Know Your Rights Fair Debt Collection Practices Act CreditCards Com Form

Understanding the Know Your Rights Fair Debt Collection Practices Act

The Know Your Rights Fair Debt Collection Practices Act is a crucial piece of legislation that protects consumers from unfair debt collection practices. It establishes guidelines that debt collectors must follow when attempting to collect debts, ensuring that consumers are treated fairly and with respect. Key provisions include prohibiting collectors from using abusive language, calling at unreasonable hours, and engaging in deceptive practices. This act empowers consumers to assert their rights and seek recourse if they believe they have been treated unfairly.

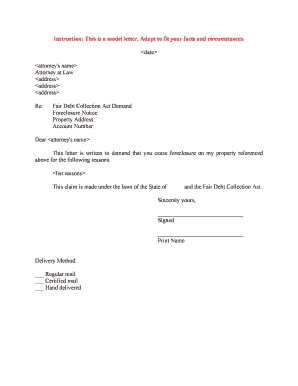

Steps to Complete the Know Your Rights Fair Debt Collection Practices Act Form

Completing the Know Your Rights Fair Debt Collection Practices Act form involves several important steps. First, gather all relevant information regarding your debt, including the name of the creditor and the amount owed. Next, carefully read the instructions provided with the form to ensure you understand what is required. Fill out the form accurately, providing all necessary details. After completing the form, review it for any errors before submitting it. Finally, choose a secure method for submission, whether online or via mail, to ensure your information remains protected.

Legal Use of the Know Your Rights Fair Debt Collection Practices Act Form

The legal use of the Know Your Rights Fair Debt Collection Practices Act form hinges on compliance with federal and state regulations. When filling out this form, it is essential to ensure that all information is accurate and truthful. Misrepresentation can lead to legal consequences. Additionally, the form must be signed and dated appropriately to validate its authenticity. Utilizing a secure eSignature solution can enhance the legal standing of the document, ensuring that it meets all necessary requirements under the ESIGN and UETA acts.

Key Elements of the Know Your Rights Fair Debt Collection Practices Act

Several key elements define the Know Your Rights Fair Debt Collection Practices Act. These include the prohibition of harassment, the requirement for debt collectors to identify themselves, and the obligation to provide validation of debts upon request. Consumers also have the right to dispute debts and request that collectors cease communication. Understanding these elements is vital for consumers to effectively navigate debt collection processes and assert their rights when necessary.

State-Specific Rules for the Know Your Rights Fair Debt Collection Practices Act

While the Know Your Rights Fair Debt Collection Practices Act sets federal standards, individual states may have additional rules that enhance consumer protections. These state-specific regulations can vary significantly, including limitations on the hours debt collectors can call or additional disclosures that must be provided. It is important for consumers to familiarize themselves with their state’s laws to ensure they are fully informed of their rights and protections under both federal and state legislation.

Examples of Using the Know Your Rights Fair Debt Collection Practices Act

Understanding how to apply the Know Your Rights Fair Debt Collection Practices Act can be illustrated through various examples. For instance, if a debt collector calls you late at night, this could be a violation of the act. Similarly, if a collector fails to provide written validation of a debt upon request, they may be acting unlawfully. Consumers can use these examples to recognize potential violations and take appropriate action, such as filing a complaint with the Consumer Financial Protection Bureau or seeking legal advice.

Quick guide on how to complete know your rights fair debt collection practices act creditcardscom

Complete Know Your Rights Fair Debt Collection Practices Act CreditCards com effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Know Your Rights Fair Debt Collection Practices Act CreditCards com on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and electronically sign Know Your Rights Fair Debt Collection Practices Act CreditCards com with ease

- Locate Know Your Rights Fair Debt Collection Practices Act CreditCards com and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Know Your Rights Fair Debt Collection Practices Act CreditCards com while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive debt collection practices. It outlines the rights of consumers regarding debt collection and the actions that collectors must abide by. To Know Your Rights under the Fair Debt Collection Practices Act, visit CreditCards.com for detailed information.

-

How can airSlate SignNow assist with debt collection documentation?

airSlate SignNow offers an efficient way to electronically sign and send documents related to debt collection. With its user-friendly interface and secure storage, businesses can manage their documentation process while adhering to the rules of the Fair Debt Collection Practices Act. Knowing your rights through CreditCards.com is essential to ensure compliance during this process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you need a basic plan for small operations or advanced features for larger enterprises, our pricing is designed to be cost-effective. Explore how the solutions align with your requirements at Know Your Rights Fair Debt Collection Practices Act CreditCards.com for insights.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow integrates seamlessly with various popular applications to enhance your document management workflow. Our integrations include CRM tools, payment processors, and other software that facilitate efficient debt collection while ensuring you Know Your Rights under the Fair Debt Collection Practices Act. Discover more integration options at CreditCards.com.

-

What are the benefits of using airSlate SignNow for businesses?

Using airSlate SignNow streamlines the document signing process, saving time and reducing operational costs. It empowers businesses to achieve greater efficiency while ensuring compliance with legal standards, including those set by the Fair Debt Collection Practices Act. Learn more about the benefits and how to Know Your Rights at CreditCards.com.

-

What features should I look for in an eSignature solution?

An effective eSignature solution should offer features like document templates, bulk sending, and secure storage for compliance purposes. Look for tools that ensure your documents adhere to the Fair Debt Collection Practices Act regulations while simplifying the signing process. For a comprehensive list of features, consult CreditCards.com to Know Your Rights.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security and uses advanced encryption and authentication protocols to protect sensitive documents. This ensures compliance with regulations, including the Fair Debt Collection Practices Act, so you can confidently send and sign documents. For peace of mind and to Know Your Rights, explore details on CreditCards.com.

Get more for Know Your Rights Fair Debt Collection Practices Act CreditCards com

Find out other Know Your Rights Fair Debt Collection Practices Act CreditCards com

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document