Tax Benefits Application Form 2017

What is the Tax Benefits Application Form

The Tax Benefits Application Form is a crucial document used by individuals and businesses to apply for various tax benefits provided by the Internal Revenue Service (IRS). This form allows taxpayers to report their eligibility for credits, deductions, or other tax advantages that can significantly reduce their tax liability. Understanding the purpose of this form is essential for anyone looking to maximize their tax benefits during the filing process.

Steps to complete the Tax Benefits Application Form

Completing the Tax Benefits Application Form involves several important steps to ensure accuracy and compliance with IRS regulations. Here’s a simplified process:

- Gather necessary documentation, including income statements and prior tax returns.

- Review the eligibility criteria for the specific tax benefits you are applying for.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Sign the form electronically or in writing, as required.

- Submit the completed form through your chosen method, whether online or by mail.

How to obtain the Tax Benefits Application Form

The Tax Benefits Application Form can be easily obtained through the IRS website or other authorized platforms. Taxpayers can download the form directly in a printable format or access it through various tax preparation software. It is important to ensure that you are using the most current version of the form to comply with IRS requirements.

Legal use of the Tax Benefits Application Form

Using the Tax Benefits Application Form legally requires adherence to IRS guidelines. Taxpayers must ensure that they are eligible for the benefits they are applying for and that all information provided is truthful and accurate. Misrepresentation or fraudulent claims can lead to penalties, including fines and potential legal action. Therefore, understanding the legal implications of submitting this form is vital for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Benefits Application Form can vary based on the type of tax benefit being applied for. Generally, it is advisable to submit the form by the tax return deadline to ensure that you receive the benefits in a timely manner. For specific dates and deadlines, taxpayers should refer to the IRS publication or consult with a tax professional to avoid missing critical submission timelines.

Required Documents

When completing the Tax Benefits Application Form, certain documents are typically required to support your application. These may include:

- Proof of income, such as W-2s or 1099 forms.

- Documentation of expenses related to the tax benefits being claimed.

- Previous tax returns for reference.

- Any additional forms that may be specific to the tax benefit.

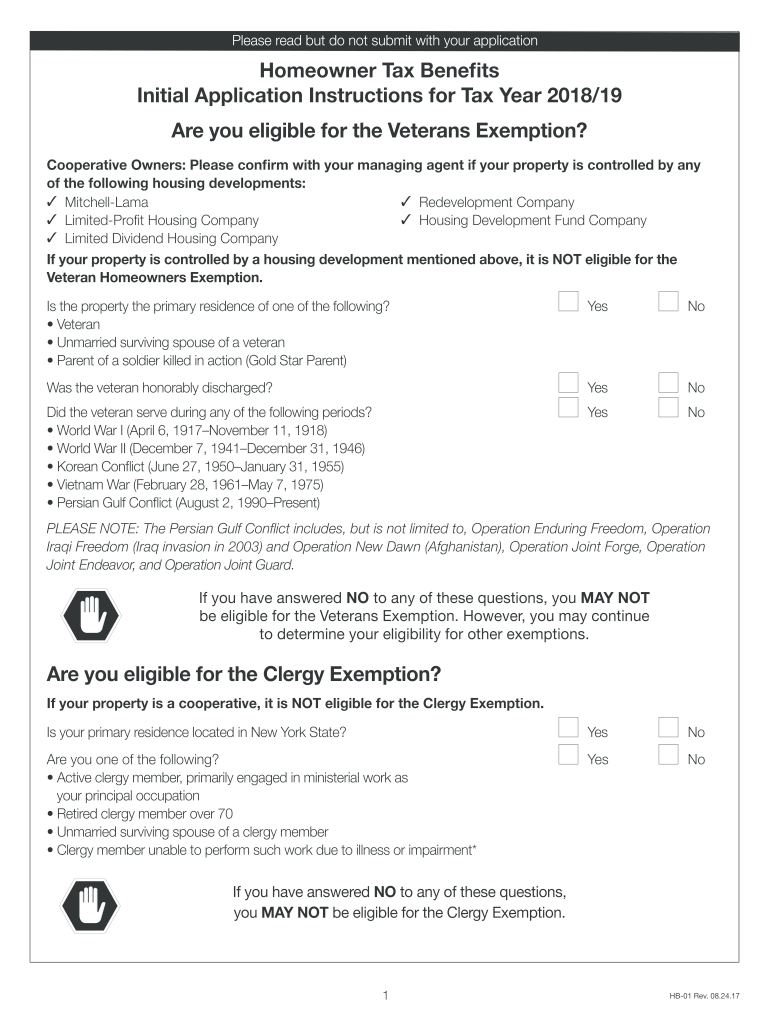

Eligibility Criteria

Eligibility for the Tax Benefits Application Form varies depending on the specific tax benefits being sought. Common criteria include income limits, filing status, and residency requirements. Taxpayers should review the specific guidelines associated with each benefit to determine their eligibility before completing the form. This ensures that the application process is efficient and compliant with IRS standards.

Quick guide on how to complete tax benefits application 2017 form

Your assistance manual on how to prepare your Tax Benefits Application Form

If you’re curious about how to finish and submit your Tax Benefits Application Form, here are some brief instructions to simplify tax filing.

First, you only need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures and return to adjust entries as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and simple sharing.

Follow these steps to finalize your Tax Benefits Application Form in just a few minutes:

- Set up your account and begin working on PDFs right away.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Tax Benefits Application Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes online with airSlate SignNow. Keep in mind that submitting on paper may lead to return errors and cause delays in refunds. And of course, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tax benefits application 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the tax benefits application 2017 form

How to generate an eSignature for the Tax Benefits Application 2017 Form in the online mode

How to generate an eSignature for your Tax Benefits Application 2017 Form in Chrome

How to generate an eSignature for signing the Tax Benefits Application 2017 Form in Gmail

How to generate an electronic signature for the Tax Benefits Application 2017 Form from your smartphone

How to make an electronic signature for the Tax Benefits Application 2017 Form on iOS devices

How to generate an electronic signature for the Tax Benefits Application 2017 Form on Android OS

People also ask

-

What is the Tax Benefits Application Form?

The Tax Benefits Application Form is a crucial document that allows individuals and businesses to claim various tax deductions and credits. By using airSlate SignNow, you can easily fill out and eSign your Tax Benefits Application Form, ensuring a fast and accurate submission to the relevant tax authorities.

-

How can airSlate SignNow simplify the Tax Benefits Application Form process?

With airSlate SignNow, you can streamline the entire process of completing the Tax Benefits Application Form. Our user-friendly platform allows you to fill out necessary fields, eSign the document, and securely send it to recipients, all in a few clicks, reducing time and effort.

-

What are the pricing plans available for using airSlate SignNow for the Tax Benefits Application Form?

airSlate SignNow offers various pricing plans based on your needs, starting from a free trial to premium plans that include advanced features. These plans provide access to tools specifically designed for managing documents like the Tax Benefits Application Form, ensuring great value for businesses of any size.

-

What features does airSlate SignNow include for managing Tax Benefits Application Forms?

airSlate SignNow includes features such as templates, custom workflows, and real-time tracking, making it easy to manage your Tax Benefits Application Forms. These features enhance efficiency, allowing you to monitor the status of your forms and streamline approvals, all from a single platform.

-

Are there any benefits to using airSlate SignNow for the Tax Benefits Application Form compared to paper forms?

Using airSlate SignNow for the Tax Benefits Application Form eliminates the hassles of printing, signing, and mailing paper forms. This digital alternative not only saves time but also reduces errors and ensures that your application is processed faster, leading to quicker access to your tax benefits.

-

Can airSlate SignNow integrate with other applications for the Tax Benefits Application Form?

Yes, airSlate SignNow offers integration capabilities with popular applications like Google Drive, Dropbox, and CRM software. This allows users to easily import and export data related to their Tax Benefits Application Form, enhancing collaboration and document management across platforms.

-

Is it secure to use airSlate SignNow for my Tax Benefits Application Form?

Absolutely! airSlate SignNow prioritizes security and compliance, implementing advanced encryption protocols and secure storage for all your documents, including the Tax Benefits Application Form. Your sensitive information is safe, giving you peace of mind while managing your tax documents.

Get more for Tax Benefits Application Form

- Senior release permission form

- Annexure 2a form download

- Sure start maternity grant online form

- Launceston art society inc art exhibition entry form artlas org

- Local television station model disaster recovery plan incident form

- R3214 internetformular deutsche rentenversicherung bund

- Irtisanoutuminen lomake form

- Lap a thon 13 0921 pledge form teamunify

Find out other Tax Benefits Application Form

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate