Consumer Credit Act Alabama State Banking Department Form

What is the Consumer Credit Act Alabama State Banking Department

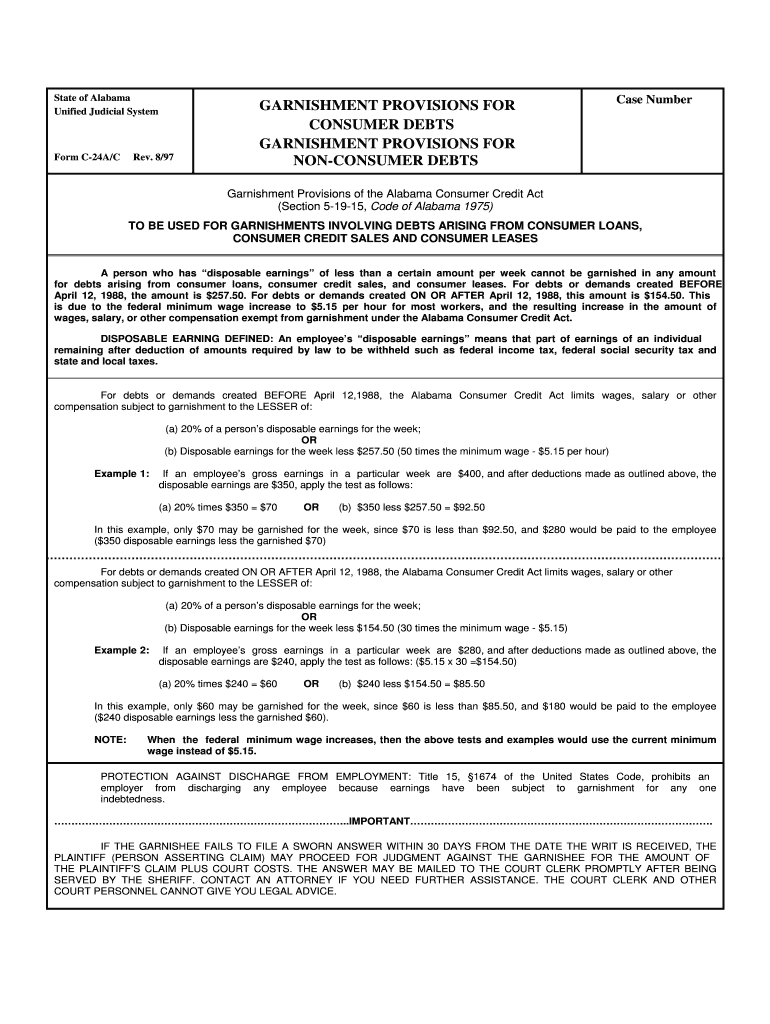

The Consumer Credit Act, governed by the Alabama State Banking Department, is a legal framework designed to regulate consumer credit transactions within the state. This act aims to protect consumers from unfair lending practices and ensure transparency in credit agreements. It mandates lenders to provide clear disclosures regarding loan terms, interest rates, and fees, allowing consumers to make informed financial decisions. By establishing guidelines for credit providers, the act promotes fair treatment and accountability in the lending process.

How to use the Consumer Credit Act Alabama State Banking Department

Utilizing the Consumer Credit Act involves understanding your rights as a borrower and the obligations of lenders. Consumers should familiarize themselves with the act's provisions, which include the right to receive accurate information about credit terms and the right to dispute unfair practices. When engaging with lenders, ensure that they comply with the act by providing all necessary disclosures and adhering to the stipulated guidelines. If you encounter issues, the act provides a framework for filing complaints with the Alabama State Banking Department, which can investigate and address violations.

Steps to complete the Consumer Credit Act Alabama State Banking Department

Completing the necessary documentation under the Consumer Credit Act involves several key steps:

- Gather all relevant financial information, including income, existing debts, and credit history.

- Review the terms and conditions of the credit agreement provided by the lender.

- Ensure that all required disclosures are included and clearly understood.

- Complete the application form accurately, providing all requested information.

- Submit the form to the lender, either online or in person, depending on their submission methods.

- Keep copies of all documents for your records, including any correspondence with the lender.

Key elements of the Consumer Credit Act Alabama State Banking Department

The key elements of the Consumer Credit Act include:

- Disclosure Requirements: Lenders must provide clear and concise information about loan terms, interest rates, and fees.

- Consumer Rights: Borrowers have the right to fair treatment and the ability to challenge unfair practices.

- Regulatory Oversight: The Alabama State Banking Department oversees compliance with the act, ensuring that lenders adhere to legal standards.

- Complaint Mechanism: Consumers can file complaints against lenders who violate the act, prompting investigations and potential penalties.

Legal use of the Consumer Credit Act Alabama State Banking Department

The legal use of the Consumer Credit Act involves adhering to its provisions during credit transactions. Lenders must comply with all disclosure requirements and treat consumers fairly throughout the lending process. Consumers should understand their rights under the act and utilize them when necessary. Legal recourse is available for borrowers who believe their rights have been violated, ensuring that the act serves its purpose of protecting consumers from predatory lending practices.

State-specific rules for the Consumer Credit Act Alabama State Banking Department

State-specific rules under the Consumer Credit Act may vary from those in other jurisdictions. In Alabama, the act outlines particular regulations regarding interest rates, fees, and the types of credit products offered. Additionally, the Alabama State Banking Department provides guidance on compliance and enforcement, ensuring that lenders operate within the state's legal framework. Understanding these state-specific rules is crucial for both consumers and lenders to navigate the credit landscape effectively.

Quick guide on how to complete consumer credit act alabama state banking department

Effortlessly Prepare Consumer Credit Act Alabama State Banking Department on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, amend, and eSign your documents promptly without delays. Handle Consumer Credit Act Alabama State Banking Department on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Consumer Credit Act Alabama State Banking Department with minimal effort

- Find Consumer Credit Act Alabama State Banking Department and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Consumer Credit Act Alabama State Banking Department while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Consumer Credit Act Alabama State Banking Department?

The Consumer Credit Act Alabama State Banking Department is a state-specific regulation designed to protect consumers in financial transactions. It governs how lenders must conduct business and ensures transparency regarding loan terms and interest rates. Understanding this act is crucial for both consumers and businesses operating within Alabama.

-

How does airSlate SignNow relate to the Consumer Credit Act Alabama State Banking Department?

airSlate SignNow helps businesses comply with the Consumer Credit Act Alabama State Banking Department by providing a secure platform for eSigning documents. Our solution ensures that all electronic signatures meet legal standards, making it easier for businesses to adhere to these regulatory requirements. This compliance can enhance customer trust and streamline lending processes.

-

What features does airSlate SignNow offer for document management regarding the Consumer Credit Act Alabama State Banking Department?

airSlate SignNow offers advanced features such as customizable templates and automated workflows that assist in managing documents per the Consumer Credit Act Alabama State Banking Department requirements. With features like in-app signing and secure document storage, businesses can ensure their practices align with state regulations seamlessly. This can lead to quicker turnaround times and improved efficiency.

-

Can airSlate SignNow assist with pricing documents related to the Consumer Credit Act Alabama State Banking Department?

Yes, airSlate SignNow provides tools that allow businesses to create and manage pricing documents in compliance with the Consumer Credit Act Alabama State Banking Department. By leveraging our template functionalities, users can ensure that all necessary pricing details are included and presented correctly. This ultimately supports transparency and adherence to regulatory standards.

-

Are there any integrations available with airSlate SignNow that benefit compliance with the Consumer Credit Act Alabama State Banking Department?

AirSlate SignNow offers various integrations with CRM and document management systems, enhancing compliance with the Consumer Credit Act Alabama State Banking Department. These integrations can streamline document handling and promote efficiency in managing consumer credit transactions, keeping everything in check with state regulations.

-

What benefits do businesses gain by using airSlate SignNow in relation to the Consumer Credit Act Alabama State Banking Department?

By utilizing airSlate SignNow, businesses can ensure efficient and compliant document management in line with the Consumer Credit Act Alabama State Banking Department. This includes saving time with eSigning, enhancing security, and improving customer satisfaction. It’s a cost-effective solution designed to meet regulatory requirements while simplifying workflows.

-

Is airSlate SignNow cost-effective for businesses needing to comply with the Consumer Credit Act Alabama State Banking Department?

Absolutely, airSlate SignNow is a cost-effective solution for businesses looking to comply with the Consumer Credit Act Alabama State Banking Department. With affordable pricing plans and a range of features, users can maximize value while ensuring adherence to necessary regulations. This allows businesses to focus on growth while managing compliance efficiently.

Get more for Consumer Credit Act Alabama State Banking Department

- Expungement form shasta county

- Where can i use my blue wellness card form

- Register of beneficial ownership template form

- Fdcpa test pdf form

- Red cross parent consent form

- Tf 311 fbks instructions for requesting records draft trial court forms

- Banner order form dt5602vnjxv0c cloudfront net

- Candy order form

Find out other Consumer Credit Act Alabama State Banking Department

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast