Division of Revenue S CORPORATION STATUS NJ Gov Form

Understanding the Division Of Revenue S Corporation Status NJ Gov

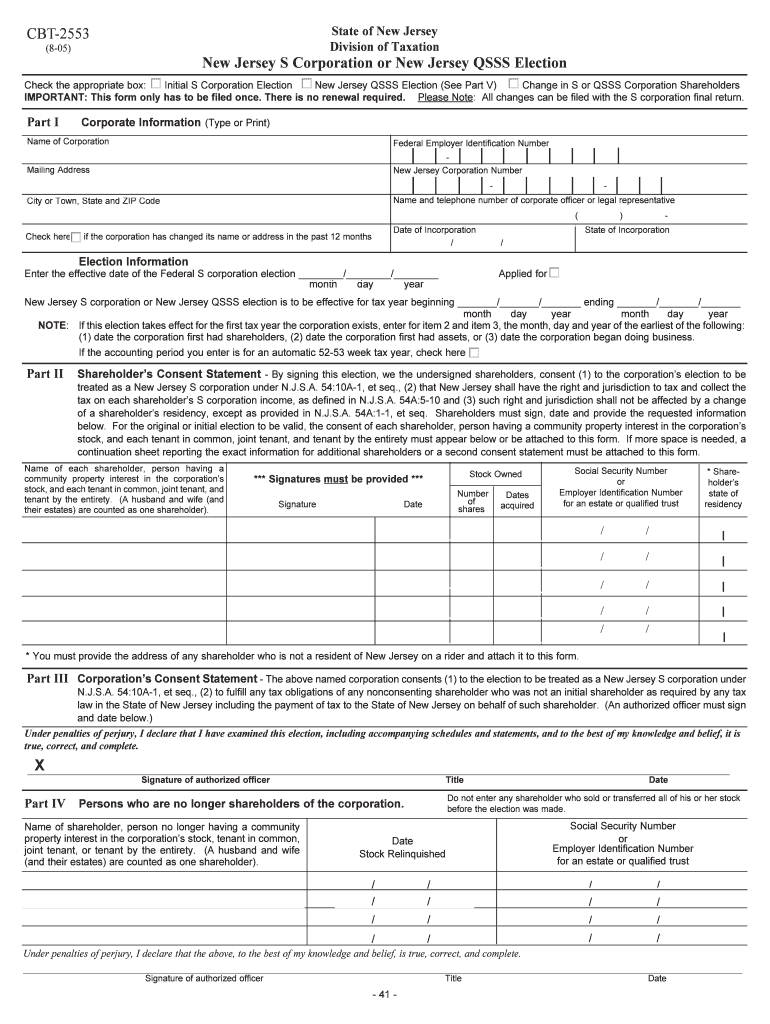

The Division Of Revenue S Corporation Status NJ Gov form is a crucial document for businesses operating as S corporations in New Jersey. This form allows entities to elect S corporation status, which can provide significant tax advantages. By opting for this status, businesses can avoid double taxation on income, as profits and losses are passed through to shareholders. Understanding the implications of this designation is essential for compliance and financial planning.

Steps to Complete the Division Of Revenue S Corporation Status NJ Gov

Filling out the Division Of Revenue S Corporation Status NJ Gov form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information about your business, including the legal name, address, and federal employer identification number (EIN).

- Determine eligibility by ensuring your business meets the requirements for S corporation status, such as having a limited number of shareholders.

- Complete the form accurately, providing all requested details. Ensure that all sections are filled out to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form either online or by mail, following the specific guidelines provided by the New Jersey Division of Revenue.

Legal Use of the Division Of Revenue S Corporation Status NJ Gov

The legal use of the Division Of Revenue S Corporation Status NJ Gov form is essential for businesses seeking to operate under S corporation regulations. This form must be filed in accordance with state laws to ensure that the election for S corporation status is recognized. Compliance with the legal requirements not only legitimizes the business structure but also protects shareholders from potential tax liabilities associated with improper classification.

Required Documents for the Division Of Revenue S Corporation Status NJ Gov

When submitting the Division Of Revenue S Corporation Status NJ Gov form, certain documents are required to support your application. These may include:

- A copy of the business's formation documents, such as articles of incorporation.

- Proof of the federal employer identification number (EIN).

- Shareholder agreements, if applicable, detailing ownership and management structure.

- Any additional documentation requested by the New Jersey Division of Revenue to verify eligibility.

Filing Deadlines for the Division Of Revenue S Corporation Status NJ Gov

Timely filing of the Division Of Revenue S Corporation Status NJ Gov form is critical to ensure that your business is recognized as an S corporation for tax purposes. The form must typically be submitted by the fifteenth day of the third month following the end of the tax year. Understanding these deadlines helps businesses avoid penalties and ensures compliance with state regulations.

State-Specific Rules for the Division Of Revenue S Corporation Status NJ Gov

New Jersey has specific rules governing the election of S corporation status. These include limitations on the number of shareholders, eligibility criteria, and compliance with state tax laws. It is important for business owners to familiarize themselves with these regulations to ensure that their S corporation status is maintained and that they remain in good standing with state authorities.

Quick guide on how to complete division of revenue s corporation status njgov

Accomplish Division Of Revenue S CORPORATION STATUS NJ gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Division Of Revenue S CORPORATION STATUS NJ gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Division Of Revenue S CORPORATION STATUS NJ gov with ease

- Locate Division Of Revenue S CORPORATION STATUS NJ gov and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your eSignature with the Sign tool, which takes a few seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your method of submission for the form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Modify and eSign Division Of Revenue S CORPORATION STATUS NJ gov while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Division Of Revenue S CORPORATION STATUS NJ gov?

The Division Of Revenue S CORPORATION STATUS NJ gov refers to the classification of businesses in New Jersey that have elected S corporation status for tax purposes. This designation allows these entities to avoid double taxation on their income. Businesses must file specific forms with the Division of Revenue to maintain this status.

-

How can airSlate SignNow assist businesses with S corporation filings?

airSlate SignNow provides a seamless way for businesses to eSign and send essential documents related to their S corporation filings. Our platform allows for quick document preparation and sharing, ensuring compliance with the requirements set by the Division Of Revenue S CORPORATION STATUS NJ gov. This saves time and streamlines your filing process.

-

What features does airSlate SignNow offer that are beneficial for S corporations?

airSlate SignNow offers features like secure eSigning, document templates, and automated workflows specifically designed for businesses. These tools can help S corporations manage their paperwork efficiently while ensuring compliance with the Division Of Revenue S CORPORATION STATUS NJ gov. Additionally, our user-friendly interface makes document management easy and effective.

-

Is there a cost associated with using airSlate SignNow for S corporation documentation?

Yes, airSlate SignNow offers various pricing tiers that cater to different business needs, ensuring you only pay for what you need. Our pricing is competitive and reflects the value of the services provided, especially for businesses dealing with the Division Of Revenue S CORPORATION STATUS NJ gov. Sign up for a trial to see if it fits your budget.

-

Can I integrate airSlate SignNow with other tools for my S corporation?

Absolutely! airSlate SignNow offers integrations with many popular software tools, helping streamline your operations and documentation processes. This is particularly useful for S corporations looking to stay compliant with the Division Of Revenue S CORPORATION STATUS NJ gov while managing other business functions in one place.

-

What are the benefits of using airSlate SignNow for my S corporation?

Using airSlate SignNow provides numerous benefits, including faster document turnaround times, enhanced security for sensitive filings, and easy collaboration with team members. These advantages are crucial for S corporations dealing with the requirements of the Division Of Revenue S CORPORATION STATUS NJ gov, allowing businesses to focus on growth instead of paperwork.

-

How does airSlate SignNow ensure compliance with New Jersey’s regulations for S corporations?

airSlate SignNow is designed to help businesses maintain compliance with important regulations, including those related to the Division Of Revenue S CORPORATION STATUS NJ gov. Our software includes templates and best practices that align with state requirements, minimizing the risk of errors in your filings and eSignatures.

Get more for Division Of Revenue S CORPORATION STATUS NJ gov

Find out other Division Of Revenue S CORPORATION STATUS NJ gov

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free