Internal Revenue Service Notice Form

What is the Internal Revenue Service Notice

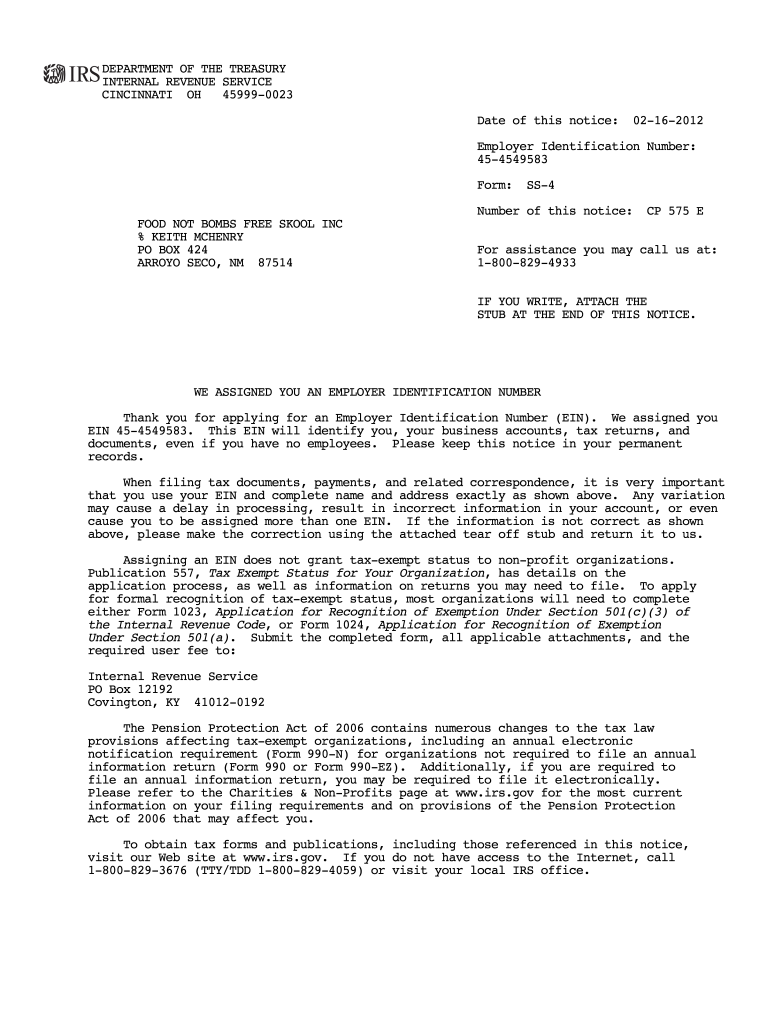

The Internal Revenue Service (IRS) Notice is an official communication from the IRS to taxpayers. It serves various purposes, including informing individuals or businesses about their tax obligations, providing updates on tax filings, or notifying them of any discrepancies in their tax records. Each notice contains specific information relevant to the recipient's tax situation, such as amounts owed, deadlines for payment, or necessary actions to resolve issues. Understanding the content of these notices is crucial for compliance and avoiding penalties.

How to use the Internal Revenue Service Notice

Using the IRS Notice effectively involves carefully reviewing the information provided and taking the appropriate actions. Taxpayers should first read the notice thoroughly to understand what it pertains to, whether it is an audit, a payment request, or a notification of a change in tax status. Following the instructions outlined in the notice is essential, as it often includes deadlines and specific forms that need to be completed. If the notice requires a response, it is important to address it promptly to avoid further complications.

How to obtain the Internal Revenue Service Notice

Taxpayers can obtain IRS Notices in several ways. Typically, these notices are mailed directly to the taxpayer's address on file with the IRS. If a notice is misplaced or not received, individuals can access their tax records through the IRS website by creating an account or using the IRS's online tools. Additionally, taxpayers can contact the IRS directly via phone for assistance in obtaining a copy of any notice. Keeping accurate records and ensuring that the IRS has the correct address is vital for receiving all relevant communications.

Steps to complete the Internal Revenue Service Notice

Completing the actions required by an IRS Notice involves several key steps:

- Read the notice carefully to understand the requirements and deadlines.

- Gather any necessary documentation that supports your case or response.

- Complete any forms mentioned in the notice, ensuring accuracy and completeness.

- Submit the required forms or payments by the specified deadline, using the method outlined in the notice.

- Keep a copy of the notice and any correspondence for your records.

Legal use of the Internal Revenue Service Notice

The IRS Notice is considered a legal document, and its contents can have significant implications for taxpayers. It is essential to treat the information within the notice seriously, as failure to comply can lead to penalties, interest on unpaid taxes, or even legal action. Taxpayers should ensure that any responses to the notice are documented and submitted in accordance with IRS guidelines. Consulting a tax professional for guidance on how to handle specific notices can also be beneficial.

Penalties for Non-Compliance

Non-compliance with the instructions or deadlines specified in an IRS Notice can result in various penalties. These may include monetary fines, additional interest on unpaid taxes, and potential legal consequences. The IRS may also take collection actions, such as garnishing wages or placing liens on property. It is crucial for taxpayers to respond to notices promptly and accurately to mitigate these risks and maintain compliance with tax laws.

Quick guide on how to complete internal revenue service notice

Prepare Internal Revenue Service Notice effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Internal Revenue Service Notice on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Internal Revenue Service Notice effortlessly

- Obtain Internal Revenue Service Notice and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that functionality.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Internal Revenue Service Notice and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for conducting an IRS employer ID number search?

Conducting an IRS employer ID number search is simple. You start by visiting the IRS website or using authorized third-party services. By entering your business name or details, you can efficiently locate your employer ID number to ensure compliance and documentation accuracy.

-

How does airSlate SignNow assist in managing IRS employer ID number searches?

airSlate SignNow provides users with document management tools that help users keep track of their IRS employer ID number searches. With eSignature capabilities, businesses can easily gather documents required for submission. This streamlines the process and ensures that your employer ID is always accessible.

-

Are there any associated costs for using airSlate SignNow for IRS employer ID number searches?

airSlate SignNow offers affordable pricing plans that cater to various business sizes. By subscribing, you gain access to a comprehensive suite of tools that not only facilitate IRS employer ID number searches but also manage document workflows efficiently. This cost-effective solution enhances productivity.

-

What features does airSlate SignNow offer for IRS employer ID number document management?

AirSlate SignNow is equipped with features such as secure document storage, customizable templates, and automated workflows that enhance the effectiveness of IRS employer ID number management. With easy eSignature functionality, you can ensure that all documentation related to your employer ID number is completed and filed correctly.

-

Can I integrate airSlate SignNow with other tools for IRS employer ID number searches?

Yes, airSlate SignNow offers seamless integrations with various third-party applications and cloud storage services. This allows users to streamline their IRS employer ID number searches alongside their existing workflows. Integrations help enhance productivity and reduce redundancy in document processing.

-

What benefits does eSigning provide for documents related to IRS employer ID number searches?

ESigning with airSlate SignNow provides legal validity and time efficiency for documents pertaining to IRS employer ID number searches. It allows users to sign documents from anywhere, speeding up the process of obtaining required approvals and enhancing compliance with IRS regulations.

-

Is airSlate SignNow suitable for businesses of all sizes in conducting IRS employer ID number searches?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup looking for your first IRS employer ID number search or a large corporation managing multiple searches, our platform provides the scalability and features you need.

Get more for Internal Revenue Service Notice

Find out other Internal Revenue Service Notice

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors