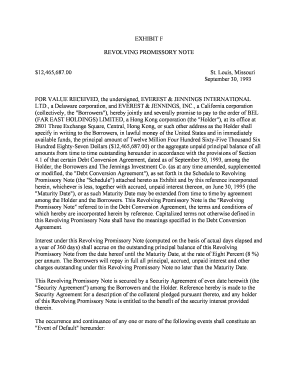

REVOLVING PROMISSORY NOTE Form

What is the revolving promissory note?

A revolving promissory note is a financial instrument that allows borrowers to access a line of credit up to a specified limit. This type of note is often used in business financing, enabling companies to draw funds as needed and repay them over time. Unlike traditional loans, which provide a lump sum, a revolving promissory note offers flexibility, allowing borrowers to withdraw and repay multiple times within the agreed-upon terms. The borrower is typically required to pay interest on the outstanding balance, making it essential to manage repayments effectively.

How to use the revolving promissory note

Using a revolving promissory note involves several key steps. First, the borrower must establish a credit limit with the lender, which outlines the maximum amount that can be borrowed. Once the note is issued, the borrower can draw funds as needed, up to the limit. It is crucial to keep track of the amount borrowed and the interest accrued. Regular repayments should be made to maintain a positive credit relationship and avoid penalties. This type of note is particularly useful for businesses that experience fluctuating cash flow, allowing them to manage expenses more effectively.

Steps to complete the revolving promissory note

Completing a revolving promissory note involves several important steps:

- Review the terms: Understand the interest rates, repayment schedule, and any fees associated with the note.

- Fill out the form: Provide accurate information, including borrower details, loan amount, and repayment terms.

- Sign the document: Ensure that all parties involved sign the note to make it legally binding.

- Keep a copy: Retain a signed copy for your records to reference in the future.

Legal use of the revolving promissory note

The legal use of a revolving promissory note requires adherence to specific regulations and guidelines. In the United States, these notes must comply with the Uniform Commercial Code (UCC), which governs commercial transactions. This ensures that the terms of the note are enforceable in court. It is essential for both parties to clearly understand their rights and obligations, including interest rates, repayment terms, and potential penalties for default. Consulting with a legal professional can help ensure compliance with applicable laws.

Key elements of the revolving promissory note

A revolving promissory note typically includes several key elements:

- Principal amount: The maximum amount that can be borrowed.

- Interest rate: The cost of borrowing, usually expressed as an annual percentage rate (APR).

- Repayment terms: Details on how and when payments should be made.

- Expiration date: The date by which the note must be repaid or renewed.

- Signatures: The signatures of all parties involved to validate the agreement.

Examples of using the revolving promissory note

Revolving promissory notes can be utilized in various scenarios. For instance, a small business may use a revolving promissory note to manage seasonal fluctuations in cash flow, allowing them to cover operational costs during slower months. Another example is a startup that requires funding for initial expenses but expects to generate revenue within a few months. By using a revolving promissory note, the startup can draw funds as needed and repay them once cash flow improves, providing flexibility and financial stability.

Quick guide on how to complete revolving promissory note

Finalize REVOLVING PROMISSORY NOTE seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, since you can locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents rapidly without delays. Manage REVOLVING PROMISSORY NOTE on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign REVOLVING PROMISSORY NOTE effortlessly

- Find REVOLVING PROMISSORY NOTE and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method of delivering your form, either by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Modify and eSign REVOLVING PROMISSORY NOTE while ensuring excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a REVOLVING PROMISSORY NOTE?

A REVOLVING PROMISSORY NOTE is a financial instrument that allows businesses to borrow funds up to a specified limit, repay them, and borrow again. This flexibility is ideal for managing cash flow and financing short-term needs without the hassle of reapplying for a loan each time. Using airSlate SignNow, you can easily create and manage your REVOLVING PROMISSORY NOTES digitally.

-

How can airSlate SignNow help me manage a REVOLVING PROMISSORY NOTE?

airSlate SignNow simplifies the process of creating, sending, and eSigning REVOLVING PROMISSORY NOTES, making it efficient and user-friendly. With the platform, you can easily track revisions and manage the terms of your notes securely. This reduces paperwork and streamlines your financial operations.

-

What are the pricing options for airSlate SignNow regarding REVOLVING PROMISSORY NOTES?

airSlate SignNow offers several pricing plans that cater to different business needs, whether you're using REVOLVING PROMISSORY NOTES for personal or commercial purposes. Each plan provides access to essential tools needed for document management and eSigning. You can choose a plan that best fits your budget and usage requirements.

-

What features does airSlate SignNow offer for REVOLVING PROMISSORY NOTES?

The platform provides features such as customizable templates, real-time tracking, secure eSigning, and document automation specifically for REVOLVING PROMISSORY NOTES. These tools enhance productivity and ensure compliance with financial regulations. With airSlate SignNow, managing your notes and agreements becomes seamless.

-

What are the benefits of using airSlate SignNow for REVOLVING PROMISSORY NOTES?

Using airSlate SignNow for REVOLVING PROMISSORY NOTES brings numerous benefits, including improved efficiency and reduced turnaround time for document processing. The software allows your team to collaborate effectively, ensuring all stakeholders can access and sign necessary documents promptly. This ultimately enhances your overall financial management.

-

Can I integrate airSlate SignNow with other tools for managing REVOLVING PROMISSORY NOTES?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms such as CRM and accounting software. This makes it easier for users to manage their REVOLVING PROMISSORY NOTES alongside other business processes. Integrations help maintain a centralized workflow and improve overall efficiency.

-

Is airSlate SignNow secure for handling REVOLVING PROMISSORY NOTES?

Absolutely! airSlate SignNow employs top-tier security measures to protect all documents, including REVOLVING PROMISSORY NOTES. With features like SSL encryption and secure cloud storage, you can trust that your sensitive information remains safe and private during transactions.

Get more for REVOLVING PROMISSORY NOTE

Find out other REVOLVING PROMISSORY NOTE

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document