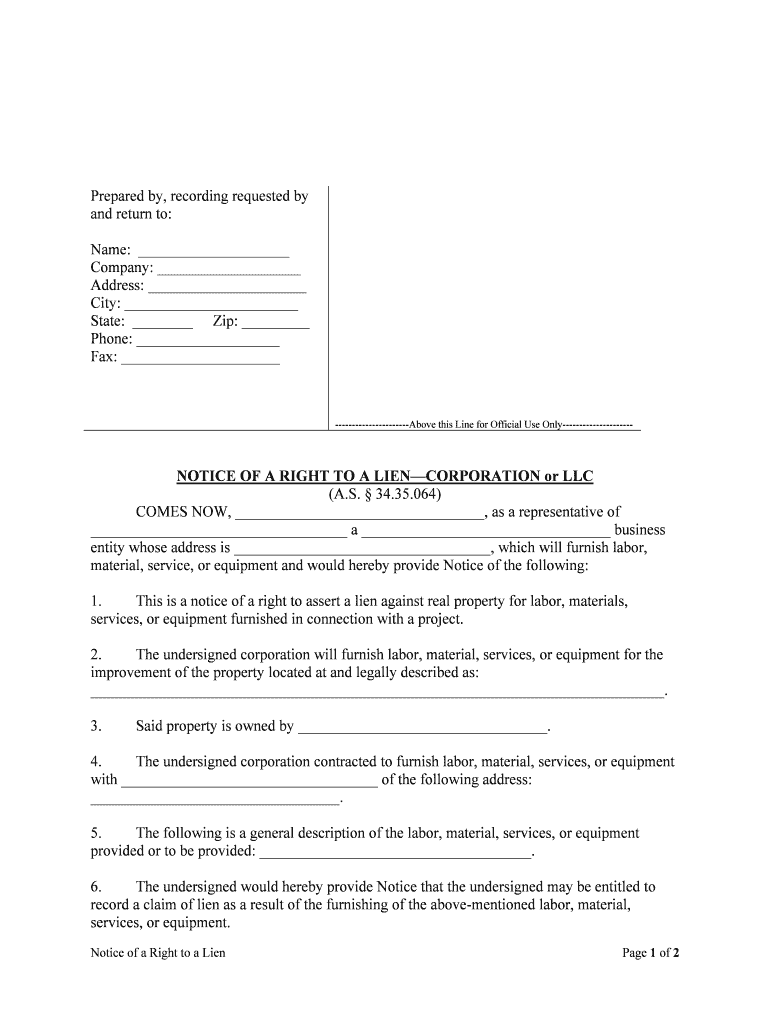

NOTICE of a RIGHT to a LIENCORPORATION or LLC Form

What is the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

The notice of a right to a liencorporation or LLC is a legal document that informs interested parties of a claim against a property or asset, typically related to unpaid debts or obligations. This notice serves as a formal declaration that a lien has been established, providing transparency regarding the financial status of the entity involved. It is essential for protecting the rights of creditors and ensuring that all parties are aware of any encumbrances that may affect ownership or transfer of the property.

How to use the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

Using the notice of a right to a liencorporation or LLC involves several steps. First, ensure that you have the correct form, which can typically be obtained from state or local government websites. Once you have the form, fill it out with accurate information regarding the debtor, the amount owed, and the property in question. After completing the form, it must be filed with the appropriate authority, often a county clerk or recorder's office, to make the lien official. It is advisable to keep a copy for your records and to notify the debtor of the lien.

Steps to complete the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

Completing the notice of a right to a liencorporation or LLC requires careful attention to detail. Follow these steps:

- Gather necessary information, including the debtor's name, address, and details of the obligation.

- Obtain the official form from the relevant state or local authority.

- Fill out the form, ensuring all information is accurate and complete.

- Sign the form where required, often in the presence of a notary public.

- File the completed form with the appropriate office, paying any required fees.

- Keep a copy of the filed document for your records.

Legal use of the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

The legal use of the notice of a right to a liencorporation or LLC is crucial for enforcing a creditor's rights. This document must comply with state laws regarding lien filings, including proper identification of the parties involved and the nature of the debt. Failure to adhere to these legal requirements can result in the lien being deemed invalid. It is important to consult legal counsel if there are uncertainties about the process or the implications of filing a lien.

Key elements of the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

Several key elements must be included in the notice of a right to a liencorporation or LLC for it to be valid:

- The name and address of the lien claimant.

- The name and address of the debtor.

- A description of the property subject to the lien.

- The amount of the debt or obligation.

- The date the debt was incurred.

- The signature of the lien claimant or their authorized representative.

State-specific rules for the NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

Each state has its own regulations governing the notice of a right to a liencorporation or LLC. These rules can dictate how the notice must be formatted, the filing process, and any associated fees. It is essential to familiarize yourself with the specific requirements in your state to ensure compliance and avoid potential legal issues. Consulting with a local attorney or legal expert can provide clarity on these state-specific rules.

Quick guide on how to complete notice of a right to a liencorporation or llc

Effortlessly Prepare NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without issues. Manage NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC seamlessly

- Find NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring reprinting of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC to guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC?

A NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC is a legal document that informs interested parties of their rights regarding a lien on a property. It serves to protect the interests of creditors and ensure transparency in financial transactions involving corporate entities. Understanding this document is essential for any business or LLC owner.

-

How can airSlate SignNow assist with managing NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents. Our features streamline the process, making it quick and secure to manage your lien documents electronically. This efficiency saves time and reduces potential errors.

-

What are the pricing plans for using airSlate SignNow for NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, allowing you to handle NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents efficiently. Our plans are competitively priced, ensuring that you get a cost-effective solution without sacrificing quality. You can choose a subscription that best fits your usage requirements.

-

What features does airSlate SignNow offer for handling NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC?

Our platform includes features like customizable templates, real-time tracking, and secure storage for NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents. You can also integrate with various applications to streamline your workflow and manage your documents effectively. These features enhance your overall experience and efficiency.

-

Can airSlate SignNow integrate with other software for NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC management?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing for efficient management of NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents. This integration helps synchronize your data across platforms, improving productivity. It enables you to work within your preferred tools while utilizing our eSigning capabilities.

-

What are the benefits of using airSlate SignNow for NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC?

Using airSlate SignNow for your NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC allows for quicker document turnaround times and reduced operational costs. Our eSigning platform enhances compliance and keeps you organized with document management tools. These benefits can signNowly improve your business operations.

-

Is it secure to send NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard security protocols to ensure that your NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC documents are secure during transmission and storage. Our platform uses encryption and secure authentication to protect sensitive data. This commitment to security gives you peace of mind when managing important legal documents.

Get more for NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

Find out other NOTICE OF A RIGHT TO A LIENCORPORATION Or LLC

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself