Revenue Louisiana GovTaxForms19026921FLouisiana Department of Revenue Installment Request for

What is the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For

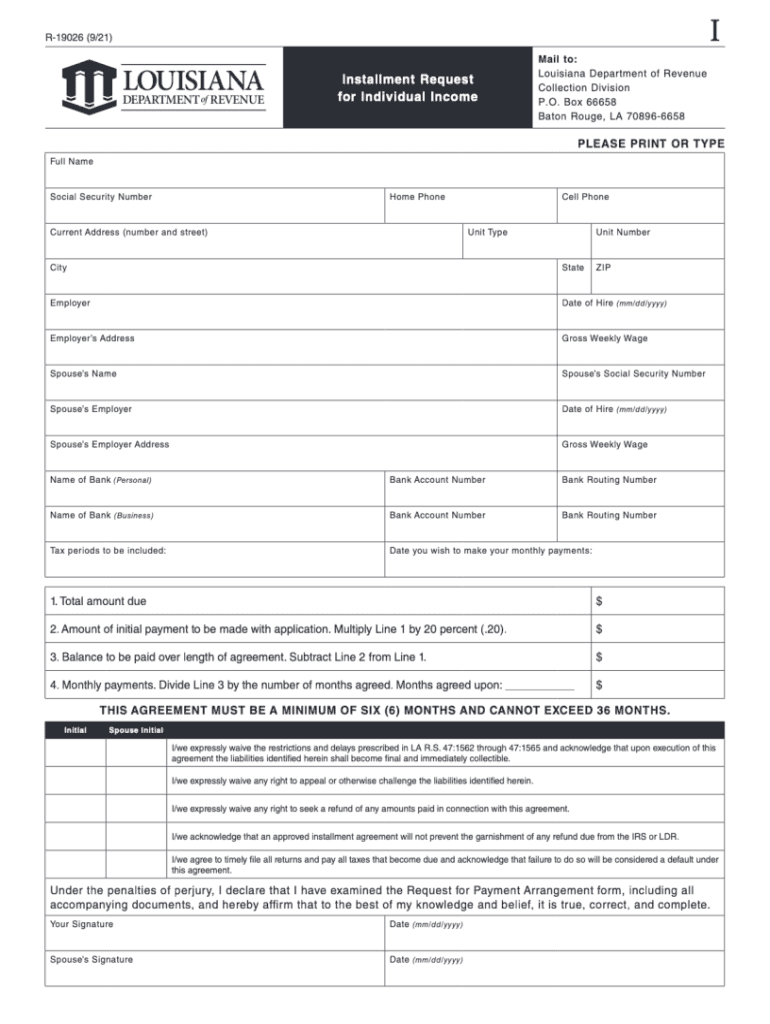

The Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For is a formal document used by taxpayers in Louisiana to request an installment payment plan for their tax obligations. This form allows individuals and businesses to manage their tax debts by breaking them into smaller, more manageable payments over time. It is particularly useful for those who may be facing financial difficulties but want to stay compliant with state tax regulations.

How to use the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For

To use the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For, taxpayers need to complete the form accurately, providing necessary details such as personal information, the amount owed, and the proposed payment plan. Once completed, the form should be submitted to the Louisiana Department of Revenue for review. It is essential to ensure that all information is correct to avoid delays in processing the request.

Steps to complete the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For

Completing the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For involves several steps:

- Gather necessary information, including your taxpayer identification number and details of your tax liability.

- Fill out the form, ensuring all required fields are completed accurately.

- Specify the proposed installment payment amounts and schedule.

- Review the form for any errors or omissions.

- Submit the completed form to the Louisiana Department of Revenue via the designated method.

Required Documents

When submitting the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For, taxpayers may need to include supporting documents. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of any financial hardships, if applicable.

- Any previous correspondence with the Louisiana Department of Revenue regarding the tax debt.

Eligibility Criteria

Eligibility for using the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For typically includes being a taxpayer with outstanding tax liabilities to the state of Louisiana. Taxpayers must demonstrate a genuine need for an installment plan, often requiring evidence of financial hardship or inability to pay the full amount due immediately. It is advisable to review specific eligibility requirements outlined by the Louisiana Department of Revenue.

Penalties for Non-Compliance

Failing to comply with the terms set forth in the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For can result in significant penalties. These may include:

- Accrued interest on unpaid balances.

- Additional fees for late payments.

- Potential legal action for collection of the outstanding tax debt.

Quick guide on how to complete revenuelouisianagovtaxforms19026921flouisiana department of revenue installment request for

Complete Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without complications. Manage Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For on any device with airSlate SignNow's Android or iOS apps and simplify any document-driven process today.

The easiest way to edit and eSign Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For without hassle

- Find Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

The Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For is a form that allows taxpayers in Louisiana to request an installment agreement for their tax liabilities. This form provides the necessary details for taxpayers to manage their payments and compliance effectively.

-

How does airSlate SignNow facilitate the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

airSlate SignNow streamlines the process of completing the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For by enabling users to fill out and eSign the document quickly. This saves time and enhances accuracy while ensuring compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. These plans provide cost-effective solutions for document management, including features like eSigning the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For efficiently.

-

What features does airSlate SignNow offer for managing the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and automated workflows to simplify the process of handling the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For. These tools enhance productivity and ensure a smooth document flow.

-

Can I integrate airSlate SignNow with other tools for the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

Absolutely! airSlate SignNow offers integrations with popular tools and platforms, making it easy to manage the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For alongside your existing systems. This maximizes efficiency and minimizes disruption in your workflow.

-

What are the benefits of using airSlate SignNow for the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

Using airSlate SignNow for the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For provides several benefits, including reduced paperwork, faster processing times, and greater accessibility. This leads to a more streamlined tax filing process and improved compliance.

-

How secure is airSlate SignNow when handling the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For?

Security is a priority at airSlate SignNow, which complies with industry standards to protect sensitive information related to the Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For. Data encryption and secure storage measures ensure that your documents remain confidential and safe.

Get more for Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For

- Mtsu football walk on tryouts form

- B941epsqswaqra 3172715 form

- Becu org forms

- Parts inventory form

- Nys sterilization consent form

- Employees certificate of nonresidence in new jersey form

- Form reg 1e application for st 5 exempt organization certificate for nonprofit exemption from sales tax

- Dr 6596 statement of economic hardship colorado tax form

Find out other Revenue louisiana govTaxForms19026921FLouisiana Department Of Revenue Installment Request For

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later