433 H Form

What is the 433 H

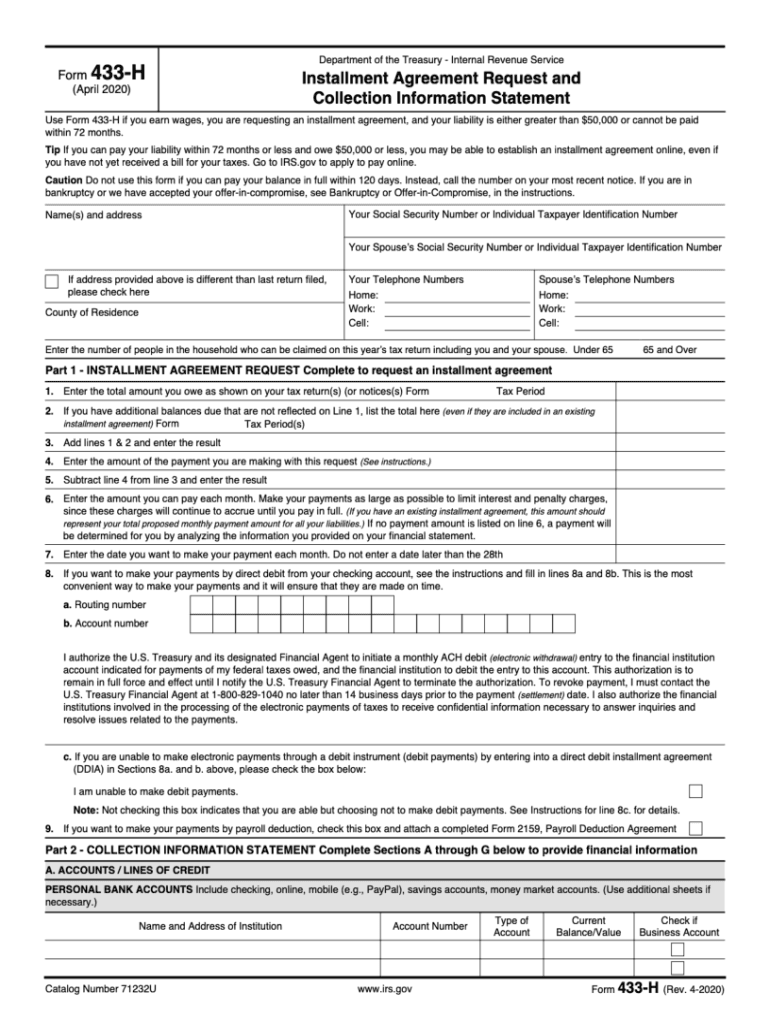

The 433 H form is an IRS document used primarily to provide financial information about a taxpayer’s income, expenses, and assets. This form is crucial for individuals who are seeking to establish an installment agreement with the IRS, particularly those who owe back taxes. It helps the IRS assess a taxpayer's ability to pay and determine the appropriate payment plan. The 433 H is designed to gather comprehensive details about a taxpayer's financial situation, including income sources, monthly expenses, and asset values.

How to Use the 433 H

Using the 433 H form involves several steps to ensure accurate and complete submission. First, gather all necessary financial documents, including pay stubs, bank statements, and proof of expenses. Next, fill out the form with precise information regarding income, expenses, and assets. It is essential to provide truthful and complete data, as inaccuracies can lead to delays or complications in processing your installment agreement request. After completing the form, review it for errors before submitting it to the IRS along with your installment agreement request.

Steps to Complete the 433 H

Completing the 433 H form requires careful attention to detail. Start by entering your personal information, including your name, Social Security number, and contact details. Then, proceed to the income section, listing all sources of income and the amounts received. Next, outline your monthly expenses, categorizing them into necessary living costs such as housing, utilities, and transportation. Finally, detail any assets you own, including real estate, vehicles, and savings. Ensure that all figures are accurate and reflect your current financial situation before submitting the form.

Legal Use of the 433 H

The 433 H form is legally recognized as a valid means of documenting a taxpayer's financial situation when negotiating with the IRS. When properly completed and submitted, it serves as a basis for the IRS to evaluate a taxpayer's request for an installment agreement. Compliance with IRS guidelines is essential to ensure that the information provided is accepted and that the taxpayer's rights are protected during the negotiation process. Understanding the legal implications of this form can help taxpayers navigate their obligations effectively.

Required Documents

To successfully complete and submit the 433 H form, several supporting documents are typically required. These may include:

- Recent pay stubs or proof of income

- Bank statements for the last few months

- Documentation of monthly expenses, such as bills and receipts

- Proof of assets, including property deeds and vehicle titles

Having these documents ready will facilitate a smoother completion process and provide the IRS with the necessary information to assess your financial situation accurately.

Eligibility Criteria

Eligibility for using the 433 H form primarily depends on the taxpayer's financial situation and their need to establish an installment agreement with the IRS. Taxpayers who owe back taxes and cannot pay the full amount immediately may qualify. Additionally, individuals must demonstrate that they meet specific income and expense thresholds set by the IRS. Understanding these criteria is vital for taxpayers to determine if they can use the 433 H form in their circumstances.

Quick guide on how to complete 433 h

Complete 433 H effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 433 H on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 433 H with ease

- Obtain 433 H and click Get Form to initiate the process.

- Use the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign 433 H to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 433h in relation to airSlate SignNow?

The term 433h refers to our unique identification code for a specific pricing plan within airSlate SignNow. This plan offers businesses an affordable way to manage their eSigning needs efficiently, allowing for streamlined document workflows and enhanced productivity.

-

How much does the 433h plan cost?

The 433h plan is competitively priced to provide excellent value for businesses looking to enhance their eSignature capabilities. It includes various features designed to meet the demands of companies of all sizes, making it an economical choice for managing electronic documents.

-

What features are included in the 433h package?

The 433h package includes essential features such as document templates, team collaboration tools, and advanced security measures to ensure your documents are safe and compliant. Additionally, users can access mobile signing options, which enhance flexibility and convenience.

-

What benefits does the 433h plan offer for businesses?

Businesses using the 433h plan can expect signNow time savings and improved efficiency in their document signing processes. The automated workflows reduce manual tasks, allowing teams to focus on core business operations while ensuring quick turnaround times for contracts and agreements.

-

Can I integrate third-party applications with the 433h plan?

Yes, the 433h plan supports various third-party integrations, allowing users to seamlessly connect airSlate SignNow with software they're already using. This flexibility ensures a smooth workflow, enhancing the overall efficiency of document management.

-

How secure is the 433h plan?

The 433h plan prioritizes security, offering features like 256-bit encryption and two-factor authentication to safeguard your documents. With compliance to industry standards, users can trust that their electronic signatures and sensitive information are handled securely.

-

Is customer support included with the 433h plan?

Absolutely! When you choose the 433h plan, you receive dedicated customer support to assist you with any issues or questions. Our team is committed to ensuring your experience with airSlate SignNow is seamless and enjoyable.

Get more for 433 H

Find out other 433 H

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney