Michigan Fixed Rate Note, Installment Payments Unsecured Form

What is the Michigan Fixed Rate Note, Installment Payments Unsecured

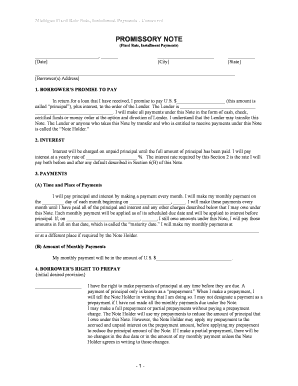

The Michigan Fixed Rate Note, Installment Payments Unsecured is a legal financial document that outlines a borrower's promise to repay a specified amount of money over a set period, typically through regular installment payments. This type of note is unsecured, meaning it is not backed by collateral, which can make it riskier for lenders. It is commonly used in personal loans, where the borrower agrees to repay the loan amount plus interest in scheduled payments. The fixed rate aspect ensures that the interest rate remains constant throughout the life of the loan, providing predictability in repayment amounts.

Key elements of the Michigan Fixed Rate Note, Installment Payments Unsecured

Several key elements define the Michigan Fixed Rate Note, Installment Payments Unsecured. These include:

- Principal Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed percentage charged on the principal, which remains constant throughout the loan term.

- Payment Schedule: Details on how often payments are due, such as monthly or quarterly.

- Maturity Date: The date by which the total amount must be repaid in full.

- Default Provisions: Conditions under which the borrower may be considered in default, including late payment penalties.

Steps to complete the Michigan Fixed Rate Note, Installment Payments Unsecured

Completing the Michigan Fixed Rate Note, Installment Payments Unsecured involves several straightforward steps:

- Gather Information: Collect necessary information such as borrower and lender details, loan amount, interest rate, and payment schedule.

- Fill Out the Form: Accurately input all required information into the form, ensuring clarity and correctness.

- Review the Document: Carefully review the completed note for any errors or omissions.

- Sign the Document: Both parties must sign the note to make it legally binding. Using a reliable eSignature tool can streamline this process.

- Distribute Copies: Provide copies of the signed note to all parties involved for their records.

Legal use of the Michigan Fixed Rate Note, Installment Payments Unsecured

The legal use of the Michigan Fixed Rate Note, Installment Payments Unsecured is governed by state and federal laws. To be considered legally binding, the document must meet specific criteria, including the inclusion of all essential elements such as the principal, interest rate, and payment terms. Additionally, both parties must sign the document, and it is advisable to use an electronic signature platform that complies with legal standards like ESIGN and UETA. This ensures that the note is enforceable in court if disputes arise.

How to use the Michigan Fixed Rate Note, Installment Payments Unsecured

Using the Michigan Fixed Rate Note, Installment Payments Unsecured involves understanding its purpose and application. It serves as a formal agreement between a borrower and a lender, outlining the terms of the loan. Once completed and signed, the note can be used to track payments and obligations. In case of default, the lender can use the note as a legal document to pursue recovery of the owed amount. It is essential to keep a copy of the signed note for reference and legal protection.

State-specific rules for the Michigan Fixed Rate Note, Installment Payments Unsecured

State-specific rules for the Michigan Fixed Rate Note, Installment Payments Unsecured may include regulations regarding maximum interest rates, disclosure requirements, and enforcement procedures. Michigan law mandates that lenders provide borrowers with clear information about the terms of the loan, including any fees associated with late payments. Additionally, the state may have specific guidelines on how to handle defaults and collections, which lenders must adhere to when enforcing the terms of the note.

Quick guide on how to complete michigan fixed rate note installment payments unsecured

Effortlessly Prepare Michigan Fixed Rate Note, Installment Payments Unsecured on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to draft, modify, and electronically sign your documents promptly without delays. Handle Michigan Fixed Rate Note, Installment Payments Unsecured on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to Alter and Electronically Sign Michigan Fixed Rate Note, Installment Payments Unsecured with Ease

- Find Michigan Fixed Rate Note, Installment Payments Unsecured and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, be it via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, and errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Alter and electronically sign Michigan Fixed Rate Note, Installment Payments Unsecured and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Michigan Fixed Rate Note with Installment Payments Unsecured?

A Michigan Fixed Rate Note with Installment Payments Unsecured is a financial agreement that allows borrowers to repay a fixed loan amount in regular installments. This type of note offers stability with a consistent interest rate, making it a popular choice for borrowers in Michigan seeking predictable payment plans without the collateral requirements of secured loans.

-

How can I benefit from using the Michigan Fixed Rate Note, Installment Payments Unsecured?

Using a Michigan Fixed Rate Note, Installment Payments Unsecured provides several advantages, including fixed monthly payments that aid in budgeting and financial planning. Additionally, due to the unsecured nature, borrowers can acquire funds without risking their assets, making it an attractive option for those who prefer minimal risk.

-

What are the typical repayment terms for a Michigan Fixed Rate Note with Installment Payments Unsecured?

The repayment terms for a Michigan Fixed Rate Note with Installment Payments Unsecured can vary, typically ranging from 1 to 5 years. Borrowers should carefully review the terms of their specific agreement to understand the schedule and amount of monthly payments required to fully repay the loan.

-

What factors influence the interest rate of a Michigan Fixed Rate Note, Installment Payments Unsecured?

The interest rate for a Michigan Fixed Rate Note, Installment Payments Unsecured is influenced by several factors, including the borrower's credit score, income level, and current market conditions. Lenders assess these elements to determine the risk associated with the loan, impacting the overall offering rate.

-

Can I apply for a Michigan Fixed Rate Note, Installment Payments Unsecured online?

Yes, many lenders offer the ability to apply for a Michigan Fixed Rate Note, Installment Payments Unsecured online. This convenient process allows you to submit your application from the comfort of your home, receive quick approvals, and get access to funds in a timely manner.

-

Are there any prepayment penalties associated with Michigan Fixed Rate Notes, Installment Payments Unsecured?

Prepayment penalties for a Michigan Fixed Rate Note, Installment Payments Unsecured depend on the specific terms set by the lender. It's essential to read your loan agreement thoroughly and consult with your lender to understand any potential fees associated with early repayment.

-

What types of expenses can I cover with a Michigan Fixed Rate Note, Installment Payments Unsecured?

A Michigan Fixed Rate Note, Installment Payments Unsecured can be used for various personal expenses, including debt consolidation, medical bills, home improvements, or even funding personal projects. The flexibility of the loan allows borrowers to use funds as needed, enhancing financial freedom.

Get more for Michigan Fixed Rate Note, Installment Payments Unsecured

Find out other Michigan Fixed Rate Note, Installment Payments Unsecured

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast