Form 940

What is the Form 940

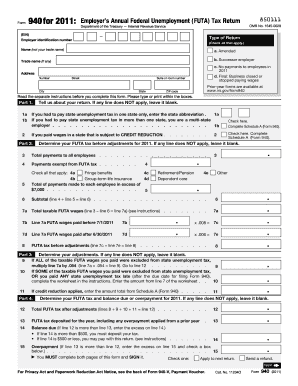

The 2011 Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document for employers in the United States. This form is used to report and pay unemployment taxes to the federal government. Employers are required to file this form annually if they paid wages of $1,500 or more in any calendar quarter or had at least one employee for a day in any 20 or more weeks during the year. The form helps ensure that employers contribute to the federal unemployment insurance program, which provides benefits to unemployed workers.

Steps to complete the Form 940

Completing the 2011 Form 940 involves several key steps to ensure accurate reporting of unemployment taxes. First, gather all necessary payroll records, including total wages paid and the number of employees. Next, follow these steps:

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Calculate the total wages subject to FUTA tax for the year.

- Determine the amount of FUTA tax owed, which is typically 6% of the first $7,000 paid to each employee.

- Account for any credits you may be eligible for, such as state unemployment tax credits.

- Complete the form by providing total tax liability and any payments made throughout the year.

- Sign and date the form before submitting it to the IRS.

Filing Deadlines / Important Dates

The filing deadline for the 2011 Form 940 is January 31 of the year following the tax year being reported. If you have made timely payments of your FUTA tax, you may be eligible for an extension until February 10. It is essential to adhere to these deadlines to avoid penalties and interest charges. Additionally, if you are required to file Form 940 and fail to do so on time, you may face significant penalties based on the amount of tax owed.

Legal use of the Form 940

The 2011 Form 940 is legally binding when filed correctly and on time. Employers must ensure that all information provided is accurate and complete to comply with IRS regulations. Electronic filing is permitted and often recommended for efficiency and ease of tracking. To maintain legal validity, employers should retain copies of the submitted form and any supporting documentation for at least four years, as the IRS may request this information during audits.

Key elements of the Form 940

Several key elements must be included in the 2011 Form 940 to ensure its proper completion. These elements include:

- Employer's name, address, and EIN.

- Total wages subject to FUTA tax.

- FUTA tax calculation, including any credits claimed.

- Payments made towards FUTA tax throughout the year.

- Signature of the employer or authorized representative.

Form Submission Methods (Online / Mail / In-Person)

The 2011 Form 940 can be submitted in various ways, providing flexibility for employers. The available submission methods include:

- Online: Employers can file electronically using the IRS e-file system, which is often faster and more secure.

- Mail: The completed form can be mailed to the appropriate IRS address, depending on the employer's location.

- In-Person: Although less common, some employers may choose to deliver the form in person to their local IRS office.

Quick guide on how to complete form 940 5435238

Execute Form 940 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to produce, modify, and eSign your documents quickly without delays. Manage Form 940 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 940 with ease

- Find Form 940 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 940 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 5435238

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 form 940, and why is it important?

The 2011 form 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is crucial for businesses to file this form annually to report and pay their federal unemployment tax, which helps fund unemployment benefits.

-

How can airSlate SignNow help me with the 2011 form 940?

airSlate SignNow provides an efficient way to eSign and send the 2011 form 940 securely. Our platform simplifies the signing process, ensuring you can handle all necessary documentation without delays, making compliance easier.

-

Is there a cost associated with using airSlate SignNow for the 2011 form 940?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure that you can seamlessly manage the signing of important documents like the 2011 form 940 without breaking the bank.

-

What features does airSlate SignNow offer for the 2011 form 940?

Our platform offers features like document templates, automated workflows, and secure eSigning specifically designed to streamline the process for the 2011 form 940. These features enhance efficiency and ensure you don't miss important deadlines.

-

How can I integrate airSlate SignNow with my existing systems for the 2011 form 940?

airSlate SignNow integrates seamlessly with many popular business applications, allowing you to handle the 2011 form 940 alongside your existing workflows. Our easy integration process ensures that you can maintain productivity while managing important documents.

-

Can I access the 2011 form 940 from my mobile device using airSlate SignNow?

Absolutely! airSlate SignNow supports mobile access, enabling you to fill out, eSign, and send the 2011 form 940 from anywhere. Our mobile-friendly platform ensures you can stay on top of your filing requirements, even on the go.

-

What are the benefits of using airSlate SignNow for the 2011 form 940?

Using airSlate SignNow for the 2011 form 940 offers numerous benefits, including faster turnaround times, increased security, and a user-friendly interface. These advantages help to ensure that your business remains compliant and efficient.

Get more for Form 940

- Application for irrevocable documentary credit maybank form

- California resale certificate isport1net form

- 52e40 form

- Serial navy gas certification and test log form

- Editing checklist i editing checklist i scholastic form

- Form scovid19

- Visa cross border chapter 6 july visa cross border qxd form

- Httpsanalytics usa govdatajusticetop downloa form

Find out other Form 940

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast