Form 941

What is the Form 941

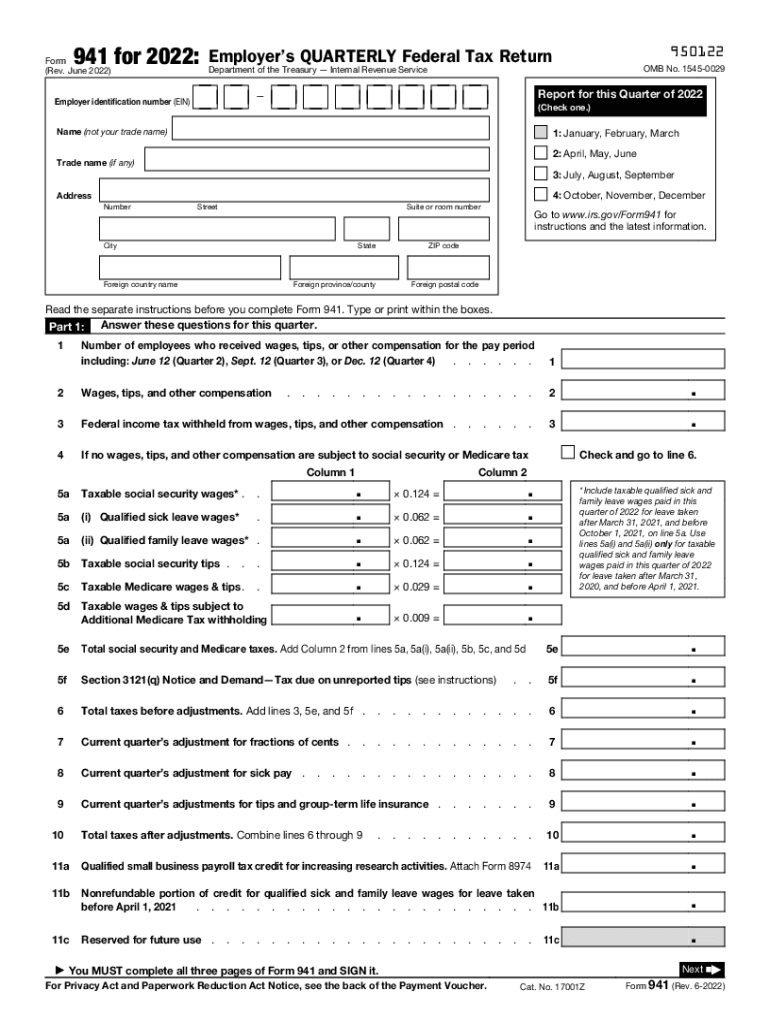

The Form 941 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is essential for businesses to accurately report their payroll taxes to the Internal Revenue Service (IRS). The form provides a record of the employer's tax obligations and is crucial for maintaining compliance with federal tax laws.

Steps to complete the Form 941

Completing the Form 941 involves several key steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form: Enter the required information in the appropriate sections, including the number of employees and total tax liability.

- Calculate taxes: Accurately compute the amounts for Social Security, Medicare, and federal income taxes withheld.

- Review your entries: Double-check all information for accuracy to avoid penalties or delays.

- Submit the form: File the completed Form 941 with the IRS by the due date, either electronically or by mail.

How to obtain the Form 941

The Form 941 can be obtained directly from the IRS website or through various tax preparation software. It is available in a fillable PDF format, making it easy to complete electronically. Employers should ensure they are using the correct version for the applicable tax year, as forms may change from year to year.

Legal use of the Form 941

The Form 941 is legally binding when properly completed and submitted. Employers must adhere to IRS guidelines regarding the accuracy of the information provided. Failure to comply with the legal requirements can result in penalties, including fines and interest on unpaid taxes. It is important to maintain accurate records and submit the form on time to avoid legal issues.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941 to remain compliant with IRS regulations. The form is due four times a year, typically on the last day of the month following the end of each quarter. For example, the deadlines for 2022 are:

- First quarter (January - March): April 30

- Second quarter (April - June): July 31

- Third quarter (July - September): October 31

- Fourth quarter (October - December): January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941. The form can be filed electronically through the IRS e-file system, which is often the quickest method. Alternatively, employers can print the completed form and mail it to the appropriate IRS address based on their location. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency and speed.

Quick guide on how to complete form 941 2021

Effortlessly Prepare Form 941 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Form 941 on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Form 941 with Ease

- Obtain Form 941 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to finalize your edits.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 941 and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 941 form 2022 fillable?

The 941 form 2022 fillable is a tax form used by employers to report wages paid and taxes withheld for the first quarter of the year. This form is crucial for businesses to comply with federal tax regulations. Using a fillable version simplifies the process, allowing for easy online completion and submission.

-

How can I access the 941 form 2022 fillable?

You can easily access the 941 form 2022 fillable through the airSlate SignNow platform. Simply visit our website, navigate to the forms section, and locate the 941 form. From there, you can fill it out online and eSign it for your convenience.

-

Is the 941 form 2022 fillable customizable?

Yes, the 941 form 2022 fillable available on airSlate SignNow can be customized to suit your business needs. You can add specific business information, adjust fields as necessary, and ensure that every detail aligns with your requirements. This flexibility enhances accuracy and efficiency in submitting your tax forms.

-

What are the benefits of using the 941 form 2022 fillable on airSlate SignNow?

Using the 941 form 2022 fillable on airSlate SignNow offers several benefits, including efficiency and compliance. Our platform ensures that you can complete and sign your form electronically, saving time while reducing the risk of errors. Plus, secure cloud storage keeps your documents safe and accessible anytime.

-

Are there any fees associated with using the 941 form 2022 fillable on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that make accessing the 941 form 2022 fillable affordable for businesses of all sizes. While some features may have associated costs, the basic functionality of filling out and signing the 941 form is typically included in our standard plans. Check our pricing page for detailed information.

-

Can I integrate the 941 form 2022 fillable with other software?

Absolutely! airSlate SignNow allows for seamless integrations with various business tools and software. This means you can easily link the 941 form 2022 fillable with your payroll systems or accounting software to enhance workflow and data accuracy.

-

What security measures are in place for the 941 form 2022 fillable on airSlate SignNow?

Security is a top priority at airSlate SignNow. The 941 form 2022 fillable is protected by multiple layers of security protocols, including encryption and secure cloud storage. This ensures that your sensitive information is safe from unauthorized access.

Get more for Form 941

Find out other Form 941

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple