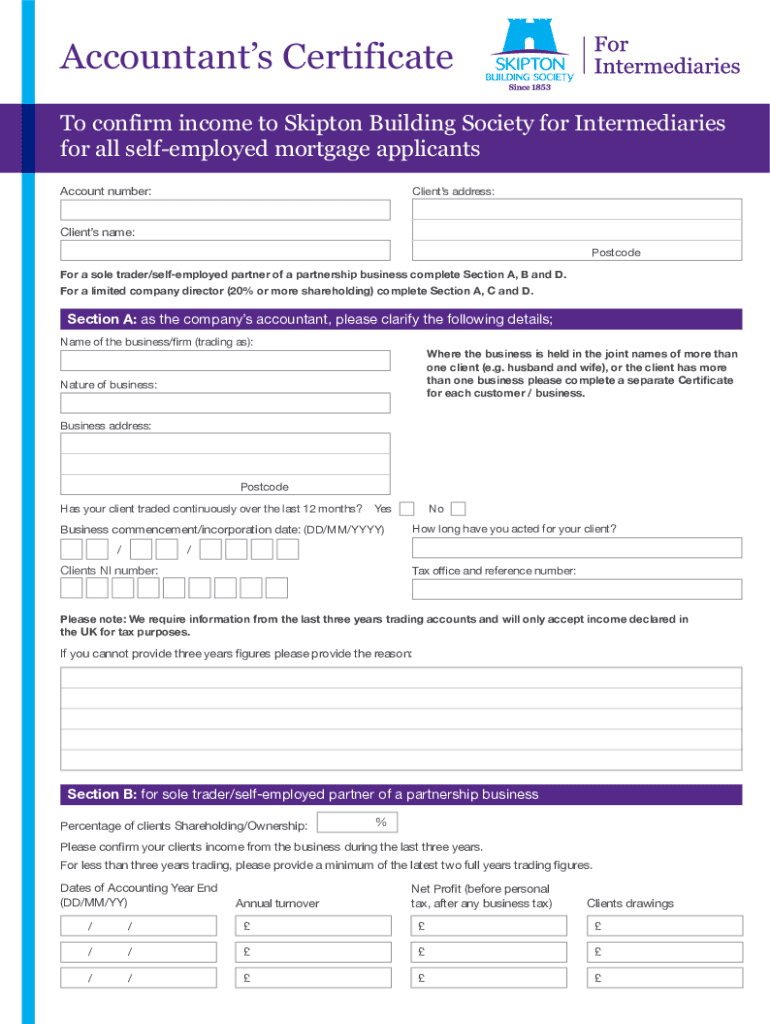

Data Capture Form Skipton Intermediary

Understanding the Data Capture Form for Self-Employed Individuals

The Data Capture Form for self-employed individuals is a crucial document that collects essential information for tax reporting and compliance. This form is designed to gather details about income, expenses, and other relevant financial data necessary for accurate tax filings. It is particularly important for freelancers, independent contractors, and small business owners who need to report their earnings to the IRS. Understanding the purpose and requirements of this form helps ensure that self-employed individuals remain compliant with tax regulations.

Steps to Complete the Data Capture Form for Self-Employed Individuals

Completing the Data Capture Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts, invoices, and bank statements. Next, enter your personal information, such as your name, address, and Social Security number. Then, detail your income sources, including any freelance work or business revenue. After that, list your deductible expenses, such as office supplies, travel costs, and other business-related expenditures. Finally, review the form for any errors before submission to ensure all information is accurate and complete.

Required Documents for the Data Capture Form

To successfully complete the Data Capture Form, certain documents are necessary. These typically include:

- Proof of income, such as 1099 forms or invoices.

- Receipts for business expenses, including utilities, supplies, and travel.

- Bank statements that reflect business transactions.

- Any relevant licenses or permits required for your business.

Having these documents ready will streamline the process and help ensure that all reported information is accurate.

Legal Use of the Data Capture Form for Self-Employed Individuals

The Data Capture Form is legally recognized as a valid method for reporting income and expenses for self-employed individuals. It must be completed accurately and submitted in accordance with IRS guidelines to avoid penalties. The form serves as a record of financial activity, which may be reviewed during audits or inquiries by tax authorities. Compliance with tax laws is essential, and using this form correctly contributes to maintaining good standing with the IRS.

Filing Deadlines and Important Dates

Self-employed individuals must be aware of key filing deadlines associated with the Data Capture Form. Typically, the deadline for submitting tax returns is April 15 for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, estimated tax payments are usually due quarterly, with specific dates set by the IRS. Staying informed about these deadlines helps avoid late fees and penalties.

Form Submission Methods for Self-Employed Individuals

Self-employed individuals have several options for submitting the Data Capture Form. The most common methods include:

- Online submission through the IRS e-file system, which allows for quick processing.

- Mailing a paper form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-person submission at local IRS offices, where assistance may be available.

Choosing the right submission method depends on personal preference and the complexity of the tax situation.

Quick guide on how to complete data capture form skipton intermediary

Complete Data Capture Form Skipton Intermediary easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Data Capture Form Skipton Intermediary on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The simplest method to modify and electronically sign Data Capture Form Skipton Intermediary with ease

- Find Data Capture Form Skipton Intermediary and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Data Capture Form Skipton Intermediary while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are form intermediaries in the context of airSlate SignNow?

Form intermediaries in airSlate SignNow refer to tools or platforms that simplify the creation, management, and eSigning of documents. These intermediaries facilitate seamless communication and workflow between users and their documents, making it easier for businesses to manage their forms efficiently.

-

How does airSlate SignNow enhance the use of form intermediaries?

airSlate SignNow enhances the use of form intermediaries by streamlining the eSigning process and providing a user-friendly interface. This integration allows businesses to quickly send, receive, and manage signed documents, signNowly reducing turnaround time and improving productivity.

-

What pricing plans are available for airSlate SignNow as a form intermediary?

airSlate SignNow offers various pricing plans to cater to different business needs. Each plan is designed to provide robust features related to form intermediaries, ensuring that businesses can choose an option that fits their budget while maximizing their workflow efficiency.

-

What key features should I look for in form intermediaries like airSlate SignNow?

When evaluating form intermediaries, consider features such as customizable templates, robust eSignature capabilities, automation tools, and integration options with other software. airSlate SignNow excels in providing these features to ensure a smooth document management process for users.

-

How can airSlate SignNow benefit businesses using form intermediaries?

Using airSlate SignNow as a form intermediary allows businesses to streamline their document processes, thereby saving time and reducing paper usage. The ability to send and eSign documents electronically enhances overall efficiency and provides a professional approach to handling business transactions.

-

Can airSlate SignNow integrate with other software when used as a form intermediary?

Yes, airSlate SignNow offers various integration options with popular software and tools, enhancing its functionality as a form intermediary. This allows businesses to connect their existing systems seamlessly, creating a cohesive workflow that supports all document-related tasks.

-

Is airSlate SignNow secure when handling documents as form intermediaries?

Absolutely! airSlate SignNow implements advanced security measures to ensure that all documents handled as form intermediaries are safe and protected. With features like encryption and secure servers, businesses can trust that their sensitive information remains confidential.

Get more for Data Capture Form Skipton Intermediary

Find out other Data Capture Form Skipton Intermediary

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease