Request for Penalty AbatementArizona Department of Revenue Form

Understanding the AZ Form 290 Fillable

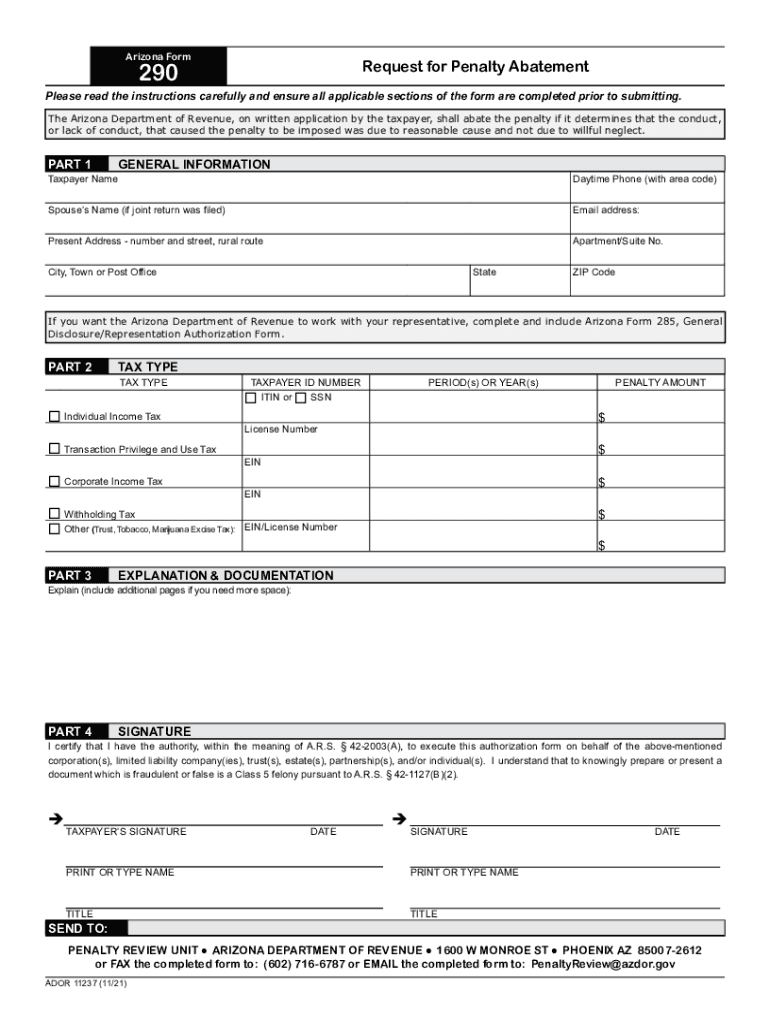

The AZ Form 290 is a request for penalty abatement issued by the Arizona Department of Revenue. This form allows taxpayers to request a reduction or elimination of penalties imposed due to late payments or non-compliance with tax obligations. It is essential for taxpayers who believe they have valid reasons for not meeting their tax responsibilities on time. The form requires detailed information about the taxpayer's situation, including the reasons for the penalty and any supporting documentation.

How to Complete the AZ Form 290 Fillable

Filling out the AZ Form 290 requires careful attention to detail. Start by entering your personal information, including your name, address, and taxpayer identification number. Next, provide a clear explanation of the circumstances that led to the penalty. It is crucial to include any relevant documentation that supports your case, such as medical records or proof of financial hardship. Ensure that all sections of the form are completed accurately to avoid delays in processing.

Eligibility Criteria for AZ Form 290 Submission

To be eligible for penalty abatement through the AZ Form 290, taxpayers must demonstrate reasonable cause for their failure to comply with tax obligations. Acceptable reasons may include serious illness, natural disasters, or other unforeseen circumstances that hindered timely payment. It is important to carefully review the eligibility criteria outlined by the Arizona Department of Revenue to ensure that your request meets the necessary requirements.

Important Filing Deadlines for AZ Form 290

Timeliness is critical when submitting the AZ Form 290. Taxpayers should be aware of the specific deadlines for filing the form to ensure their requests are considered. Generally, the form should be submitted as soon as the penalty is assessed, and it is advisable to file it within a reasonable timeframe after receiving a notice of penalty. Keeping track of these deadlines can significantly impact the outcome of your request.

Required Documentation for AZ Form 290

When submitting the AZ Form 290, it is essential to include all necessary documentation that supports your request for penalty abatement. This may include copies of tax returns, payment receipts, or any correspondence with the Arizona Department of Revenue. Providing comprehensive documentation can strengthen your case and improve the chances of a favorable outcome.

Submission Methods for AZ Form 290

The AZ Form 290 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers should ensure they have access to the appropriate digital tools to complete and sign the form securely. If choosing to mail the form, it is advisable to send it via certified mail to confirm delivery. In-person submissions can be made at designated Arizona Department of Revenue offices.

Quick guide on how to complete request for penalty abatementarizona department of revenue

Effortlessly prepare Request For Penalty AbatementArizona Department Of Revenue on any device

The management of documents online has gained considerable popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Request For Penalty AbatementArizona Department Of Revenue on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Request For Penalty AbatementArizona Department Of Revenue with ease

- Obtain Request For Penalty AbatementArizona Department Of Revenue and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Request For Penalty AbatementArizona Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the AZ form 290 fillable and how can it be used?

The AZ form 290 fillable is a versatile document used for various business processes in Arizona. With airSlate SignNow, you can easily fill out this form online, streamlining your workflow and reducing paper usage.

-

How does airSlate SignNow ensure the security of the AZ form 290 fillable?

airSlate SignNow prioritizes security for all documents, including the AZ form 290 fillable. Our platform employs advanced encryption protocols and complies with industry standards to ensure your sensitive information remains protected.

-

Are there any costs associated with using the AZ form 290 fillable in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to use the AZ form 290 fillable. We provide various subscription options, allowing businesses to choose a plan that fits their budget and document needs.

-

What features does airSlate SignNow offer for the AZ form 290 fillable?

With airSlate SignNow, the AZ form 290 fillable benefits from features like electronic signatures, template creation, and automated workflows. These tools enhance productivity and make managing documents easier for teams.

-

Can I integrate airSlate SignNow with other applications while using the AZ form 290 fillable?

Yes, airSlate SignNow supports integrations with popular applications like Google Drive, Salesforce, and Zapier. This allows you to seamlessly manage and send the AZ form 290 fillable alongside other essential tools.

-

Is it possible to track responses for the AZ form 290 fillable sent via airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive tracking for all documents, including the AZ form 290 fillable. You can monitor who has opened the document, signed it, and when, ensuring complete transparency.

-

Can the AZ form 290 fillable be customized within airSlate SignNow?

Yes, users can easily customize the AZ form 290 fillable in airSlate SignNow. You can add your branding, modify fields, and create templates to match your specific business requirements.

Get more for Request For Penalty AbatementArizona Department Of Revenue

- Biological classification worksheet answer key pdf form

- Insurance paper form

- Father designation meaning form

- Audiology case history examples 359924874 form

- Book request form library

- Child medical certificate for school form

- Sbar interact form

- Form 588 nonresident withholding waiver request form 588 nonresident withholding waiver request

Find out other Request For Penalty AbatementArizona Department Of Revenue

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe