8944 Form 2021-2026

What is the 8944 Form

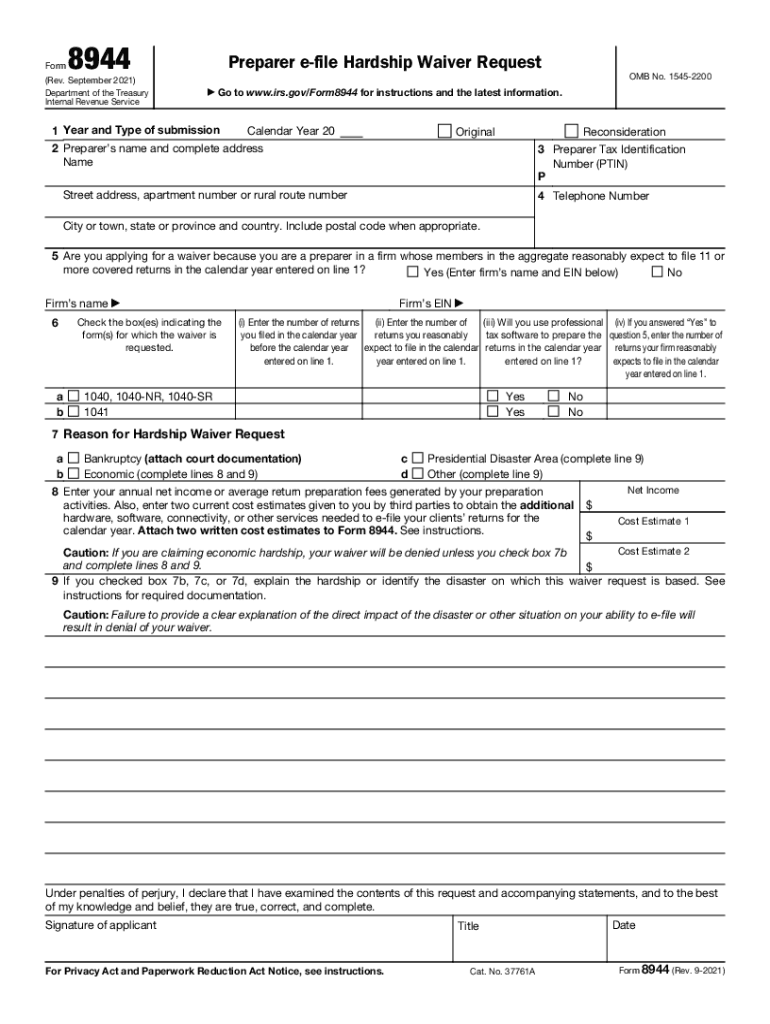

The 8944 Form, officially known as the Hardship Form for the IRS, is used by individuals to request relief from certain tax obligations due to financial hardship. This form is particularly relevant for taxpayers who find themselves unable to meet their tax liabilities due to unforeseen circumstances, such as job loss, medical emergencies, or other significant financial challenges. It serves as a formal request to the Internal Revenue Service (IRS) to consider these hardships when assessing tax obligations.

How to use the 8944 Form

To effectively use the 8944 Form, individuals must first gather necessary information regarding their financial situation. This includes details about income, expenses, and any relevant documentation that supports their claim of hardship. Once the form is completed, it should be submitted to the appropriate IRS office, either electronically or via mail, depending on the specific requirements outlined by the IRS. It's essential to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the 8944 Form

Completing the 8944 Form involves several key steps:

- Begin by downloading the form from the official IRS website or obtaining a physical copy.

- Fill in personal information, including your name, address, and Social Security number.

- Provide detailed information about your financial situation, including income sources and monthly expenses.

- Attach any supporting documents that verify your claims of hardship, such as pay stubs or medical bills.

- Review the form for accuracy and completeness before submission.

Legal use of the 8944 Form

The 8944 Form is legally binding when submitted correctly and in compliance with IRS regulations. This means that the information provided must be truthful and verifiable. Misrepresentation or failure to provide accurate information can result in penalties or denial of the hardship request. It is crucial for individuals to understand their rights and obligations when using this form, ensuring that they are fully aware of the legal implications involved.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 8944 Form. These guidelines include instructions on what constitutes a qualifying hardship, the necessary documentation to support claims, and the timeline for processing requests. Familiarizing oneself with these guidelines can significantly improve the chances of a successful submission. It is advisable to consult the IRS official site for the most current information and updates regarding the form and its requirements.

Eligibility Criteria

Eligibility for using the 8944 Form is generally based on the individual's financial situation. Taxpayers must demonstrate that they are experiencing significant financial hardship that affects their ability to meet tax obligations. Common criteria include a substantial decrease in income, unexpected medical expenses, or other circumstances that severely impact financial stability. Understanding these criteria is essential for individuals considering submitting the form.

Quick guide on how to complete 8944 form

Accomplish 8944 Form effortlessly on any platform

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional paper-based and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the features required to create, amend, and eSign your documents promptly without delays. Manage 8944 Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

How to adjust and eSign 8944 Form smoothly

- Locate 8944 Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign 8944 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8944 form

Create this form in 5 minutes!

People also ask

-

What is the role of the internal revenue service treasury in document signing?

The internal revenue service treasury plays a critical role in ensuring that electronic signatures are compliant with legal standards, which is essential for any business looking to streamline their document signing process. By using platforms like airSlate SignNow, you can sign and manage documents securely while adhering to IRS regulations.

-

How does airSlate SignNow support compliance with the internal revenue service treasury?

airSlate SignNow provides features that ensure compliance with the internal revenue service treasury guidelines for electronic signatures. Our platform includes robust security measures and audit trails that allow businesses to maintain proper documentation for IRS purposes.

-

What pricing plans are available for airSlate SignNow considering internal revenue service treasury regulations?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses while staying compliant with internal revenue service treasury regulations. Our plans are affordable, ensuring that even small businesses can access cost-effective solutions for their document signing needs.

-

What are the key features of airSlate SignNow related to internal revenue service treasury compliance?

Key features of airSlate SignNow include advanced security protocols, customizable workflows, and comprehensive audit trails, all essential for compliance with the internal revenue service treasury guidelines. These features ensure that your documents are securely signed and verifiable at all stages.

-

Can airSlate SignNow integrate with other systems that deal with the internal revenue service treasury requirements?

Yes, airSlate SignNow integrates seamlessly with various systems used for managing documents and financial data, addressing internal revenue service treasury requirements. These integrations help streamline processes and improve overall efficiency in handling sensitive documents.

-

How does airSlate SignNow benefit businesses concerning the internal revenue service treasury?

By utilizing airSlate SignNow, businesses can enhance their efficiency in managing documents that require compliance with internal revenue service treasury standards. The ability to eSign documents quickly and securely helps save time and reduces the risk of errors.

-

Is airSlate SignNow suitable for businesses that frequently interact with the internal revenue service treasury?

Absolutely! airSlate SignNow is designed for businesses that often interact with the internal revenue service treasury by providing reliable tools for electronic signatures and document management. It ensures that your signing process is both secure and compliant with IRS standards.

Get more for 8944 Form

Find out other 8944 Form

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast