WI DoR W 700 Form

What is the WI DoR W-700

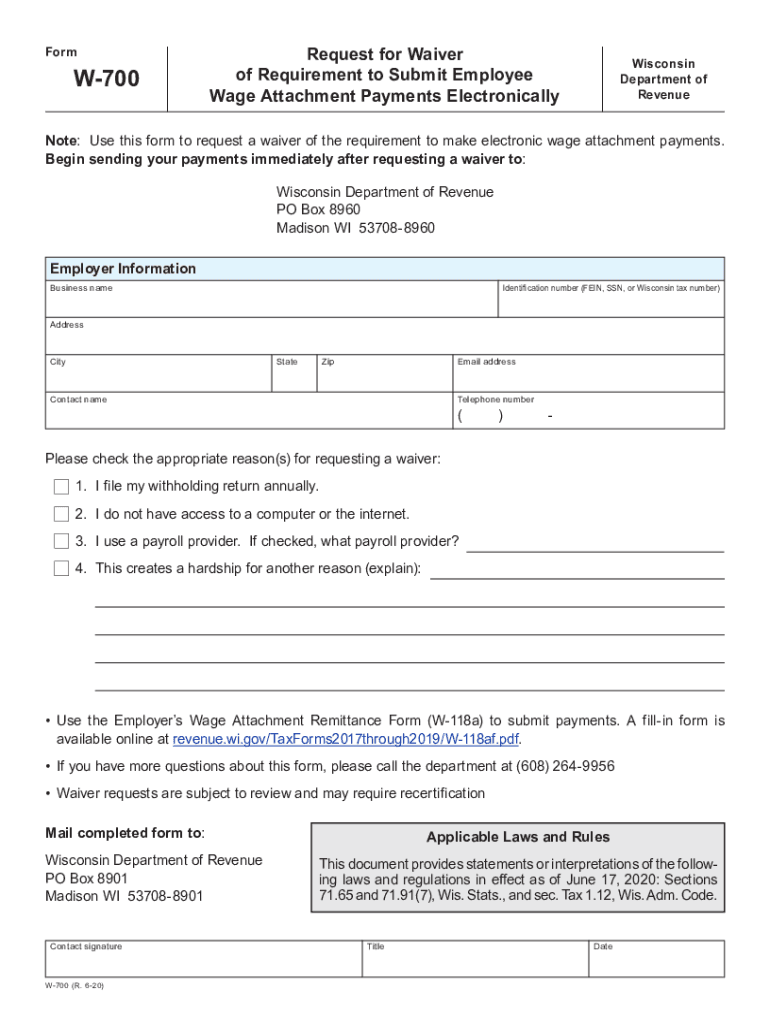

The WI DoR W-700 form is a document used in the state of Wisconsin for reporting and documenting certain tax-related information. This form is essential for individuals and businesses who need to comply with state tax regulations. It serves as a means to ensure that the correct information is submitted to the Wisconsin Department of Revenue, facilitating accurate tax processing and compliance.

How to use the WI DoR W-700

Using the WI DoR W-700 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation that supports the information you will provide on the form. Next, fill out the form carefully, ensuring that all fields are completed according to the instructions provided. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the guidelines set forth by the Wisconsin Department of Revenue.

Steps to complete the WI DoR W-700

Completing the WI DoR W-700 form requires attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Collect all relevant documents, such as income statements and tax records.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check your entries for any errors or omissions.

- Submit the form according to the preferred method: electronically or by mail.

Legal use of the WI DoR W-700

The legal use of the WI DoR W-700 form is governed by Wisconsin state tax laws. This form must be completed and submitted in compliance with these laws to ensure that it is considered valid and legally binding. Providing false information on this form can lead to penalties and legal repercussions. Therefore, it is crucial to ensure that all data entered is accurate and truthful.

Filing Deadlines / Important Dates

Filing deadlines for the WI DoR W-700 form are established by the Wisconsin Department of Revenue. It is important to be aware of these dates to avoid late fees or penalties. Typically, the deadlines align with the state tax filing periods. Keeping track of these dates ensures timely submission and compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The WI DoR W-700 form can be submitted through various methods. You may choose to file online, which is often the quickest option, or you can mail the completed form to the appropriate address provided by the Wisconsin Department of Revenue. In-person submissions may also be accepted at designated offices. Each method has its own advantages, so select the one that best fits your needs.

Quick guide on how to complete wi dor w 700

Prepare WI DoR W 700 easily on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle WI DoR W 700 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign WI DoR W 700 effortlessly

- Obtain WI DoR W 700 and then select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign WI DoR W 700 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi dor w 700

Create this form in 5 minutes!

How to create an eSignature for the wi dor w 700

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is the WI DoR W 700 form and how can airSlate SignNow assist with it?

The WI DoR W 700 form is essential for businesses in Wisconsin for tax purposes. airSlate SignNow simplifies the process by allowing users to easily eSign and send this form, ensuring that submissions are timely and secure. With airSlate SignNow, you can complete your WI DoR W 700 without the hassle of printing and mailing.

-

Is airSlate SignNow a cost-effective solution for handling the WI DoR W 700?

Yes, airSlate SignNow offers competitive pricing plans, making it a cost-effective choice for managing the WI DoR W 700. Our flexible subscription options cater to businesses of all sizes, ensuring you get the features you need without overspending. Save money while streamlining your document management with airSlate SignNow.

-

What features does airSlate SignNow provide for the WI DoR W 700 form?

airSlate SignNow includes a range of features tailored for the WI DoR W 700 and similar documents, including customizable templates, secure eSignature capabilities, and audit trails. This ensures that every step of the signing process is efficient and compliant with regulatory standards. You can manage your documents related to the WI DoR W 700 with ease.

-

How secure is the signing process for the WI DoR W 700 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols to protect all documents, including the WI DoR W 700, ensuring that your sensitive information remains confidential and secure. This commitment to security allows users to confidently manage their important documents.

-

Can airSlate SignNow integrate with other tools for managing the WI DoR W 700?

Absolutely! airSlate SignNow integrates with various third-party applications, enhancing your workflow when managing the WI DoR W 700 and other documents. Whether you use CRM systems or cloud storage solutions, our integrations streamline processes and improve efficiency, ensuring a cohesive workflow.

-

What benefits does airSlate SignNow offer for businesses handling the WI DoR W 700?

Using airSlate SignNow to manage the WI DoR W 700 offers numerous benefits, including faster document turnaround times, improved organization, and enhanced compliance. With our user-friendly interface, businesses can increase productivity while ensuring accurate and timely submissions of essential forms. Experience these benefits firsthand with airSlate SignNow.

-

Can I track the status of my WI DoR W 700 submission with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their WI DoR W 700 submissions in real time. With our comprehensive dashboard, you can monitor when documents are sent, viewed, and signed, ensuring you stay informed throughout the process. This feature enhances accountability and helps manage your workflows efficiently.

Get more for WI DoR W 700

- Driving certification for maryland commercial drivers license mva maryland form

- Hipaa handout for patients form

- Basketball tryout sheet form

- Globalization worksheet pdf form

- Cyprexx vacancy posting form

- British airways receipt form

- Tarion critical dates form

- Application submission checklist hudson county hudsoncountynj form

Find out other WI DoR W 700

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online