Aflac W9 Formpdffillercom 2011

What is the Aflac W-9 Form?

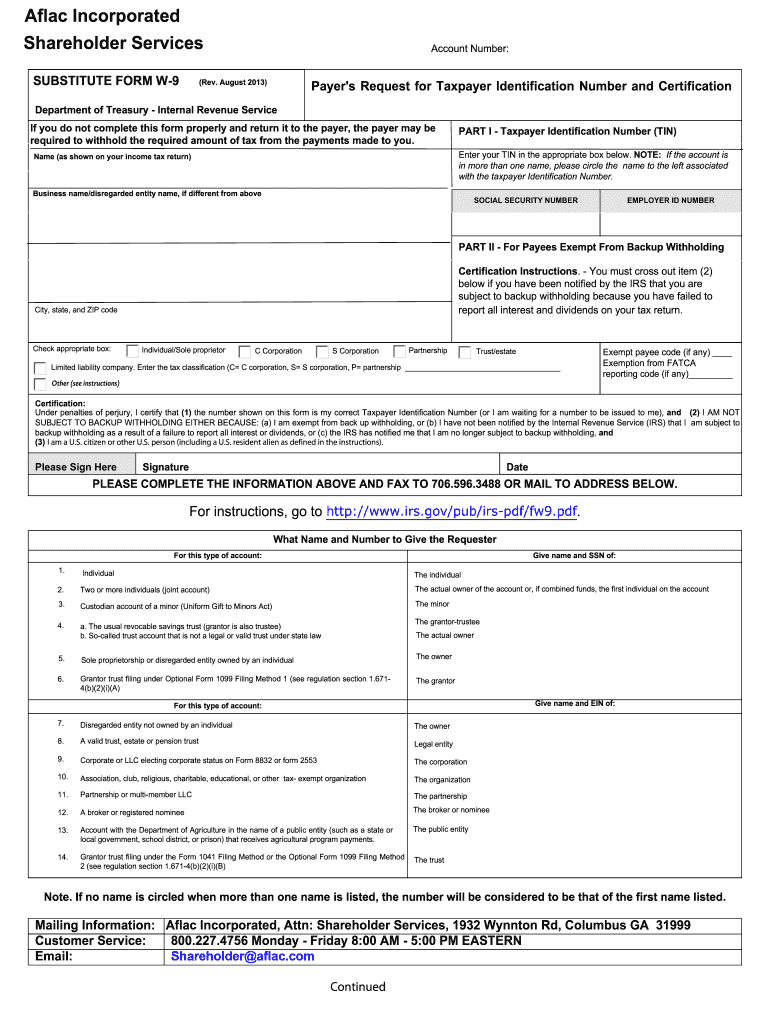

The Aflac W-9 Form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information. This form is essential for Aflac policyholders who need to report income to the IRS. It ensures that the correct tax identification number is associated with the payments made to Aflac, facilitating accurate tax reporting and compliance.

Steps to Complete the Aflac W-9 Form

Completing the Aflac W-9 Form involves several straightforward steps:

- Begin by downloading the Aflac W-9 Form from a reliable source.

- Fill in your name as it appears on your tax return.

- Provide your business name if applicable.

- Indicate your federal tax classification, such as individual, corporation, or partnership.

- Enter your taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number.

- Complete the address section with your current mailing address.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Aflac W-9 Form

The Aflac W-9 Form serves a legal purpose by ensuring compliance with IRS regulations. By accurately completing and submitting this form, individuals and businesses can avoid potential penalties associated with incorrect tax reporting. It is crucial to ensure that all information is current and accurate to maintain compliance with federal tax laws.

Key Elements of the Aflac W-9 Form

Several key elements are essential when filling out the Aflac W-9 Form:

- Name: The name of the individual or business entity.

- Business Name: If applicable, the name under which the business operates.

- Tax Classification: The federal tax classification of the individual or entity.

- Taxpayer Identification Number: The TIN, which is crucial for tax reporting.

- Address: The current mailing address for correspondence.

How to Obtain the Aflac W-9 Form

The Aflac W-9 Form can be obtained easily through various channels. It is typically available on the Aflac website or can be requested directly from Aflac customer service. Additionally, the form can be found on IRS resources or other reputable tax-related websites. Ensure that you are using the most current version of the form to comply with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Aflac W-9 Form is vital for compliance. While the W-9 itself does not have a specific submission deadline, it is important to provide the completed form to Aflac before any payments are made. Additionally, ensure that you are aware of any relevant tax filing deadlines to avoid penalties.

Quick guide on how to complete aflac w9 formpdffillercom

The simplest method to locate and authorize Aflac W9 Formpdffillercom

At the level of an entire organization, ineffective procedures concerning document approval can consume a signNow amount of work hours. Signing documents such as Aflac W9 Formpdffillercom is an inherent aspect of operations in every sector, which is why the efficacy of each agreement’s lifecycle profoundly impacts the company’s overall productivity. With airSlate SignNow, signing your Aflac W9 Formpdffillercom can be as straightforward and rapid as possible. You will discover on this platform the most recent version of virtually any form. Even better, you can sign it right away without the need to install external software on your device or print any physical copies.

Steps to obtain and sign your Aflac W9 Formpdffillercom

- Browse our collection by category or use the search bar to locate the document you require.

- View the form preview by clicking Learn more to ensure it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any essential information using the toolbar.

- When finished, click the Sign tool to authorize your Aflac W9 Formpdffillercom.

- Choose the signature option that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your documents efficiently. You can find, fill out, edit, and even share your Aflac W9 Formpdffillercom in a single tab effortlessly. Enhance your processes with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct aflac w9 formpdffillercom

FAQs

-

How do I fill out a W9 as a non-US person?

You don’t. Form W9 is only for US individuals. If you are a non-US individual then you need to be completing a W8. There is a W8 BEN for non-US income and W8 ECI for US effectively connected income. You complete the appropriate form based on the nature of income you are receiving.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

If someone receives a gratuity do they need to fill out a W9 tax form?

It depends on the amount of the gratuity and the context in which it is received.First a W9 form is used when a business pays for services to vendors that it reasonably expects the payments will total more than $600 during a calendar year. The W9 is required to give the business the necessary information needed to complete a Form 1099 to report payments for services provided during the year. Gratuities received for providing services to a business would certainly fall under the 1099 reporting requirements and therefore a W9 form would be appropriate.Some businesses have a policy of requiring a W9 from every service provider before any payment in any amount is made. Not particularly a legal requirement, but given the frequent difficulty of obtaining the information after payment has been made, not a necessarily unreasonable policy to have.That is when the gratuity is received in the context of providing a service to a business. Payments for personal services are not subject to 1099 reporting and a W9 should not be needed. Payment of gratuities in the context of what we typically think of in terms of gratuity such as a wait staff at a restaurant or stylist at a hair salon are generally personal in nature and the reporting falls on the service person’s employer and not the person paying the gratuity, so a W9 in that case would not be typical.So did you work a weekend event for a business convention and they want to give you a $500 tip for doing a great job, but require a W9, yea I would probably fill out the form. Do you wait tables at a restaurant and the guest wants to tip you $50 for his business luncheon, I would probably not be inclined to fill out the form.

-

How do I fill out a W9 if I am a sole-proprietorship operating with a DBA?

Put your name on line 1 and the business name on line 2. Use your social security number or if you have an EIN for the business, you can use that.

-

Who do I send this W9 form to after I fill it out? Then what happens?

Send the W-9 to the business that asked you to complete it.Then the business will have your social security number or employer identification number so it can prepare a 1099 to report the income it gave you after year end.

Create this form in 5 minutes!

How to create an eSignature for the aflac w9 formpdffillercom

How to make an electronic signature for the Aflac W9 Formpdffillercom in the online mode

How to make an eSignature for the Aflac W9 Formpdffillercom in Google Chrome

How to create an electronic signature for putting it on the Aflac W9 Formpdffillercom in Gmail

How to make an electronic signature for the Aflac W9 Formpdffillercom straight from your smart phone

How to generate an electronic signature for the Aflac W9 Formpdffillercom on iOS devices

How to create an electronic signature for the Aflac W9 Formpdffillercom on Android

People also ask

-

What is the Aflac W9 FormsignNowcom and how does it work?

The Aflac W9 FormsignNowcom is an online tool designed to help users fill out and manage W9 forms efficiently. With airSlate SignNow, you can easily access and complete the Aflac W9 FormsignNowcom, ensuring that your tax documents are filled out accurately and securely. This solution streamlines the process, making it quick and hassle-free.

-

How much does the Aflac W9 FormsignNowcom service cost?

Pricing for the Aflac W9 FormsignNowcom through airSlate SignNow is competitive and tailored to meet various business needs. We offer different subscription plans that provide access to essential features and integrations. For specific pricing details, you can visit our pricing page or contact our sales team for personalized assistance.

-

What features does the Aflac W9 FormsignNowcom offer?

The Aflac W9 FormsignNowcom includes a range of features such as electronic signatures, customizable templates, and secure document storage. Users can easily edit, sign, and send the form from any device, enhancing accessibility and efficiency. Additionally, it allows for real-time tracking of document status, keeping you informed throughout the process.

-

Can I integrate the Aflac W9 FormsignNowcom with other tools?

Absolutely! The Aflac W9 FormsignNowcom integrates seamlessly with various business applications and tools. This ensures that you can incorporate it into your existing workflow, whether it's CRM software, accounting tools, or document management systems. These integrations enhance productivity and streamline your operations.

-

Is the Aflac W9 FormsignNowcom secure for sensitive information?

Yes, the Aflac W9 FormsignNowcom prioritizes security and compliance. airSlate SignNow employs advanced encryption and security measures to protect your sensitive information. You can confidently fill out and store your W9 forms, knowing that your data is safeguarded against unauthorized access.

-

How can airSlate SignNow help with the Aflac W9 FormsignNowcom?

airSlate SignNow simplifies the process of using the Aflac W9 FormsignNowcom by providing an intuitive interface and comprehensive support. Our platform allows users to quickly fill, sign, and share forms, reducing the time spent on paperwork. Moreover, our customer service team is available to assist with any questions or concerns.

-

What are the benefits of using the Aflac W9 FormsignNowcom?

Using the Aflac W9 FormsignNowcom offers numerous benefits, such as increased efficiency, reduced paperwork, and improved accuracy. By leveraging airSlate SignNow's features, you can complete and manage your W9 forms in a fraction of the time compared to traditional methods. This ultimately helps businesses save time and resources.

Get more for Aflac W9 Formpdffillercom

- Housing discrimination complaint questionnaire form

- Homeschool completion affidavit form

- Ga cobb district form

- Office of secretary of state corporations division 2 martin form

- Form cd 415 georgia secretary of state georgiagov

- Pdf trees for kids grant application and instructions iowa dnr form

- Iowa department of natural resources urban and community form

- Accidentincident report naperville park district form

Find out other Aflac W9 Formpdffillercom

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document