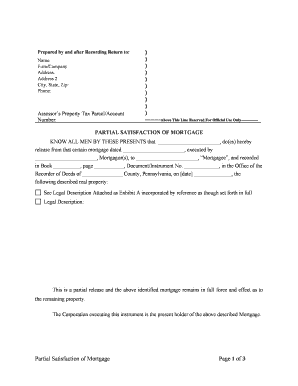

Assessors Property Tax ParcelAccount Form

What is the Assessors Property Tax ParcelAccount

The Assessors Property Tax ParcelAccount is a crucial document used by property owners to manage their property tax obligations. This form provides detailed information about a specific property, including its assessed value, tax rates, and any exemptions that may apply. It serves as an official record that helps local governments assess property taxes fairly and accurately. Understanding this form is essential for homeowners and real estate investors alike, as it directly impacts financial responsibilities and property ownership rights.

How to use the Assessors Property Tax ParcelAccount

Using the Assessors Property Tax ParcelAccount involves several steps to ensure accurate completion and submission. First, gather all necessary information about the property, including its location, size, and any improvements made. Next, fill out the form with precise details, ensuring that all fields are completed to avoid delays. Once the form is filled out, review it for accuracy before submission. This form can often be submitted electronically, which streamlines the process and provides immediate confirmation of receipt.

Steps to complete the Assessors Property Tax ParcelAccount

Completing the Assessors Property Tax ParcelAccount requires careful attention to detail. Follow these steps for successful completion:

- Collect property information, including the parcel number and legal description.

- Fill in the property owner's details, ensuring names and addresses are accurate.

- Provide information on property use, such as residential or commercial status.

- List any exemptions or special assessments applicable to the property.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Assessors Property Tax ParcelAccount

The legal use of the Assessors Property Tax ParcelAccount is governed by state and local laws. This form must be completed accurately to ensure compliance with property tax regulations. Failure to provide accurate information can lead to penalties, including fines or increased tax assessments. Additionally, the information contained in the form may be used in legal proceedings related to property disputes or tax appeals, making its accuracy vital for legal protection.

Key elements of the Assessors Property Tax ParcelAccount

Several key elements must be included in the Assessors Property Tax ParcelAccount to ensure it serves its purpose effectively. These include:

- Parcel Number: A unique identifier assigned to the property.

- Property Description: Details about the property’s size, location, and type.

- Owner Information: Name and contact details of the property owner.

- Assessed Value: The value assigned to the property for tax purposes.

- Exemptions: Any applicable tax exemptions that may reduce liability.

Form Submission Methods (Online / Mail / In-Person)

The Assessors Property Tax ParcelAccount can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions allow electronic submission through their official websites, which is often the fastest method.

- Mail: Completed forms can be sent via postal service to the appropriate local assessor’s office.

- In-Person: Property owners may also choose to submit the form in person at their local assessor's office, allowing for immediate confirmation of receipt.

Quick guide on how to complete assessors property tax parcelaccount

Complete Assessors Property Tax ParcelAccount effortlessly on any device

Online document management has gained signNow popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to generate, modify, and electronically sign your documents swiftly without any holdups. Manage Assessors Property Tax ParcelAccount on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Assessors Property Tax ParcelAccount without hassle

- Find Assessors Property Tax ParcelAccount and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools provided specifically by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Assessors Property Tax ParcelAccount and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Assessors Property Tax ParcelAccount feature in airSlate SignNow?

The Assessors Property Tax ParcelAccount feature in airSlate SignNow allows you to easily manage and eSign documents related to property tax assessments. This tool streamlines the property tax assessment process, making it more efficient and user-friendly for both assessors and property owners.

-

How does airSlate SignNow's pricing work for the Assessors Property Tax ParcelAccount?

airSlate SignNow offers flexible pricing plans that accommodate various business needs for the Assessors Property Tax ParcelAccount feature. Customers can choose from monthly or annual subscriptions that include different levels of access and functionality, ensuring a cost-effective solution tailored to your requirements.

-

What are the key benefits of using the Assessors Property Tax ParcelAccount?

Using the Assessors Property Tax ParcelAccount through airSlate SignNow provides numerous benefits, including increased productivity, reduced paper usage, and a streamlined workflow. It enhances collaboration between assessors and property owners by facilitating swift document signing and management.

-

Can I integrate the Assessors Property Tax ParcelAccount feature with other software?

Yes, airSlate SignNow allows seamless integration of the Assessors Property Tax ParcelAccount feature with various software applications. This capability enhances your workflow by connecting with tools you already use, providing a cohesive ecosystem for document management and eSigning.

-

Is there a mobile app for the Assessors Property Tax ParcelAccount feature?

Absolutely! The airSlate SignNow mobile app allows users to access the Assessors Property Tax ParcelAccount feature on-the-go. This mobile capability ensures that assessors and property owners can manage and eSign documents anytime, from any location.

-

How secure is the Assessors Property Tax ParcelAccount in airSlate SignNow?

Security is a top priority for airSlate SignNow users. The Assessors Property Tax ParcelAccount feature employs industry-standard encryption and security protocols to protect your sensitive property tax documents and personal information.

-

What types of documents can be managed using the Assessors Property Tax ParcelAccount feature?

The Assessors Property Tax ParcelAccount feature in airSlate SignNow can manage a variety of documents, including property assessment notices, appeals, tax exemption forms, and more. This versatility ensures that all necessary paperwork for property tax processes is easily handled.

Get more for Assessors Property Tax ParcelAccount

Find out other Assessors Property Tax ParcelAccount

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors