Estate to Five 5 Individual Beneficiaries Form

What is the Estate To Five 5 Individual Beneficiaries

The Estate To Five 5 Individual Beneficiaries form is a legal document used to designate five separate beneficiaries to receive assets from an estate. This form is essential in estate planning, ensuring that the decedent's wishes regarding asset distribution are clearly outlined and legally recognized. By specifying individual beneficiaries, the form helps prevent disputes among potential heirs and provides clarity on how the estate's assets should be divided.

How to use the Estate To Five 5 Individual Beneficiaries

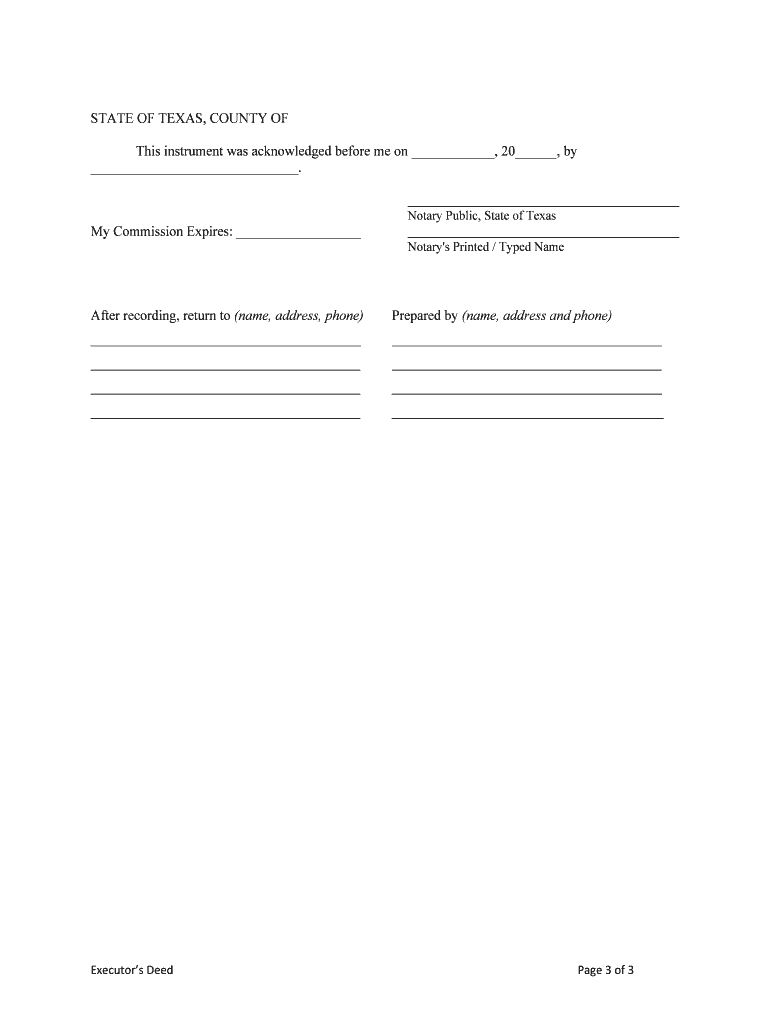

Using the Estate To Five 5 Individual Beneficiaries form involves several steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information about the beneficiaries, including their full names, addresses, and relationship to the decedent. Next, fill out the form carefully, ensuring that each beneficiary is clearly identified. After completing the form, it should be signed by the individual creating the estate plan, often in the presence of witnesses or a notary, depending on state laws.

Steps to complete the Estate To Five 5 Individual Beneficiaries

Completing the Estate To Five 5 Individual Beneficiaries form involves a systematic approach:

- Gather information about the decedent and the beneficiaries.

- Fill in the decedent's details, including name and date of death.

- List each of the five beneficiaries with their full names and contact information.

- Specify the percentage or specific assets each beneficiary will receive.

- Review the form for accuracy and completeness.

- Sign the document in accordance with state requirements, which may include notarization.

Legal use of the Estate To Five 5 Individual Beneficiaries

The legal use of the Estate To Five 5 Individual Beneficiaries form is crucial for ensuring that the distribution of assets complies with state laws. This form must be executed according to the legal standards set forth by the state where the decedent resided. It is important to understand that improper execution or failure to meet legal requirements can lead to challenges in probate court, potentially delaying the distribution of assets and causing disputes among beneficiaries.

Key elements of the Estate To Five 5 Individual Beneficiaries

Key elements of the Estate To Five 5 Individual Beneficiaries form include:

- The decedent's full name and date of death.

- A clear list of the five beneficiaries, including their names and addresses.

- The specific shares or assets allocated to each beneficiary.

- The signature of the decedent or the person creating the estate plan.

- Witness signatures or notarization, if required by state law.

Examples of using the Estate To Five 5 Individual Beneficiaries

Examples of using the Estate To Five 5 Individual Beneficiaries form can vary based on individual circumstances. For instance, a parent may use this form to allocate their estate among their five children, specifying that each child receives an equal share. Alternatively, a grandparent might designate different assets, such as property or investments, to each grandchild, ensuring that their unique contributions to the family are recognized. Such examples illustrate the flexibility and importance of clearly defining beneficiary roles in estate planning.

Quick guide on how to complete estate to five 5 individual beneficiaries

Complete Estate To Five 5 Individual Beneficiaries seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Estate To Five 5 Individual Beneficiaries on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign Estate To Five 5 Individual Beneficiaries effortlessly

- Find Estate To Five 5 Individual Beneficiaries and click on Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow has specially designed for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Estate To Five 5 Individual Beneficiaries to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for creating an estate to five 5 individual beneficiaries using airSlate SignNow?

To create an estate to five 5 individual beneficiaries, users can easily design a document using airSlate SignNow’s intuitive platform. The process involves drafting a will or estate plan, specifying the beneficiaries, and utilizing the eSignature feature for official acknowledgment. This ensures a legally binding document that all involved parties can quickly and efficiently sign.

-

How does airSlate SignNow ensure the security of documents related to the estate to five 5 individual beneficiaries?

airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect documents related to the estate to five 5 individual beneficiaries. Additionally, our platform complies with various industry standards to ensure data integrity and confidentiality during the signing process.

-

What pricing options are available for managing an estate to five 5 individual beneficiaries with airSlate SignNow?

airSlate SignNow offers various pricing plans suitable for individuals and businesses managing estates to five 5 individual beneficiaries. You can choose from monthly or annual subscriptions, ensuring flexibility in cost management. Our pricing is transparent and designed to cater to diverse needs without any hidden fees.

-

Can I personalize the estate documents for five 5 individual beneficiaries using airSlate SignNow?

Yes, airSlate SignNow allows for complete personalization of estate documents meant for five 5 individual beneficiaries. Users can add specific terms, clauses, and personal messages to ensure the document meets their unique requirements. This ability to customize ensures that all aspects of your estate planning are addressed.

-

What additional features does airSlate SignNow provide for managing estate documents?

In addition to eSignature capabilities, airSlate SignNow offers features such as document templates, automated reminders, and comprehensive tracking tools which are beneficial for managing estate documents for five 5 individual beneficiaries. These features streamline the process, ensuring that all parties are informed and nothing falls through the cracks.

-

Is airSlate SignNow compatible with other software when handling estates for five 5 individual beneficiaries?

Absolutely! airSlate SignNow integrates seamlessly with many popular software solutions, making it easier to manage estates involving five 5 individual beneficiaries. This integration ensures a smooth workflow by allowing users to pull information from other platforms directly into their estate documents.

-

What are the benefits of using airSlate SignNow for estate planning with five 5 individual beneficiaries?

Using airSlate SignNow for estate planning provides numerous benefits, including ease of use, affordability, and efficient handling of signatures. It simplifies the entire process, ensuring that all five 5 individual beneficiaries can easily review and sign documents without unnecessary delays.

Get more for Estate To Five 5 Individual Beneficiaries

- Punjab revenue authority tax payment challan form

- T mobile corporate discount migration form prtl uhcl

- Purdue immunization form 31357066

- Forklift annual inspection form

- Oklahoma i9 form

- Vehicle inspection form get a genuine mopar vehicle

- Sequatchie valley head start p form

- Commissions contract template form

Find out other Estate To Five 5 Individual Beneficiaries

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word