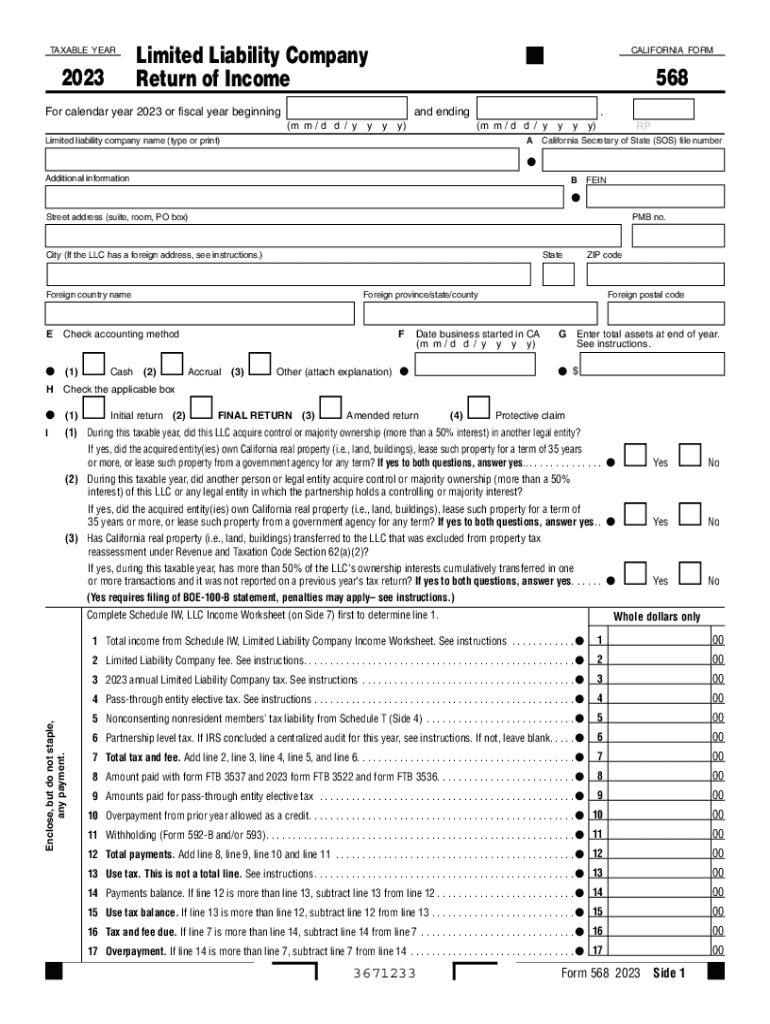

CA Form 568 Limited Liability Company Return of Income

Understanding the CA Form 568 Limited Liability Company Return of Income

The CA Form 568 is a tax form specifically designed for Limited Liability Companies (LLCs) operating in California. This form is used to report the income, deductions, and credits of the LLC to the California Franchise Tax Board (FTB). It is important for LLCs to accurately complete this form to ensure compliance with state tax regulations. The form is applicable to both single-member and multi-member LLCs, making it essential for all types of LLCs registered in California.

Steps to Complete the CA Form 568 Limited Liability Company Return of Income

Completing the CA Form 568 involves several key steps:

- Gather necessary information: Collect financial records, including income statements, expense reports, and any relevant documentation related to the LLC's activities.

- Fill out the form: Begin by entering the LLC's name, address, and other identifying information. Proceed to report income, deductions, and credits as required.

- Review for accuracy: Ensure all entries are correct and that calculations are accurate to prevent issues with the FTB.

- Sign and date: The form must be signed by a member or authorized representative of the LLC.

- Submit the form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Filing Deadlines for the CA Form 568

It is crucial for LLCs to be aware of the filing deadlines for the CA Form 568. Typically, the form is due on the 15th day of the fourth month following the close of the LLC's tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Late submissions may incur penalties, so timely filing is essential.

Required Documents for Filing the CA Form 568

When preparing to file the CA Form 568, certain documents are necessary to ensure a complete and accurate submission. These documents include:

- Financial statements detailing income and expenses

- Records of any credits or deductions claimed

- Previous year’s tax returns, if applicable

- Any additional documentation required by the FTB

Having these documents ready will streamline the filing process and help avoid errors.

Form Submission Methods for the CA Form 568

LLCs have multiple options for submitting the CA Form 568. These methods include:

- Online: Filing electronically through the California Franchise Tax Board's website is often the fastest method.

- By Mail: Completed forms can be printed and mailed to the appropriate FTB address. Ensure sufficient postage is applied.

- In-Person: Some LLCs may choose to deliver their forms directly to a local FTB office, though this may require an appointment.

Choosing the right submission method can help ensure that the form is filed correctly and on time.

Penalties for Non-Compliance with the CA Form 568

Failure to file the CA Form 568 on time or inaccuracies in the form can result in penalties imposed by the California Franchise Tax Board. Common penalties include:

- Late filing penalties, which can accumulate daily

- Interest on any unpaid taxes

- Potential legal repercussions for continued non-compliance

It is important for LLCs to understand these penalties to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 568 limited liability company return of income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the filing 568 form and who needs to complete it?

The filing 568 form is a tax document required by the California Franchise Tax Board for LLCs doing business in California. It is essential for LLCs to report their income, deductions, and other relevant information. If you operate an LLC in California, you must ensure timely filing of the 568 form to avoid penalties.

-

How can airSlate SignNow assist with filing the 568 form?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, including the filing 568 form. With our user-friendly interface, you can easily prepare, sign, and submit your tax documents securely. This simplifies the process and ensures that your filing is completed accurately and on time.

-

What are the costs associated with using airSlate SignNow for filing the 568 form?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. The cost-effective solution allows you to manage your document signing and filing processes without breaking the bank. You can choose a plan that best fits your requirements for filing the 568 form and other documents.

-

Are there any features specifically designed for filing the 568 form?

Yes, airSlate SignNow includes features that facilitate the filing 568 form process, such as customizable templates and automated reminders. These tools help ensure that you never miss a filing deadline. Additionally, our platform allows for easy collaboration with your tax professionals to ensure accuracy.

-

Can I integrate airSlate SignNow with other software for filing the 568 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your filing 568 form alongside your financial records. This integration helps streamline your workflow and reduces the chances of errors during the filing process.

-

What benefits does airSlate SignNow offer for businesses filing the 568 form?

Using airSlate SignNow for filing the 568 form provides numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing for quicker submissions.

-

Is airSlate SignNow compliant with regulations for filing the 568 form?

Yes, airSlate SignNow is fully compliant with industry regulations, ensuring that your filing 568 form meets all legal requirements. Our platform adheres to strict security protocols to protect your sensitive information. You can trust that your documents are handled in accordance with the law.

Get more for CA Form 568 Limited Liability Company Return Of Income

- Container damage report pdf form

- Permohonan politeknik port dickson form

- How to fill ubl cheque form

- Cctv footage request form template

- Fill pdf in arabic form

- Egg carton fractions worksheets form

- Publication order form mail to oregon state marine board oregon

- 25 beaver street room 888 new york ny 10004 phone 212 428 2105 form

Find out other CA Form 568 Limited Liability Company Return Of Income

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document