File Number Outside Form

What is the File Number Outside

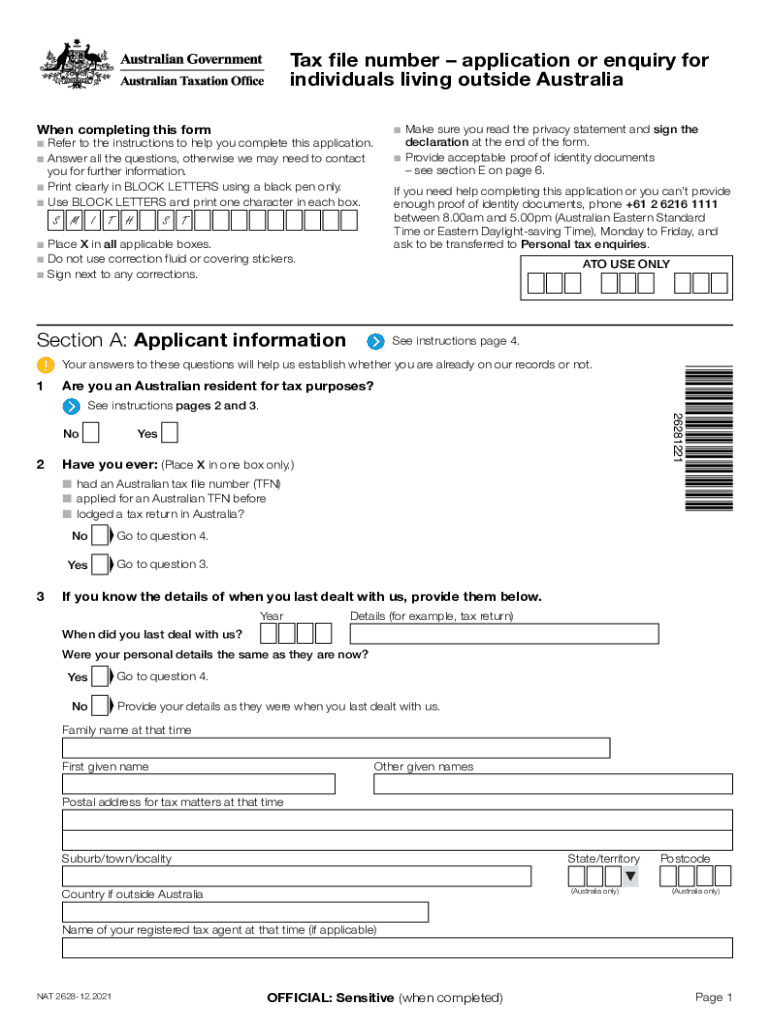

The File Number Outside is a specific identifier used in various tax-related documents, particularly for individuals who are applying for or inquiring about their tax file number. This number is essential for proper identification in the tax system and is often required when submitting forms to the Internal Revenue Service (IRS) or other financial institutions. It helps ensure that all tax-related activities are accurately tracked and attributed to the correct individual or entity.

How to Obtain the File Number Outside

To obtain the File Number Outside, individuals typically need to complete a specific application process. This may involve filling out the appropriate forms, such as the tax file number application form, and providing necessary identification documents. The application can often be submitted online, by mail, or in person, depending on the requirements set by the IRS or relevant state authorities. Ensuring that all information is accurate and complete is crucial for a smooth approval process.

Steps to Complete the File Number Outside

Completing the File Number Outside involves several key steps:

- Gather necessary documents, including identification and any previous tax information.

- Fill out the tax file number application form accurately.

- Review the application for completeness and accuracy.

- Submit the application via the chosen method: online, by mail, or in person.

- Await confirmation and any additional instructions from the IRS or relevant authority.

Legal Use of the File Number Outside

The File Number Outside is legally recognized for various tax purposes. It is critical for ensuring compliance with tax regulations and for the proper processing of tax returns. Using this number helps prevent identity theft and fraud, as it uniquely identifies individuals within the tax system. It is important to keep this number secure and to use it only in legitimate tax-related activities.

Required Documents

When applying for the File Number Outside, several documents are typically required to verify identity and eligibility. These may include:

- Government-issued identification (e.g., driver's license, passport).

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Proof of residency, such as utility bills or bank statements.

- Any previous tax documents, if applicable.

Form Submission Methods

Individuals can submit their applications for the File Number Outside through various methods:

- Online: Many forms can be completed and submitted electronically through official IRS portals.

- By Mail: Completed forms can be printed and sent to the appropriate IRS address.

- In-Person: Some individuals may choose to visit local IRS offices for assistance and submission.

Quick guide on how to complete file number outside

Effortlessly complete File Number Outside on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage File Number Outside on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign File Number Outside with ease

- Obtain File Number Outside and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and eSign File Number Outside and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a file number outside in airSlate SignNow?

A file number outside in airSlate SignNow refers to a unique identifier assigned to documents that are stored or processed outside the typical folder structure. This feature helps users efficiently track and manage their documents while ensuring easy access and organization.

-

How does airSlate SignNow handle file numbers outside?

airSlate SignNow allows users to create and assign file numbers outside to different documents for improved tracking and management. This feature ensures that users can locate and reference their documents quickly, streamlining business workflows and enhancing productivity.

-

What are the pricing options for using file number outside in airSlate SignNow?

airSlate SignNow offers various pricing plans that include features for managing file numbers outside. Each plan is designed to cater to different business needs, allowing users to choose a cost-effective solution that fits their requirements for document management and eSigning.

-

Can I integrate airSlate SignNow with other platforms while using file numbers outside?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing you to streamline your workflow even when using file numbers outside. This integration ensures that your documents and their corresponding file numbers are synchronized across all your business tools.

-

What are the benefits of using file number outside in my documents?

Using file numbers outside enhances document management by enabling clear tracking and reference. This feature simplifies locating specific documents within larger repositories, saving you time and reducing errors during the signing process.

-

Is it easy to assign file numbers outside to my documents?

Absolutely! Assigning file numbers outside in airSlate SignNow is a user-friendly process. The intuitive interface allows you to quickly assign, edit, and update file numbers, making document organization straightforward and efficient.

-

What types of documents can I manage with file number outside in airSlate SignNow?

You can manage a wide variety of document types using file numbers outside in airSlate SignNow, including contracts, agreements, and forms. This flexibility ensures that all your important documents can be efficiently tracked and managed, regardless of their format.

Get more for File Number Outside

Find out other File Number Outside

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement