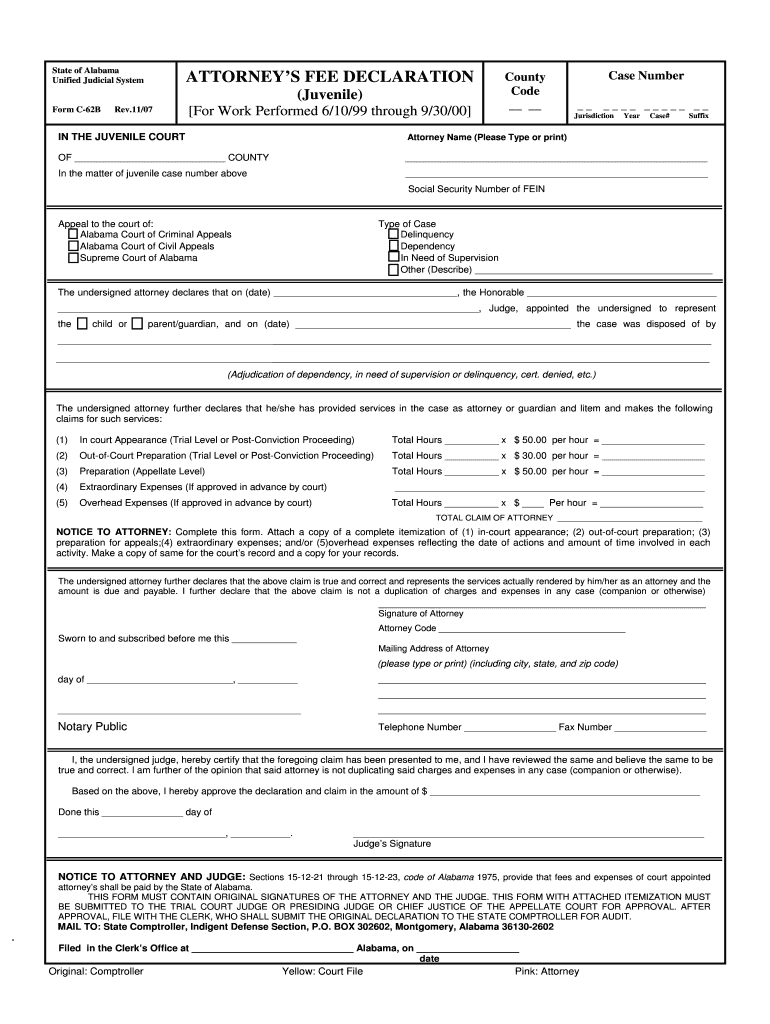

For Work Performed 61099 through 93000

What is the For Work Performed 61099 Through 93000

The For Work Performed 61099 Through 93000 is a specific form used to report payments made to independent contractors or service providers. This form is essential for businesses to document the services rendered and the corresponding payments made. It ensures compliance with IRS regulations, allowing businesses to accurately report income and expenses associated with contract work. Understanding this form is crucial for maintaining proper financial records and fulfilling tax obligations.

Steps to complete the For Work Performed 61099 Through 93000

Completing the For Work Performed 61099 Through 93000 involves several key steps. First, gather all necessary information about the contractor, including their legal name, address, and taxpayer identification number. Next, document the total amount paid to the contractor during the reporting period. Ensure that all entries are accurate and reflect the payments made for services performed. Finally, review the completed form for any errors before submitting it to the IRS and providing a copy to the contractor.

Legal use of the For Work Performed 61099 Through 93000

The legal use of the For Work Performed 61099 Through 93000 is governed by IRS guidelines, which stipulate that businesses must report payments made to independent contractors. This form is legally binding when completed accurately and submitted on time. It serves as a record of income for the contractor and helps the IRS track earnings for tax purposes. Compliance with these regulations is essential to avoid penalties and ensure that both businesses and contractors fulfill their tax responsibilities.

Required Documents

To complete the For Work Performed 61099 Through 93000, certain documents are required. These include the contractor's W-9 form, which provides necessary identification details, such as their Social Security number or Employer Identification Number. Additionally, businesses should have records of all payments made to the contractor during the reporting period. Keeping accurate financial records will facilitate the completion of the form and ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the For Work Performed 61099 Through 93000 are critical to ensure compliance with IRS regulations. Typically, businesses must submit this form to the IRS by January thirty-first of the year following the reporting period. Additionally, a copy must be provided to the contractor by the same date. Being aware of these deadlines helps prevent late filing penalties and ensures that contractors receive their tax documents on time.

Who Issues the Form

The For Work Performed 61099 Through 93000 is issued by the Internal Revenue Service (IRS). This federal agency is responsible for overseeing tax collection and enforcing tax laws in the United States. Businesses must ensure that they are using the most current version of the form as provided by the IRS to maintain compliance and avoid any issues during tax reporting.

Quick guide on how to complete for work performed 61099 through 93000

Complete For Work Performed 61099 Through 93000 seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage For Work Performed 61099 Through 93000 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign For Work Performed 61099 Through 93000 effortlessly

- Obtain For Work Performed 61099 Through 93000 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign For Work Performed 61099 Through 93000 to ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for services related to 'For Work Performed 61099 Through 93000'?

airSlate SignNow offers competitive pricing plans tailored for businesses needing services for 'For Work Performed 61099 Through 93000'. We provide flexible subscription options that cater to different organizational sizes and document workflows, ensuring you receive the best value for your investment.

-

What features does airSlate SignNow provide for 'For Work Performed 61099 Through 93000'?

With airSlate SignNow, businesses can easily send and eSign documents relevant to 'For Work Performed 61099 Through 93000'. Our platform includes features like custom templates, real-time tracking, and automated workflows to help streamline the document management process.

-

How can airSlate SignNow benefit my organization for 'For Work Performed 61099 Through 93000'?

Implementing airSlate SignNow for 'For Work Performed 61099 Through 93000' can signNowly enhance your document workflow efficiency. By enabling seamless eSigning and document sharing, your team can save time, reduce errors, and increase overall productivity.

-

Does airSlate SignNow integrate with other software for 'For Work Performed 61099 Through 93000'?

Yes, airSlate SignNow supports integrations with various software applications, making it ideal for 'For Work Performed 61099 Through 93000'. Our platform seamlessly connects with popular tools like Salesforce, Google Workspace, and more, allowing for a cohesive workflow across your tech stack.

-

Is there a mobile app available for airSlate SignNow related to 'For Work Performed 61099 Through 93000'?

Absolutely! airSlate SignNow provides a mobile app that allows users to manage documents on-the-go for 'For Work Performed 61099 Through 93000'. With the app, you can send and sign documents anytime, anywhere, ensuring your business stays agile and responsive.

-

What kind of support does airSlate SignNow offer for 'For Work Performed 61099 Through 93000'?

airSlate SignNow is committed to providing excellent support for its clients working on 'For Work Performed 61099 Through 93000'. Our dedicated support team is available through various channels, including live chat, email, and a comprehensive help center, ensuring you have assistance when needed.

-

Can I customize documents in airSlate SignNow for 'For Work Performed 61099 Through 93000'?

Yes, airSlate SignNow allows users to create and customize documents specific to 'For Work Performed 61099 Through 93000'. Our intuitive editing tools enable you to add fields, logos, and branding to fit your organization’s needs perfectly.

Get more for For Work Performed 61099 Through 93000

- Bpss 30v form

- X ray release form techdentistrycom

- Virginia freshwater trophys aarded form

- Ab216 form

- Application form for academic admission lilitha college of

- Dps 414 c assault weapon certificate application ct gov form

- Self retracting lifeline inspections form

- Firearms application addendum used firearm explanation form

Find out other For Work Performed 61099 Through 93000

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document