T Rowe Price Hardship Withdrawal Form

What is the T Rowe Price Hardship Withdrawal Form

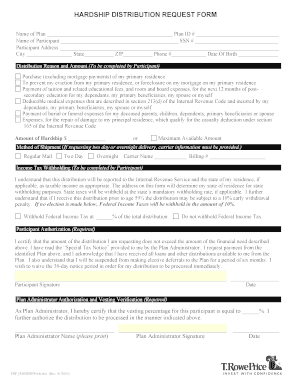

The T Rowe Price hardship withdrawal form is a specific document designed for individuals seeking to access their retirement funds under circumstances of financial hardship. This form allows participants in a T Rowe Price retirement plan to withdraw funds from their 401(k) or similar accounts when faced with urgent financial needs. Common qualifying reasons include medical expenses, purchasing a primary residence, tuition payments, and preventing eviction or foreclosure. Understanding the purpose and requirements of this form is essential for those considering a hardship withdrawal.

Steps to Complete the T Rowe Price Hardship Withdrawal Form

Completing the T Rowe Price hardship withdrawal form involves several key steps to ensure accuracy and compliance with regulations. First, gather necessary documentation that supports your claim of financial hardship, such as medical bills or eviction notices. Next, fill out the form with your personal information, including your account number and details about the hardship. Ensure you provide clear and concise explanations for your withdrawal request. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online or via mail.

Required Documents for the T Rowe Price Hardship Withdrawal

When applying for a hardship withdrawal from T Rowe Price, specific documentation is required to substantiate your claim. Essential documents may include:

- Proof of medical expenses, such as invoices or receipts.

- Documentation of housing-related financial issues, like eviction notices or mortgage statements.

- Tuition statements or enrollment confirmations for educational expenses.

- Any other relevant financial documents that demonstrate the need for withdrawal.

Having these documents ready will facilitate a smoother application process and help expedite the review of your request.

Eligibility Criteria for the T Rowe Price Hardship Withdrawal

To qualify for a hardship withdrawal from T Rowe Price, certain eligibility criteria must be met. Generally, you must be a participant in a T Rowe Price retirement plan, such as a 401(k). Additionally, the withdrawal must be necessary due to an immediate and pressing financial need. The IRS outlines specific circumstances under which withdrawals are permitted, including medical expenses, purchase of a primary residence, tuition payments, and prevention of eviction or foreclosure. It is important to review these criteria carefully to ensure your situation qualifies.

Form Submission Methods for the T Rowe Price Hardship Withdrawal

Submitting the T Rowe Price hardship withdrawal form can be done through various methods, depending on your preference and urgency. The primary submission methods include:

- Online Submission: Many users prefer to complete and submit the form electronically through the T Rowe Price website, ensuring a quicker processing time.

- Mail: You can print the completed form and send it via postal mail to the designated T Rowe Price address. This method may take longer for processing.

- In-Person: If applicable, you may also choose to deliver the form in person at a T Rowe Price office location.

Each method has its own processing times, so consider your needs when choosing how to submit your form.

Legal Use of the T Rowe Price Hardship Withdrawal Form

The T Rowe Price hardship withdrawal form must be used in accordance with legal guidelines to ensure compliance with IRS regulations. This includes accurately representing your financial hardship and providing the necessary documentation to support your request. It is crucial to understand that misuse of the form or providing false information can lead to penalties, including tax implications or denial of the withdrawal request. Therefore, it is advisable to consult with a financial advisor or tax professional if you have questions about the legal aspects of your withdrawal.

Quick guide on how to complete t rowe price hardship withdrawal form

Prepare T Rowe Price Hardship Withdrawal Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and smoothly. Manage T Rowe Price Hardship Withdrawal Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign T Rowe Price Hardship Withdrawal Form with ease

- Obtain T Rowe Price Hardship Withdrawal Form and click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign T Rowe Price Hardship Withdrawal Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a T Rowe Price hardship withdrawal?

A T Rowe Price hardship withdrawal allows you to access your retirement funds in the event of an immediate and pressing financial need. This type of withdrawal is typically limited to specific circumstances such as medical expenses, education costs, or buying a primary home. Understanding the guidelines and implications of a hardship withdrawal is crucial for managing your retirement savings effectively.

-

How do I apply for a T Rowe Price hardship withdrawal?

To apply for a T Rowe Price hardship withdrawal, you will need to provide documentation supporting your financial need and follow the application process outlined by T Rowe Price. This usually involves filling out specific forms and supplying necessary evidence such as bills or quotes. Ensuring all required documentation is complete can expedite the approval of your withdrawal.

-

What are the tax implications of a T Rowe Price hardship withdrawal?

T Rowe Price hardship withdrawals may be subject to income tax, and if you are under the age of 59½, you might also incur a 10% early withdrawal penalty. It’s important to understand these tax implications to avoid unexpected financial burdens. Consulting a tax professional can help you navigate the finances surrounding your hardship withdrawal.

-

Are there any fees associated with a T Rowe Price hardship withdrawal?

While T Rowe Price typically does not charge fees specifically for hardship withdrawals, you should review your account details to confirm any potential charges. Additionally, consider that the impact on your retirement savings might outweigh the absence of withdrawal fees. Evaluating your overall financial situation will help assess if proceeding with a hardship withdrawal is the best choice.

-

Can I take multiple T Rowe Price hardship withdrawals?

Yes, you can apply for multiple T Rowe Price hardship withdrawals; however, each request must meet the required criteria and you must demonstrate a continued financial need. Keep in mind that excessive withdrawals can signNowly affect your long-term retirement savings. It's essential to consider all available financial options before opting for another hardship withdrawal.

-

What features of airSlate SignNow can help with T Rowe Price hardship withdrawal applications?

airSlate SignNow streamlines the process of sending and eSigning documents required for applying for a T Rowe Price hardship withdrawal. With its user-friendly interface, you can quickly gather signatures and ensure all necessary paperwork is complete. This efficiency can help speed up your application process, allowing you to focus on addressing your financial needs.

-

How does airSlate SignNow ensure the security of my documents during the T Rowe Price hardship withdrawal process?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your documents throughout the T Rowe Price hardship withdrawal process. This ensures that sensitive information remains confidential and is accessible only to authorized personnel. Prioritizing your data security provides peace of mind as you navigate your financial options.

Get more for T Rowe Price Hardship Withdrawal Form

Find out other T Rowe Price Hardship Withdrawal Form

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple