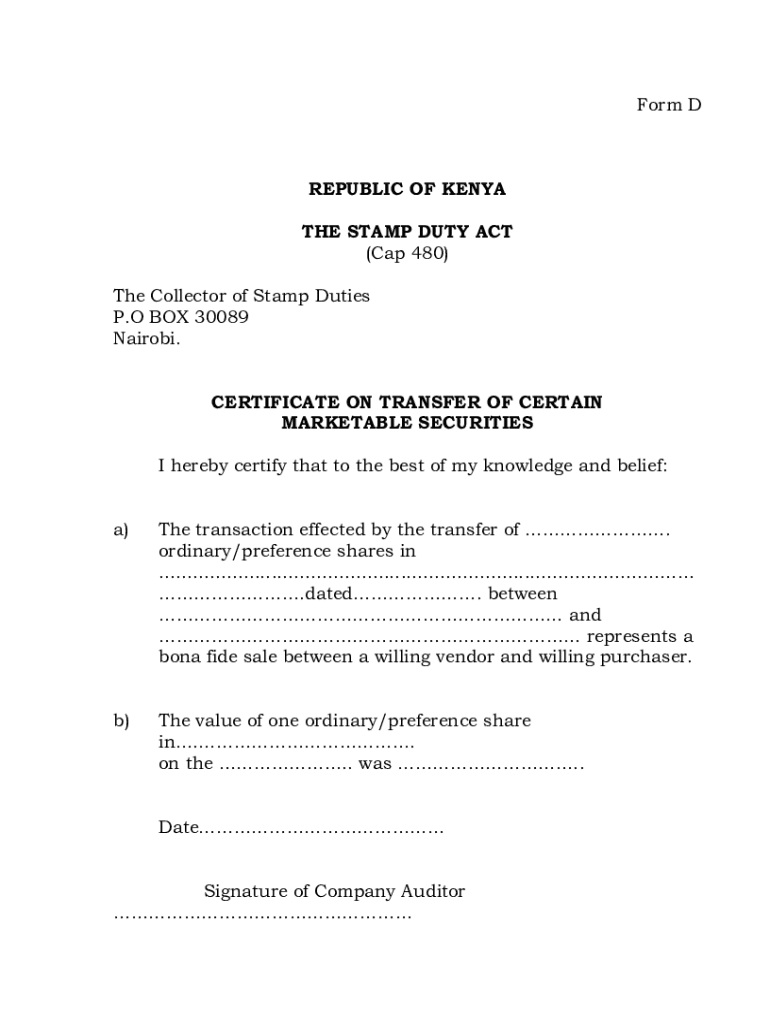

Stamp Duty Transfer Securities Form

What is the Stamp Duty Transfer Securities

The Stamp Duty Transfer Securities refers to a tax imposed on the transfer of securities, which can include stocks, bonds, and other financial instruments. This duty is typically calculated as a percentage of the transaction value and is payable to the government upon the transfer of ownership. Understanding this form is crucial for individuals and businesses involved in buying or selling securities, as it ensures compliance with local regulations and helps avoid potential penalties.

How to use the Stamp Duty Transfer Securities

Using the Stamp Duty Transfer Securities form involves several steps to ensure proper completion and submission. First, gather all necessary information regarding the securities being transferred, including details about the buyer and seller. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it should be signed by all relevant parties. Finally, submit the form along with any required payment to the appropriate government agency, either online or via mail.

Steps to complete the Stamp Duty Transfer Securities

Completing the Stamp Duty Transfer Securities form requires careful attention to detail. Follow these steps for successful completion:

- Collect necessary information about the securities being transferred.

- Fill in the personal details of both the buyer and seller.

- Provide the transaction details, including the value of the securities.

- Sign the form where indicated, ensuring all parties have signed if applicable.

- Submit the completed form along with payment of the stamp duty.

Legal use of the Stamp Duty Transfer Securities

The legal use of the Stamp Duty Transfer Securities form is essential for ensuring that the transfer of securities is recognized by the government. This form serves as proof that the appropriate taxes have been paid, which is necessary for the legal transfer of ownership. Failure to properly complete and submit this form can result in legal complications, including fines or the invalidation of the transfer.

Key elements of the Stamp Duty Transfer Securities

Several key elements must be included in the Stamp Duty Transfer Securities form to ensure its validity. These include:

- The names and addresses of the buyer and seller.

- A detailed description of the securities being transferred.

- The total value of the transaction.

- The date of the transfer.

- Signatures of all parties involved.

Required Documents

When completing the Stamp Duty Transfer Securities form, certain documents may be required to support the transaction. These typically include:

- Proof of identity for both the buyer and seller.

- Documentation of the securities being transferred, such as certificates or account statements.

- Any prior agreements related to the transfer, if applicable.

Quick guide on how to complete stamp duty transfer securities

Complete Stamp Duty Transfer Securities effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary format and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Stamp Duty Transfer Securities on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedures today.

How to edit and electronically sign Stamp Duty Transfer Securities with ease

- Find Stamp Duty Transfer Securities and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Stamp Duty Transfer Securities and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the duty act cap 480 and how is it relevant to airSlate SignNow?

The duty act cap 480 refers to specific regulations governing electronic signature use in various jurisdictions. airSlate SignNow complies with these regulations, ensuring that all eSignatures are legally binding and secure. By using our platform, you can confidently sign and manage documents in accordance with the duty act cap 480.

-

How does airSlate SignNow ensure compliance with the duty act cap 480?

airSlate SignNow takes compliance seriously by implementing features that align with the duty act cap 480. Our platform adheres to the legal standards for electronic signatures, ensuring that all documents signed through our service are valid. This commitment to compliance protects your transactions and upholds the integrity of your agreements.

-

What features does airSlate SignNow offer to support the duty act cap 480?

airSlate SignNow provides a range of features such as secure eSigning, document templates, and audit trails that comply with the duty act cap 480. These tools enhance your document management process and ensure that all signatures are legally effective. Our user-friendly interface makes it easy for anyone to utilize these features efficiently.

-

Is pricing for airSlate SignNow competitive when considering compliance with the duty act cap 480?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses looking for compliant eSigning solutions under the duty act cap 480. Our cost-effective options provide great value for organizations of all sizes, ensuring that you receive a robust service without breaking your budget. You can choose the plan that best fits your needs and compliance requirements.

-

What benefits does eSigning with airSlate SignNow provide in relation to the duty act cap 480?

ESigning with airSlate SignNow streamlines your workflow, reduces administrative overhead, and ensures compliance with the duty act cap 480. This efficiency leads to faster turnaround times and enhances customer satisfaction. By digitizing your signature processes, you save time and resources while ensuring legal compliance.

-

Can airSlate SignNow integrate with other software while adhering to the duty act cap 480?

Yes, airSlate SignNow integrates seamlessly with various software applications, ensuring that your document workflows remain compliant with the duty act cap 480. Our platform supports integrations with popular tools like CRM and project management systems. This flexibility allows you to maintain compliance while optimizing your business processes.

-

How can businesses verify that airSlate SignNow signatures meet the duty act cap 480 standards?

Businesses can verify that airSlate SignNow signatures comply with the duty act cap 480 by accessing the platform’s audit trails and Certificate of Completion. These features provide proof of each signature’s legality and authenticity. Additionally, our support team is available to assist with any compliance-related queries regarding the duty act cap 480.

Get more for Stamp Duty Transfer Securities

- Change of address affidavit form

- Unit 1 worksheet 2 reading scales answer key 340893525 form

- T1 adjustment request form

- Dl 14a 100337167 form

- Pennsylvania builders association instructions to home improvement model contract standard form introduction below are

- Bid security sample form

- Makeup consultation form

- State of rhode island and providence plantations e form

Find out other Stamp Duty Transfer Securities

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast