Debtor is a Form

What is the Debtor Is A

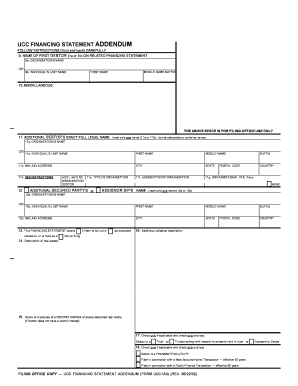

The "Debtor Is A" form is a legal document used to identify individuals or entities that owe money to creditors. This form is often utilized in various legal and financial contexts, particularly in bankruptcy proceedings and loan agreements. It serves to clarify the relationship between the debtor and the creditor, ensuring that all parties involved understand their rights and obligations. Properly completing this form is essential for maintaining accurate records and facilitating communication between debtors and creditors.

How to use the Debtor Is A

To effectively use the "Debtor Is A" form, start by gathering all necessary information about the debtor, including their full name, address, and any relevant identification numbers. Next, accurately fill out the form, ensuring that all details are correct and up-to-date. Once completed, the form should be signed by the debtor and submitted to the appropriate creditor or legal entity. It is advisable to keep a copy of the submitted form for your records, as it may be needed for future reference or legal purposes.

Key elements of the Debtor Is A

Several key elements must be included in the "Debtor Is A" form to ensure its validity. These elements typically include:

- Debtor Information: Full name and contact details of the debtor.

- Creditor Information: Name and contact details of the creditor to whom the debt is owed.

- Debt Details: A clear description of the debt, including the amount owed and any relevant account numbers.

- Signature: The debtor's signature, confirming their acknowledgment of the debt.

- Date: The date on which the form is completed and signed.

Steps to complete the Debtor Is A

Completing the "Debtor Is A" form involves several straightforward steps:

- Gather all necessary information about the debtor and creditor.

- Obtain the official "Debtor Is A" form from a reliable source.

- Fill out the form accurately, ensuring all details are correct.

- Review the completed form for any errors or omissions.

- Sign the form and include the date of signing.

- Submit the form to the appropriate creditor or legal entity.

- Keep a copy for your records.

Legal use of the Debtor Is A

The "Debtor Is A" form is legally binding when completed and submitted correctly. It is essential to adhere to all relevant laws and regulations governing debt acknowledgment in your jurisdiction. This form can be used in various legal scenarios, such as bankruptcy filings, loan agreements, or debt settlement negotiations. Ensuring compliance with legal standards helps protect the rights of both the debtor and the creditor, minimizing the risk of disputes or misunderstandings.

Examples of using the Debtor Is A

The "Debtor Is A" form can be utilized in various situations, including:

- When an individual takes out a personal loan and needs to acknowledge the debt.

- In bankruptcy proceedings, where the debtor must identify all outstanding debts.

- When entering into a payment plan with a creditor for outstanding bills.

- In business transactions where a company owes money to suppliers or service providers.

Quick guide on how to complete debtor is a

Easily Prepare Debtor Is A on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Debtor Is A on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Modify and eSign Debtor Is A Effortlessly

- Find Debtor Is A and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Debtor Is A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is meant by 'Debtor Is A' in the context of airSlate SignNow?

'Debtor Is A' refers to an individual or entity that owes a debt. In the context of airSlate SignNow, this term is important for businesses managing contracts and agreements, as it helps identify parties involved in financial obligations in a clear and legally binding manner.

-

How does airSlate SignNow help when dealing with a Debtor Is A?

airSlate SignNow provides a streamlined platform for electronically signing documents, making it easier for businesses to manage agreements with any debtor. This efficiency not only speeds up the signing process but also ensures that all parties, including a debtor, are properly acknowledged during electronic transactions.

-

What are the pricing options for airSlate SignNow targeting small businesses with debtors?

airSlate SignNow offers flexible pricing plans suitable for small businesses, allowing them to cater to their unique needs when managing debtors. With different tiers available, businesses can choose a cost-effective solution that scales according to their document signing requirements involving both debtors and creditors.

-

What features make airSlate SignNow a top choice for managing debtors?

airSlate SignNow offers features such as customizable templates, bulk sending, and in-depth tracking of document statuses. These functionalities allow businesses to effectively manage transactions involving debtors, ensuring that every party can easily access, review, and sign necessary documents.

-

Can airSlate SignNow integrate with accounting software for managing debtors?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enabling businesses to manage their debtors more efficiently. This integration allows for streamlined workflows, where businesses can send contracts and agreements directly to debtors without switching between applications.

-

What benefits does airSlate SignNow offer specifically for agreements with debtors?

The key benefits of using airSlate SignNow for debtor agreements include increased efficiency, enhanced security, and simplified tracking. Businesses can quickly send, eSign, and store documents while ensuring that all sensitive information relating to debtors is protected throughout the signing process.

-

Is there a mobile application for airSlate SignNow to manage documents with debtors?

Absolutely! airSlate SignNow provides a mobile application that allows users to manage documents on the go. This means businesses can easily handle agreements with debtors from their smartphones or tablets, ensuring that no opportunity is missed regardless of location.

Get more for Debtor Is A

- Form ps 31174 2

- Pmsby form

- Ebiz meezan form

- Appraisal rider form

- Application for noise permit of variance city of form

- Application for business licenseoccupational tax license form

- Form cd410 ampquotnotice of intent to dissolveampquot georgia

- Chatham county georgia alarm registration fees annual renewal chathamcounty form

Find out other Debtor Is A

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed