Form C 62A Rev

What is the Form C 62A Rev

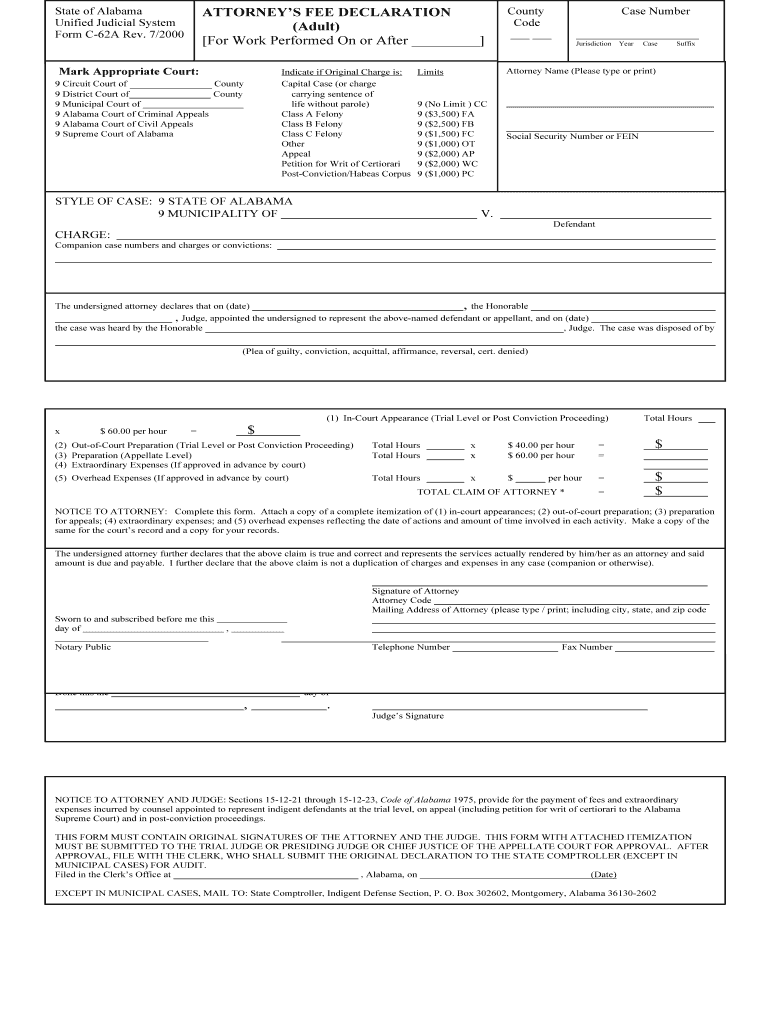

The Form C 62A Rev is a specific document used in various legal and administrative processes. This form is essential for individuals and organizations to fulfill certain requirements set forth by regulatory bodies. It serves as a formal declaration or request, often related to compliance or reporting obligations. Understanding its purpose is crucial for anyone required to submit this form, as it ensures adherence to legal standards and facilitates efficient processing.

How to use the Form C 62A Rev

Using the Form C 62A Rev involves several key steps to ensure proper completion and submission. First, gather all necessary information and documentation required to fill out the form accurately. Next, carefully read the instructions accompanying the form to understand each section's requirements. Once completed, you can submit the form through the designated method, whether online, by mail, or in person, depending on the specific guidelines provided by the issuing authority.

Steps to complete the Form C 62A Rev

Completing the Form C 62A Rev involves a systematic approach to ensure accuracy and compliance. Begin by entering your personal or business information in the designated fields. Follow this by providing any required details specific to the purpose of the form, such as financial data or supporting documentation. After filling out all sections, review the form for completeness and correctness. Finally, sign and date the form as required before submission to validate it.

Legal use of the Form C 62A Rev

The legal use of the Form C 62A Rev is governed by specific regulations that dictate its validity and acceptance. To be considered legally binding, the form must be completed in accordance with the relevant laws, including any eSignature requirements if submitted electronically. Ensuring compliance with these legal standards is vital, as failure to do so may result in the form being deemed invalid or rejected by the relevant authorities.

Key elements of the Form C 62A Rev

Key elements of the Form C 62A Rev include essential information that must be accurately provided to ensure its validity. This typically encompasses the name and contact information of the individual or entity submitting the form, the purpose of the submission, and any relevant identification numbers. Additionally, it may require signatures from authorized representatives, along with any necessary supporting documents that substantiate the claims made within the form.

Form Submission Methods (Online / Mail / In-Person)

The Form C 62A Rev can be submitted through various methods, each offering different advantages. Online submission is often the quickest and most efficient way to file the form, allowing for immediate processing. Alternatively, mailing the form provides a physical record of submission but may involve longer processing times. In-person submission can be beneficial for those who require immediate confirmation of receipt or have questions about the filing process. Understanding these options can help users choose the most suitable method for their needs.

Quick guide on how to complete form c 62a rev

Complete Form C 62A Rev effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Form C 62A Rev on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form C 62A Rev with ease

- Obtain Form C 62A Rev and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Secure important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Formulate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that require republishing document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Form C 62A Rev and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form C 62A Rev. used for?

Form C 62A Rev. is primarily utilized for electronic signatures and document management across various industries. It allows businesses to streamline their processes by enabling secure eSignatures, improving compliance and efficiency.

-

How can airSlate SignNow help with completing Form C 62A Rev.?

airSlate SignNow offers intuitive tools that simplify the completion of Form C 62A Rev. Users can easily fill out this form electronically, ensuring accuracy and speed in document processing. The platform provides a seamless signing experience for all parties involved.

-

What are the pricing options for airSlate SignNow when using Form C 62A Rev.?

airSlate SignNow provides flexible pricing plans to accommodate various business needs when utilizing Form C 62A Rev. Each plan offers specific features that enhance document management and eSigning capabilities. Interested users can explore the pricing page for detailed options tailored to their requirements.

-

Are there any integrations available for Form C 62A Rev. with airSlate SignNow?

Yes, airSlate SignNow supports numerous integrations that complement the use of Form C 62A Rev. Businesses can connect with CRM tools, cloud storage services, and other applications to streamline their workflows and enhance productivity. Check the integrations page for a complete list.

-

What benefits does airSlate SignNow offer for users of Form C 62A Rev.?

Using airSlate SignNow for Form C 62A Rev. presents multiple benefits, including reduced turnaround times and improved document security. The platform ensures that all electronic signatures comply with legal standards, thus enhancing trust in business transactions. Overall, it boosts efficiency and helps in maintaining accurate records.

-

Is airSlate SignNow secure for handling Form C 62A Rev.?

Absolutely! airSlate SignNow prioritizes security when handling Form C 62A Rev. The platform employs encryption and other security measures to protect sensitive information. Users can feel confident that their documents and signatures are safe from unauthorized access.

-

Can I track the status of Form C 62A Rev. sent through airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking features for documents, including Form C 62A Rev. Users can monitor the status of their sent forms in real-time, receive notifications upon completion, and view audit trails for enhanced accountability. This feature ensures transparency throughout the signing process.

Get more for Form C 62A Rev

Find out other Form C 62A Rev

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document