Maine Real Estate Transfer Tax Form

What is the Maine Real Estate Transfer Tax Form

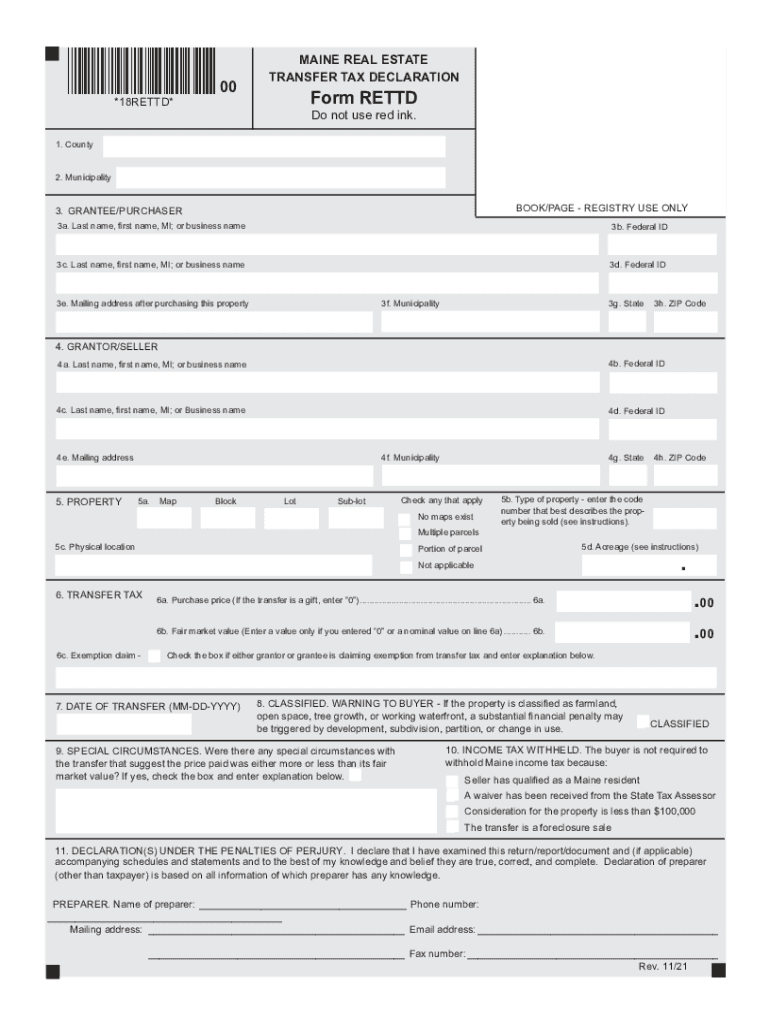

The Maine Real Estate Transfer Tax Form is a legal document used to report and pay the transfer tax imposed on real estate transactions within the state of Maine. This form is crucial for both buyers and sellers, as it ensures compliance with state tax regulations when property changes hands. The transfer tax is calculated based on the sale price of the property, and the form must be completed accurately to avoid penalties.

How to use the Maine Real Estate Transfer Tax Form

Using the Maine Real Estate Transfer Tax Form involves several key steps. First, gather all necessary information regarding the property and the transaction, including the sale price and the names of the parties involved. Next, fill out the form with accurate details, ensuring that all sections are completed. After completing the form, it must be signed by the appropriate parties. Finally, submit the form along with the required payment to the designated state authority.

Steps to complete the Maine Real Estate Transfer Tax Form

Completing the Maine Real Estate Transfer Tax Form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Maine Revenue Services website.

- Fill in the property details, including the address and sale price.

- Provide the names and addresses of both the buyer and seller.

- Calculate the transfer tax based on the sale price.

- Sign and date the form as required.

- Submit the form along with payment to the appropriate state office.

Key elements of the Maine Real Estate Transfer Tax Form

The Maine Real Estate Transfer Tax Form includes several key elements that must be accurately filled out to ensure compliance. These elements typically consist of:

- Property identification details, including the address and tax map number.

- Information about the buyer and seller, including names and contact information.

- The sale price of the property, which is essential for calculating the transfer tax.

- Signature lines for both parties to confirm the accuracy of the information provided.

Legal use of the Maine Real Estate Transfer Tax Form

The legal use of the Maine Real Estate Transfer Tax Form is essential for ensuring that property transactions comply with state laws. This form serves as an official record of the transfer and is required for the proper assessment of transfer taxes. Failure to complete and submit the form can result in penalties, including fines or additional tax liabilities. It is important to retain a copy of the completed form for personal records and future reference.

Form Submission Methods (Online / Mail / In-Person)

The Maine Real Estate Transfer Tax Form can be submitted through various methods, providing flexibility for users. Options include:

- Online: Some jurisdictions may allow electronic submission through designated state portals.

- Mail: The completed form can be printed and sent via postal service to the appropriate state office.

- In-Person: Individuals may also choose to deliver the form directly to the local tax office for immediate processing.

Quick guide on how to complete maine real estate transfer tax form

Effortlessly Prepare Maine Real Estate Transfer Tax Form on Any Device

The management of documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without issues. Manage Maine Real Estate Transfer Tax Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Method to Modify and Electronically Sign Maine Real Estate Transfer Tax Form

- Locate Maine Real Estate Transfer Tax Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Maine Real Estate Transfer Tax Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Maine real estate transfer tax form?

The Maine real estate transfer tax form is a document required when transferring ownership of real property in Maine. This form helps ensure that the proper taxes are paid during the transfer process, making it an essential part of any real estate transaction in the state.

-

How do I fill out the Maine real estate transfer tax form?

To fill out the Maine real estate transfer tax form, you need to provide specific information about the property, the buyer, and the seller. Detailed instructions are typically included with the form, and you can also find resources online to guide you through the process of completing it accurately.

-

Where can I obtain the Maine real estate transfer tax form?

You can obtain the Maine real estate transfer tax form from the official Maine state government website or through your local municipal office. Additionally, many real estate professionals and legal service providers can supply the form along with guidance on its use.

-

What are the fees associated with the Maine real estate transfer tax form?

The fees for the Maine real estate transfer tax form vary depending on the property's sale price. Typically, it is a percentage of the sale price, and it’s important to check the latest rates before completing the form to ensure accurate payment of taxes.

-

Can I eSign the Maine real estate transfer tax form?

Yes, you can eSign the Maine real estate transfer tax form using platforms like airSlate SignNow. This eSigning capability offers a convenient and quick way to complete your real estate transactions without the need for physical paperwork.

-

What are the benefits of using airSlate SignNow for the Maine real estate transfer tax form?

Using airSlate SignNow for the Maine real estate transfer tax form simplifies the signing process. It provides an easy-to-use interface, ensures compliance with legal standards, and allows for secure document handling, making real estate transactions more efficient.

-

Does airSlate SignNow integrate with other platforms for managing the Maine real estate transfer tax form?

Yes, airSlate SignNow offers integrations with a variety of platforms, allowing you to manage the Maine real estate transfer tax form alongside your other business applications. This streamlines workflows and enhances productivity for real estate professionals.

Get more for Maine Real Estate Transfer Tax Form

- Locating the epicenter of an earthquake lab answer key form

- Iowa workforce development form

- Labourer by dash 02 form

- Download application form pdf version london fire brigade

- Shimano warranty registration form

- Pips form 12

- Your company name hvac service order bcrownmaxb form

- Maintenance request form louise beck properties

Find out other Maine Real Estate Transfer Tax Form

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later