State of Rhode Island and Providence Plantations E Form

Understanding the Rhode Island W-4 Form

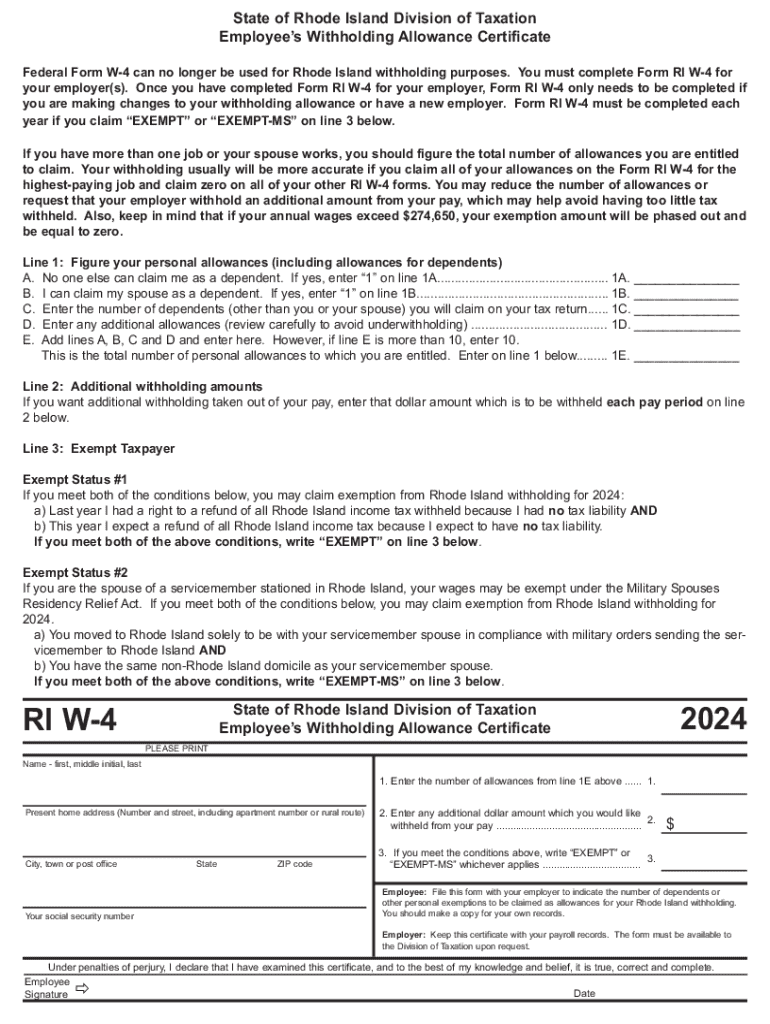

The Rhode Island W-4 form, also known as the Rhode Island withholding form, is essential for employees to indicate their state tax withholding preferences. This form allows individuals to specify the number of allowances they wish to claim, which directly affects the amount of state income tax withheld from their paychecks. Understanding this form is crucial for ensuring that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment during tax season.

Steps to Complete the Rhode Island W-4 Form

Completing the Rhode Island W-4 form involves several key steps:

- Personal Information: Start by filling in your name, address, and Social Security number at the top of the form.

- Allowances: Determine the number of allowances you wish to claim. This can be based on your filing status, dependents, and other personal circumstances.

- Additional Withholding: If you want to withhold more than the standard amount, indicate this in the designated section.

- Signature: Finally, sign and date the form to validate your submission.

Legal Use of the Rhode Island W-4 Form

The Rhode Island W-4 form is legally recognized as the official document for state tax withholding purposes. Employers are required to provide this form to their employees and must ensure that the information submitted is used to calculate the appropriate state income tax deductions. Accurate completion of this form is essential for compliance with state tax laws, and incorrect information can lead to penalties or unexpected tax liabilities.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Rhode Island W-4 form. Employees should submit their completed forms to their employers as soon as they start a new job or experience changes in their tax situation, such as marriage or the birth of a child. Employers must process these forms promptly to ensure accurate withholding from the first paycheck. Additionally, keeping track of any changes in tax laws or deadlines is crucial for maintaining compliance.

Form Submission Methods

The Rhode Island W-4 form can be submitted in various ways, depending on the employer's policies. Common submission methods include:

- Online: Many employers offer digital platforms for employees to complete and submit their W-4 forms electronically.

- Mail: Employees may also print the form and send it via postal mail to their employer's human resources department.

- In-Person: Submitting the form in person is another option, allowing for immediate confirmation of receipt.

Examples of Using the Rhode Island W-4 Form

There are several scenarios where the Rhode Island W-4 form is particularly relevant:

- New Employment: When starting a new job, employees must complete the form to ensure proper tax withholding from their initial paycheck.

- Life Changes: Changes such as marriage, divorce, or the birth of a child may necessitate a reevaluation of allowances claimed on the W-4 form.

- Seasonal Employment: Temporary or seasonal workers should also complete the form to ensure accurate withholding during their period of employment.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island and providence plantations e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rhode Island W4 form?

The Rhode Island W4 form is a state-specific tax form that employees use to determine the amount of state income tax to withhold from their paychecks. It is essential for ensuring that the correct amount of taxes is withheld based on your personal financial situation. Completing the Rhode Island W4 form accurately helps avoid underpayment or overpayment of taxes.

-

How can airSlate SignNow help with the Rhode Island W4 form?

airSlate SignNow provides a seamless platform for businesses to send and eSign the Rhode Island W4 form electronically. This not only speeds up the process but also ensures that all documents are securely stored and easily accessible. With airSlate SignNow, you can manage your tax forms efficiently and reduce paperwork.

-

Is there a cost associated with using airSlate SignNow for the Rhode Island W4 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value considering the features included, such as unlimited eSigning and document storage. You can choose a plan that best fits your requirements for managing the Rhode Island W4 form.

-

What features does airSlate SignNow offer for managing the Rhode Island W4 form?

airSlate SignNow offers features like customizable templates, secure eSigning, and real-time tracking for the Rhode Island W4 form. These features streamline the process, making it easier for both employers and employees to complete and submit the form. Additionally, the platform ensures compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Rhode Island W4 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the Rhode Island W4 form alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Rhode Island W4 form?

Using airSlate SignNow for the Rhode Island W4 form offers numerous benefits, including time savings, enhanced security, and improved accuracy. The electronic signing process eliminates the need for physical paperwork, reducing the risk of errors. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow when handling the Rhode Island W4 form?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including the Rhode Island W4 form. Your data is stored securely, and access is restricted to authorized users only. This ensures that sensitive information remains confidential and safe.

Get more for State Of Rhode Island And Providence Plantations E

- Lic deformity questionnaire form pdf

- Unit circle fill in the blank pdf form

- Ssf pag ibig form

- Pan card back side pdf form

- Chemical hazard assessment form

- Seattle city light application form

- Hhs ocr model attestation form re reproductive health careuse of attestation required hipaa sample form

- Composer contract template form

Find out other State Of Rhode Island And Providence Plantations E

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word