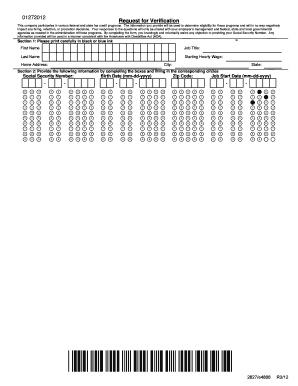

01272012 Request for Verifiction Form

Understanding the 01272012 Request for Verification

The 01272012 request for verification is a specific form used in the context of voluntary tax compliance. This form allows taxpayers to confirm their tax status or to request verification of their tax information from the IRS. It is particularly important for individuals who may be self-employed, retired, or in unique taxpayer scenarios. Understanding this form is essential for ensuring compliance with tax obligations and for accessing various tax benefits or programs.

Steps to Complete the 01272012 Request for Verification

Completing the 01272012 request for verification involves several key steps:

- Gather necessary information, including your Social Security number and any relevant tax documents.

- Access the form through the IRS website or other authorized platforms.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form either electronically or by mail, depending on your preference and the instructions provided.

Legal Use of the 01272012 Request for Verification

The 01272012 request for verification is legally recognized when it is filled out and submitted according to IRS guidelines. It serves as an official document that can be used to verify tax information for various purposes, including loan applications, government assistance programs, or other financial transactions. Compliance with the legal requirements ensures that the form is valid and can be accepted by institutions that require proof of tax status.

IRS Guidelines for the 01272012 Request for Verification

The IRS provides specific guidelines for completing the 01272012 request for verification. These guidelines include:

- Instructions on how to fill out the form accurately.

- Information on submission deadlines and acceptable submission methods.

- Details about the types of verification available through the request.

Following these guidelines helps ensure that your request is processed efficiently and correctly.

Filing Deadlines for the 01272012 Request for Verification

Filing deadlines for the 01272012 request for verification can vary based on individual circumstances. It is important to be aware of key dates, such as:

- The annual tax filing deadline, typically April 15.

- Specific deadlines for requesting verification for certain tax programs or benefits.

Staying informed about these deadlines can help prevent delays in processing your request.

Examples of Using the 01272012 Request for Verification

There are various scenarios in which the 01272012 request for verification may be utilized:

- A self-employed individual seeking a loan may need to provide tax verification to the lender.

- A retiree applying for government benefits may be required to verify their tax status.

- Students applying for financial aid may need to submit this form to demonstrate their tax information.

These examples illustrate the form's importance in various financial and legal contexts.

Quick guide on how to complete 01272012 request for verifiction

Easily prepare 01272012 Request For Verifiction on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environment-friendly alternative to conventional printed and signed documents, as you can locate the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without holdups. Manage 01272012 Request For Verifiction on any device using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The ultimate way to adjust and electronically sign 01272012 Request For Verifiction effortlessly

- Obtain 01272012 Request For Verifiction and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed by airSlate SignNow for that task.

- Create your electronic signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form navigation, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign 01272012 Request For Verifiction and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 01272012 request for verifiction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is voluntary tax and how can it benefit my business?

Voluntary tax refers to taxes that individuals and businesses can choose to pay in order to reduce their tax obligations. Leveraging airSlate SignNow can help your business streamline document management related to voluntary tax, making the process more efficient and organized.

-

How does airSlate SignNow assist with voluntary tax documentation?

airSlate SignNow facilitates the electronic signing and management of documents necessary for voluntary tax payments. This enhances compliance and accuracy, allowing users to focus more on their tax strategies rather than on administrative tasks.

-

What are the pricing plans available for using airSlate SignNow for voluntary tax management?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan includes features that simplify the voluntary tax payment process, ensuring that you can easily handle your documentation without overspending.

-

Is airSlate SignNow user-friendly for managing voluntary tax forms?

Yes, airSlate SignNow is designed with user experience in mind, making it simple for anyone to manage voluntary tax forms. The intuitive interface ensures that even those with minimal technical skills can navigate the platform effectively.

-

Can airSlate SignNow integrate with other accounting tools for voluntary tax purposes?

Absolutely! airSlate SignNow supports a variety of integrations with popular accounting software to streamline your voluntary tax processes. This ensures that all your financial data is synchronized and accessible, enhancing overall efficiencies.

-

What security measures does airSlate SignNow employ for voluntary tax documentation?

airSlate SignNow prioritizes the security of your voluntary tax documents through end-to-end encryption and compliance with international security standards. You can rest assured that your sensitive information is protected at all times.

-

How can airSlate SignNow reduce the time spent on voluntary tax documentation?

By utilizing airSlate SignNow's automation features, you can signNowly reduce the time required to prepare and manage voluntary tax documentation. Automated workflows and templates enable quick document creation, minimizing delays and ensuring timely submissions.

Get more for 01272012 Request For Verifiction

Find out other 01272012 Request For Verifiction

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement