DEED of TRUSTMORTGAGE Form

What is the Deed of Trust Mortgage

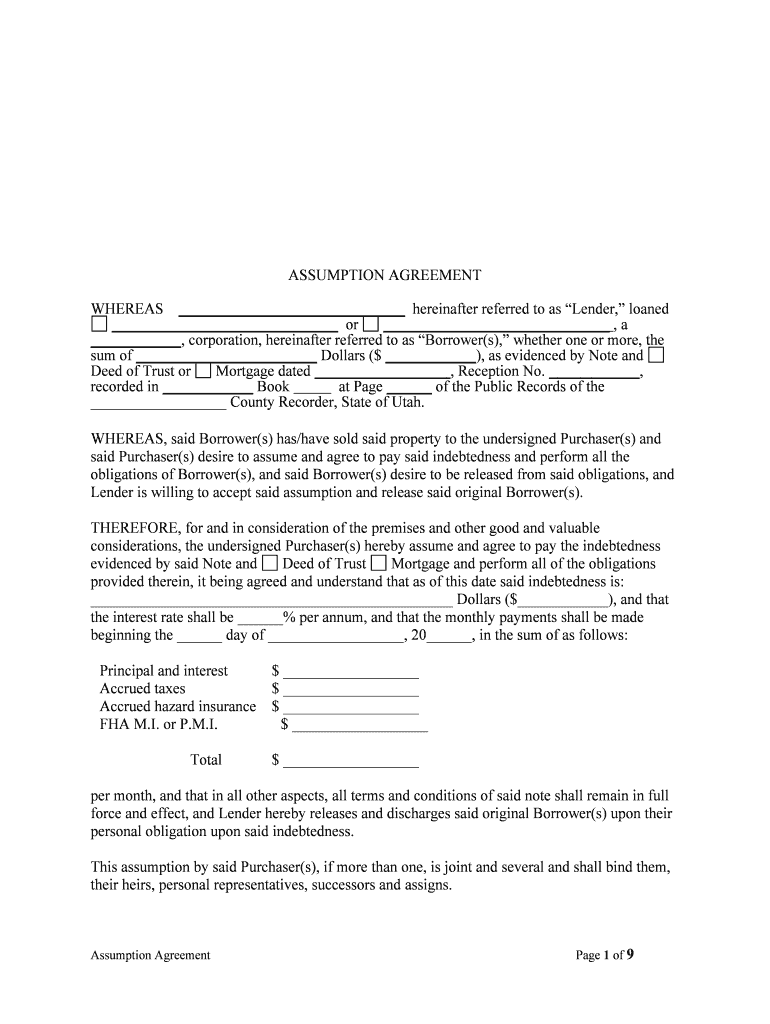

A deed of trust mortgage is a legal document used in real estate transactions that involves three parties: the borrower, the lender, and a third-party trustee. This document secures a loan by transferring the title of the property to the trustee until the borrower repays the loan in full. Unlike a traditional mortgage, which typically involves only the borrower and lender, a deed of trust provides an added layer of security for the lender, allowing for a more streamlined foreclosure process if the borrower defaults.

How to Use the Deed of Trust Mortgage

Using a deed of trust mortgage involves several key steps. First, the borrower and lender agree on the loan terms, including the amount, interest rate, and repayment schedule. Next, the deed of trust is prepared and signed by all parties involved. This document is then recorded with the appropriate county office to establish a public record of the loan. Throughout the loan term, the borrower makes payments as agreed, and once the loan is paid off, the trustee will reconvey the title back to the borrower, removing the lien from the property.

Key Elements of the Deed of Trust Mortgage

Several essential elements make up a deed of trust mortgage. These include:

- Parties Involved: Identification of the borrower, lender, and trustee.

- Loan Details: The principal amount, interest rate, and repayment terms.

- Property Description: A legal description of the property being secured.

- Default Terms: Conditions under which the lender may initiate foreclosure.

- Signatures: Signatures of all parties to validate the agreement.

Steps to Complete the Deed of Trust Mortgage

Completing a deed of trust mortgage involves a series of organized steps:

- Gather necessary information, including borrower and lender details.

- Draft the deed of trust document, ensuring all required elements are included.

- Have all parties review and sign the document in the presence of a notary.

- Record the signed deed of trust with the local county recorder's office.

- Keep a copy of the recorded document for personal records.

Legal Use of the Deed of Trust Mortgage

The legal use of a deed of trust mortgage is governed by state laws, which can vary significantly. In general, it serves as a secure method for lenders to protect their interests in the event of borrower default. It is essential to comply with all relevant laws and regulations when creating and executing a deed of trust to ensure its enforceability. Failing to adhere to these legal standards may result in challenges during foreclosure or disputes over property ownership.

State-Specific Rules for the Deed of Trust Mortgage

Each state in the U.S. has its own regulations regarding the use of a deed of trust mortgage. Some states may require specific language in the document, while others may have unique recording requirements. It is crucial for borrowers and lenders to familiarize themselves with their state’s laws to ensure compliance. Consulting with a legal professional can provide valuable guidance in navigating these state-specific rules and ensuring that the deed of trust is valid and enforceable.

Quick guide on how to complete deed of trustmortgage

Complete DEED OF TRUSTMORTGAGE effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage DEED OF TRUSTMORTGAGE on any device through the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign DEED OF TRUSTMORTGAGE with ease

- Find DEED OF TRUSTMORTGAGE and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign DEED OF TRUSTMORTGAGE and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a DEED OF TRUSTMORTGAGE?

A DEED OF TRUSTMORTGAGE is a legal document that secures a loan on real estate. It involves three parties: the borrower, the lender, and a third-party trustee. This document is vital for protecting the lender's interest in the event of the borrower's default.

-

How does airSlate SignNow simplify the process of creating a DEED OF TRUSTMORTGAGE?

With airSlate SignNow, creating a DEED OF TRUSTMORTGAGE is straightforward and efficient. Users can utilize customizable templates and electronic signatures, which streamline the documentation process. This allows for quicker turnaround times and reduces the chances of errors.

-

What are the costs associated with using airSlate SignNow for DEED OF TRUSTMORTGAGE documents?

airSlate SignNow offers cost-effective pricing plans designed to meet various business needs. The costs depend on the features selected, such as document storage and number of users. Businesses can easily manage their budgeting while efficiently handling DEED OF TRUSTMORTGAGE documents.

-

What features does airSlate SignNow offer for managing DEED OF TRUSTMORTGAGE documents?

airSlate SignNow provides a range of features tailored for managing DEED OF TRUSTMORTGAGE documents, including advanced document editing, real-time notifications, and secure cloud storage. Users can also integrate with other platforms for seamless workflow management. This increases efficiency in document handling.

-

Can I integrate airSlate SignNow with other software for DEED OF TRUSTMORTGAGE management?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easier to manage DEED OF TRUSTMORTGAGE documents alongside your existing systems. This ensures a smooth flow of information, improving productivity and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for DEED OF TRUSTMORTGAGE signatures?

Using airSlate SignNow for DEED OF TRUSTMORTGAGE signatures enhances document security and compliance. It provides a legally binding electronic signature option that meets regulatory requirements. This not only protects your interests but also speeds up the agreement process.

-

How can airSlate SignNow help with the security of my DEED OF TRUSTMORTGAGE documents?

airSlate SignNow prioritizes document security with robust encryption protocols and secure access controls. All DEED OF TRUSTMORTGAGE documents are safeguarded to prevent unauthorized access, thus ensuring the integrity of sensitive information throughout the signing process.

Get more for DEED OF TRUSTMORTGAGE

Find out other DEED OF TRUSTMORTGAGE

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement