810 14 1 04 Installment Payment Agreements into Written Form

What is the 810 14 1 04 Installment Payment Agreements Into Written

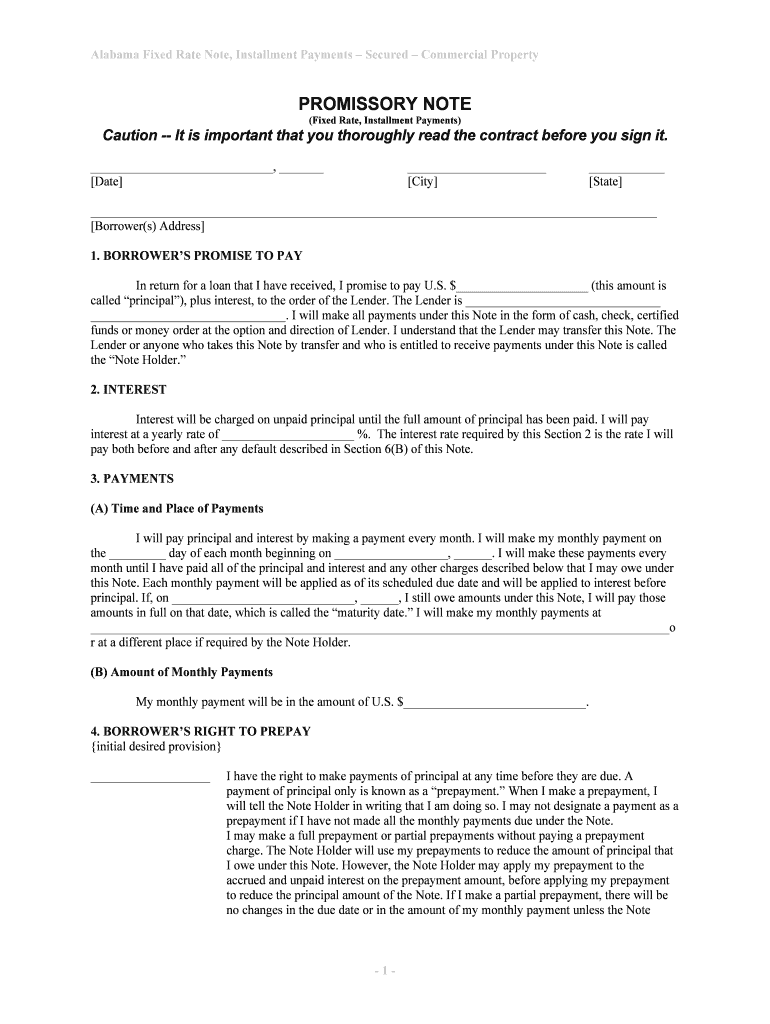

The 810 14 1 04 installment payment agreements into written form is a formal document used to outline the terms and conditions under which a taxpayer agrees to pay their tax liabilities over time. This agreement is essential for individuals or businesses facing financial difficulties, allowing them to manage their debts in a structured manner. The document specifies the payment amount, frequency, and duration, ensuring both the taxpayer and the IRS have a clear understanding of the obligations involved.

How to use the 810 14 1 04 Installment Payment Agreements Into Written

Using the 810 14 1 04 installment payment agreements into written form involves several steps. First, gather all necessary financial information, including income, expenses, and any existing debts. Next, complete the form with accurate details regarding your financial situation and proposed payment plan. Once filled out, review the agreement for accuracy before submitting it to the IRS. It is advisable to keep a copy of the signed agreement for your records, as it serves as proof of your commitment to the payment plan.

Steps to complete the 810 14 1 04 Installment Payment Agreements Into Written

Completing the 810 14 1 04 installment payment agreements into written form requires careful attention to detail. Follow these steps:

- Collect your financial documents, including income statements and expense records.

- Determine the total amount you owe to the IRS and how much you can afford to pay monthly.

- Fill out the form, ensuring all information is accurate and complete.

- Sign and date the agreement to validate it.

- Submit the completed form to the IRS through the appropriate channels, such as online submission or mail.

Key elements of the 810 14 1 04 Installment Payment Agreements Into Written

Several key elements must be included in the 810 14 1 04 installment payment agreements into written form to ensure its effectiveness:

- Taxpayer Information: Full name, address, and Social Security number or Employer Identification Number.

- Payment Terms: The proposed monthly payment amount, payment frequency, and total duration of the agreement.

- Financial Disclosure: A summary of your financial situation, including income, expenses, and any other debts.

- Signature: A signed declaration affirming the accuracy of the information provided and the commitment to the payment plan.

Legal use of the 810 14 1 04 Installment Payment Agreements Into Written

The legal use of the 810 14 1 04 installment payment agreements into written form is governed by IRS regulations. This agreement is legally binding once signed by both the taxpayer and the IRS. It is crucial to adhere to the terms outlined in the agreement to avoid penalties or additional interest on the owed amount. Failure to comply with the payment schedule can result in the IRS taking further collection actions, including wage garnishment or bank levies.

Eligibility Criteria

To qualify for the 810 14 1 04 installment payment agreements into written form, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate financial hardship, showing that they cannot pay their tax liability in full by the due date. Additionally, taxpayers should not have defaulted on a previous installment agreement. The IRS evaluates each request based on the taxpayer's financial situation and compliance history.

Quick guide on how to complete 810 14 1 04 installment payment agreements into written

Complete 810 14 1 04 Installment Payment Agreements Into Written effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage 810 14 1 04 Installment Payment Agreements Into Written on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 810 14 1 04 Installment Payment Agreements Into Written with ease

- Obtain 810 14 1 04 Installment Payment Agreements Into Written and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any chosen device. Edit and eSign 810 14 1 04 Installment Payment Agreements Into Written and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 810 14 1 04 Installment Payment Agreements?

810 14 1 04 Installment Payment Agreements are formal arrangements that allow individuals or businesses to pay debts over a specified period. With airSlate SignNow, you can efficiently draft and manage these agreements, ensuring compliance and clarity. This service empowers users to create legally binding agreements easily.

-

How can airSlate SignNow help with 810 14 1 04 Installment Payment Agreements?

airSlate SignNow provides an intuitive platform for preparing and signing 810 14 1 04 Installment Payment Agreements electronically. Our features streamline the entire process, enabling users to gather signatures quickly and securely. This greatly reduces turnaround time and enhances the customer experience.

-

Are there any costs associated with using airSlate SignNow for 810 14 1 04 Installment Payment Agreements?

airSlate SignNow offers competitive pricing for its eSigning and document management services, including for creating 810 14 1 04 Installment Payment Agreements. There are various subscription plans available to fit different business needs and budgets. We suggest reviewing our pricing page for more information.

-

Can I integrate airSlate SignNow with other software for 810 14 1 04 Installment Payment Agreements?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing the workflow for 810 14 1 04 Installment Payment Agreements. By connecting with platforms like CRM systems and document storage solutions, you can manage agreements more effectively. This integration facilitates better organization and access to crucial documents.

-

What security measures does airSlate SignNow offer for my 810 14 1 04 Installment Payment Agreements?

airSlate SignNow prioritizes the security of your documents, including 810 14 1 04 Installment Payment Agreements. We utilize industry-standard encryption, user authentication, and secure data storage practices. This ensures that your sensitive information remains protected throughout the signing process.

-

How long does it take to set up 810 14 1 04 Installment Payment Agreements with airSlate SignNow?

Setting up 810 14 1 04 Installment Payment Agreements with airSlate SignNow is quick and straightforward. Most users can get started within minutes by creating an account and utilizing our customizable templates. Our user-friendly platform is designed for efficiency, allowing you to focus on your agreements rather than the setup.

-

Can I track the status of my 810 14 1 04 Installment Payment Agreements?

Absolutely! airSlate SignNow provides you with real-time tracking features for your 810 14 1 04 Installment Payment Agreements. You can monitor when documents are viewed, signed, and completed, ensuring you stay informed throughout the signing process. This transparency is essential for managing your agreements effectively.

Get more for 810 14 1 04 Installment Payment Agreements Into Written

- Mun acceptance letter 14622151 form

- Medicare coordination of benefits form

- Firearm safety certificate form

- Affidavit of singleness form

- Atlanta perinatal associates riverdale form

- Matt talbot retreat movement inc literature order form matttalbotretreats

- British columbia separation agreement template form

- Broadband service agreement template form

Find out other 810 14 1 04 Installment Payment Agreements Into Written

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease