KY DoR 40A102 Form

What is the KY DoR 40A102

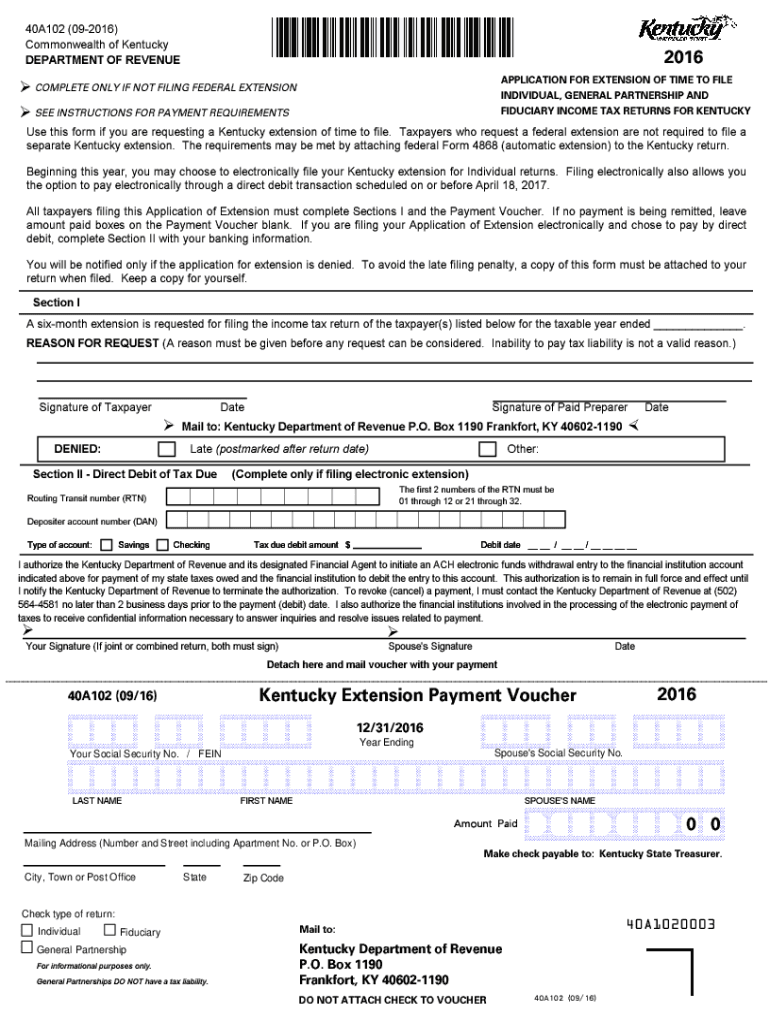

The KY DoR 40A102 is a specific form used by the Kentucky Department of Revenue. This form is primarily utilized for reporting and documenting various tax-related information. It serves as a crucial tool for individuals and businesses to comply with state tax regulations. Understanding the purpose and requirements of the KY DoR 40A102 is essential for ensuring accurate reporting and avoiding potential penalties.

How to use the KY DoR 40A102

Using the KY DoR 40A102 involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation required for the form. This may include financial records, identification numbers, and any relevant tax documents. Next, fill out the form accurately, ensuring that all fields are completed as per the instructions provided. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred method.

Steps to complete the KY DoR 40A102

Completing the KY DoR 40A102 requires careful attention to detail. Follow these steps for a smooth process:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documents, including income statements and previous tax returns.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the form through the chosen method, ensuring it is sent before the deadline.

Legal use of the KY DoR 40A102

The legal use of the KY DoR 40A102 is governed by Kentucky state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Electronic submissions are considered valid as long as they comply with the state's eSignature regulations. It is important to maintain copies of the submitted form and any supporting documents for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the KY DoR 40A102 are critical to avoid penalties. Typically, the form must be submitted by the designated tax deadline, which may vary based on the taxpayer's situation. It is advisable to check the Kentucky Department of Revenue's official calendar for specific dates. Marking these deadlines on a personal calendar can help ensure timely filing and compliance with state regulations.

Who Issues the Form

The KY DoR 40A102 is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide the necessary forms and guidelines for individuals and businesses to fulfill their tax obligations. For any questions or clarifications regarding the form, contacting the department directly can provide valuable assistance.

Quick guide on how to complete ky dor 40a102

Complete KY DoR 40A102 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hindrances. Manage KY DoR 40A102 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and electronically sign KY DoR 40A102 without stress

- Find KY DoR 40A102 and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign KY DoR 40A102 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky dor 40a102

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is KY DoR 40A102?

KY DoR 40A102 is a specific form required by the Kentucky Department of Revenue that can be effortlessly managed through airSlate SignNow. It facilitates the eSigning process to optimize compliance and efficiency in handling crucial tax documents.

-

How does airSlate SignNow integrate with KY DoR 40A102?

airSlate SignNow provides seamless integration for KY DoR 40A102, allowing users to easily customize, send, and eSign the form. This enhances workflow efficiency and ensures that your documents are compliant with state requirements.

-

Is there a cost associated with using the KY DoR 40A102 form on airSlate SignNow?

airSlate SignNow offers a cost-effective pricing model that includes access to KY DoR 40A102. Pricing plans cater to diverse needs, ensuring that businesses can choose an option that fits their budget while leveraging powerful eSigning capabilities.

-

What features does airSlate SignNow offer for the KY DoR 40A102?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for KY DoR 40A102. These features streamline the signing process, improve document management, and enhance overall productivity.

-

What benefits can businesses expect from using KY DoR 40A102 with airSlate SignNow?

Businesses can expect increased efficiency, reduced errors, and faster turnaround times when using KY DoR 40A102 with airSlate SignNow. The platform ensures compliance and provides a user-friendly environment for both senders and signers.

-

Can KY DoR 40A102 be accessed from mobile devices using airSlate SignNow?

Yes, airSlate SignNow allows users to access and eSign KY DoR 40A102 from any mobile device. This flexibility ensures that users can manage their documents on the go, enhancing convenience and productivity.

-

How can I track the status of my KY DoR 40A102 submissions in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your KY DoR 40A102 submissions through real-time notifications and dashboards. This feature keeps you informed about who has viewed or signed your document, ensuring transparency in your workflow.

Get more for KY DoR 40A102

Find out other KY DoR 40A102

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document