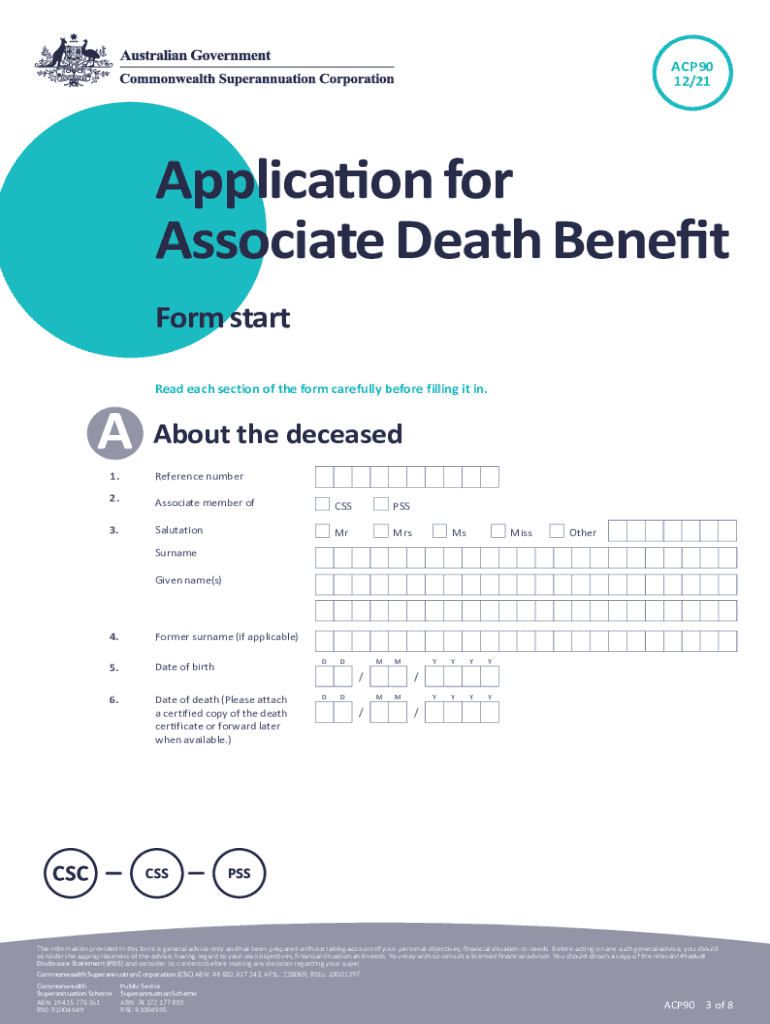

What is the AU death benefit form?

The AU death benefit form is a document used in Australia to facilitate the distribution of a deceased person's benefits. This form allows beneficiaries to claim their rightful entitlements according to the deceased's wishes. Using airSlate SignNow, you can easily eSign and send this form, ensuring a quick and efficient process.

-

How can airSlate SignNow help with filling out the AU death benefit form?

airSlate SignNow simplifies the process of completing the AU death benefit form by providing templates and an intuitive interface. Users can fill out the necessary fields quickly and securely online. Additionally, the platform allows for collaborative editing, making it easier to gather all required information before submission.

-

Is there a cost associated with using airSlate SignNow for the AU death benefit form?

Yes, there is a subscription fee for using airSlate SignNow, but it offers flexible pricing plans to fit various needs. The cost-effective solution allows for efficient handling of documents, including the AU death benefit form. This investment can save time and reduce the hassle of traditional paper processes.

-

What are the main features of airSlate SignNow relevant to the AU death benefit form?

Key features of airSlate SignNow that benefit users handling the AU death benefit form include electronic signatures, document templates, and secure storage. The platform also offers automated notifications and reminders to keep track of the submission process. These features streamline the overall workflow for both senders and signers.

-

Can I integrate airSlate SignNow with other applications for managing the AU death benefit form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs and document management systems. This integration enhances the efficiency of managing the AU death benefit form and related documents, allowing you to connect workflows across platforms effortlessly.

-

What are the benefits of using airSlate SignNow for the AU death benefit form submission?

Using airSlate SignNow for the AU death benefit form submission ensures a secure, efficient, and paperless process. It reduces the time taken for document processing and improves compliance with legal requirements. Moreover, eSigning accelerates the overall claiming process, providing peace of mind to beneficiaries.

-

Is the AU death benefit form secure with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption and security measures to protect sensitive data associated with the AU death benefit form. Users can confidently manage their documents, knowing that their information is safe and secure.

Get more for Tax Information Death Benefit Payments

Find out other Tax Information Death Benefit Payments

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT