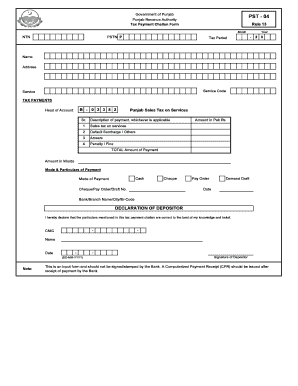

Punjab Revenue Authority Tax Payment Challan Form

What is the Punjab Revenue Authority Tax Payment Challan Form

The Punjab Revenue Authority Tax Payment Challan Form is an official document used for the payment of taxes in Punjab. This form is essential for individuals and businesses to comply with tax regulations set by the Punjab Revenue Authority. It serves as a record of payment and is necessary for various tax-related processes. By completing this form, taxpayers ensure that their tax obligations are met in a timely manner, contributing to the overall revenue system.

How to use the Punjab Revenue Authority Tax Payment Challan Form

Using the Punjab Revenue Authority Tax Payment Challan Form involves several straightforward steps. First, taxpayers need to access the form, which can typically be obtained online or through designated offices. After acquiring the form, individuals must fill in their personal and tax information accurately. Once completed, the form can be submitted along with the payment to the appropriate tax authority. It is crucial to retain a copy of the completed form for personal records and future reference.

Steps to complete the Punjab Revenue Authority Tax Payment Challan Form

Completing the Punjab Revenue Authority Tax Payment Challan Form requires careful attention to detail. The following steps outline the process:

- Obtain the form from an official source.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Specify the type of tax being paid and the corresponding amount.

- Review all entered information for accuracy.

- Submit the form along with the payment to the designated authority.

Following these steps ensures that the form is completed correctly, minimizing the risk of errors that could lead to compliance issues.

Legal use of the Punjab Revenue Authority Tax Payment Challan Form

The Punjab Revenue Authority Tax Payment Challan Form is legally binding when completed and submitted according to established guidelines. To ensure its legal standing, it must be filled out accurately and submitted to the appropriate tax authority. Compliance with the relevant tax laws and regulations is essential for the form to be considered valid. This includes adhering to any deadlines associated with tax payments, as failure to do so may result in penalties.

Key elements of the Punjab Revenue Authority Tax Payment Challan Form

Several key elements are critical to the Punjab Revenue Authority Tax Payment Challan Form. These include:

- Taxpayer Information: Essential personal details such as name and identification number.

- Tax Type: The specific type of tax being paid, which must be clearly indicated.

- Payment Amount: The total amount due, which should be calculated accurately.

- Date of Payment: The date when the payment is made, which is important for record-keeping.

Ensuring that all these elements are correctly filled out is crucial for the form's validity and for maintaining compliance with tax obligations.

Form Submission Methods

The Punjab Revenue Authority Tax Payment Challan Form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online Submission: Many tax authorities offer online platforms for submitting forms and payments.

- Mail: Taxpayers can send the completed form and payment via postal services.

- In-Person: Submitting the form directly at designated tax offices is also an option.

Choosing the most convenient submission method can help streamline the payment process and ensure timely compliance.

Quick guide on how to complete punjab revenue authority tax payment challan form

Prepare Punjab Revenue Authority Tax Payment Challan Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Punjab Revenue Authority Tax Payment Challan Form on any platform using airSlate SignNow's Android or iOS applications and elevate your document-focused operations today.

How to edit and eSign Punjab Revenue Authority Tax Payment Challan Form with ease

- Obtain Punjab Revenue Authority Tax Payment Challan Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from a device of your choice. Edit and eSign Punjab Revenue Authority Tax Payment Challan Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the punjab revenue authority tax payment challan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pra challan and how can airSlate SignNow assist with it?

A pra challan is a payment acknowledgment document that is essential for various financial transactions. With airSlate SignNow, you can easily eSign and send pra challan documents, ensuring compliance and speeding up your financial processes seamlessly.

-

How does airSlate SignNow enhance the efficiency of handling pra challan?

airSlate SignNow streamlines the preparation and signing of pra challan by providing a user-friendly interface. The platform allows you to automate workflows, reduce manual errors, and easily track the status of each document, making the process efficient and error-free.

-

Is there a cost associated with using airSlate SignNow for pra challan transactions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling pra challan. The plans provide a cost-effective solution, enabling businesses to send and eSign documents without breaking the bank.

-

What features does airSlate SignNow provide for managing pra challan documents?

airSlate SignNow provides multiple features for managing pra challan documents, including secure eSignature, customizable templates, and document tracking. These tools help ensure that your pra challan is processed swiftly and securely, enhancing productivity.

-

Can airSlate SignNow integrate with other software for pra challan processing?

Absolutely! airSlate SignNow seamlessly integrates with popular software tools, enhancing your ability to manage pra challan processes. This integration allows for smooth data transfer and greater overall efficiency in your financial operations.

-

What are the benefits of using airSlate SignNow for pra challan?

Using airSlate SignNow for pra challan provides signNow benefits, including increased speed in processing, reduced administrative burden, and enhanced security features. It enables businesses to manage documents more effectively, ensuring compliance and quicker payment handling.

-

How secure is my pra challan data when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect your pra challan data, ensuring that your sensitive financial information is safe from unauthorized access.

Get more for Punjab Revenue Authority Tax Payment Challan Form

- Rogers cinema application form

- Medical release of information form aba

- Crestron fusion specifiers workbook form

- Allstardriveredonline form

- Fac simile attestato tirocinio formativo

- One page partnership agreement template form

- Non equity partnership agreement template form

- Operation llc agreement template form

Find out other Punjab Revenue Authority Tax Payment Challan Form

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form