The Trustors Are Married and the Parents of the Following Living Child Form

What is the Trustors Are Married And The Parents Of The Following Living Child

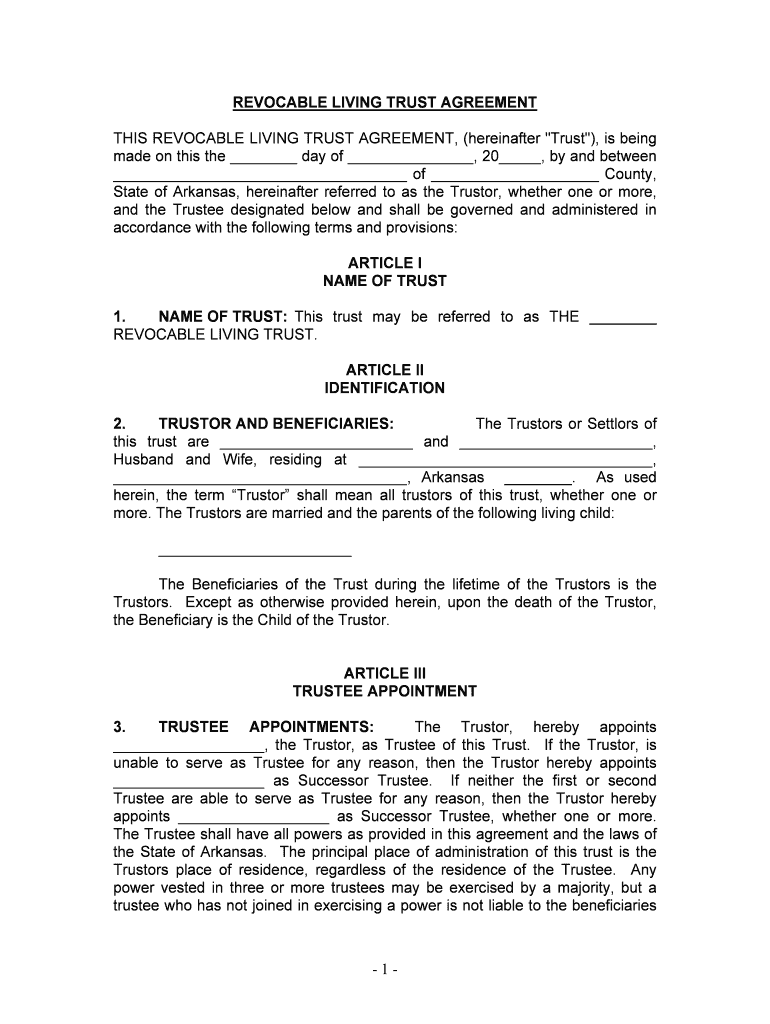

The Trustors Are Married And The Parents Of The Following Living Child form is a legal document that establishes the relationship and responsibilities of trustors who are married and have a living child. This form is essential in various legal contexts, including estate planning and family law. It serves to clarify the rights and obligations of the trustors concerning their child, ensuring that their intentions are documented and legally recognized.

Key elements of the Trustors Are Married And The Parents Of The Following Living Child

This form typically includes several critical components:

- Identification of Trustors: Names and details of the married trustors.

- Child’s Information: Full name, date of birth, and any relevant identification details of the living child.

- Intentions of Trustors: A clear statement outlining the trustors' intentions regarding the child's welfare and any assets involved.

- Signatures: Required signatures of both trustors to validate the document legally.

Steps to complete the Trustors Are Married And The Parents Of The Following Living Child

Completing the Trustors Are Married And The Parents Of The Following Living Child form involves several straightforward steps:

- Gather Information: Collect necessary information about both trustors and the child.

- Fill Out the Form: Enter the required details accurately, ensuring all information is current and correct.

- Review the Document: Check for any errors or omissions before finalizing the form.

- Sign the Document: Both trustors must sign the form in the presence of a witness or notary, if required.

Legal use of the Trustors Are Married And The Parents Of The Following Living Child

This form is legally recognized in various contexts, including:

- Estate Planning: Establishing how assets will be managed and distributed concerning the child.

- Guardianship Arrangements: Clarifying who will care for the child if the trustors are unable to do so.

- Legal Proceedings: Serving as evidence of the trustors' intentions in family law cases.

How to use the Trustors Are Married And The Parents Of The Following Living Child

Using the Trustors Are Married And The Parents Of The Following Living Child form effectively involves understanding its purpose and ensuring it is filled out correctly. This form can be utilized in legal contexts to affirm the relationship between trustors and their child, making it crucial for estate planning and family law matters. It is advisable to consult with a legal professional to ensure compliance with state laws and regulations.

Who Issues the Form

The Trustors Are Married And The Parents Of The Following Living Child form is typically issued by legal professionals, such as attorneys specializing in family law or estate planning. Additionally, some online legal services may provide templates for this form, allowing trustors to customize it according to their needs. It is essential to ensure that the version used complies with local laws and regulations.

Quick guide on how to complete the trustors are married and the parents of the following living child

Complete The Trustors Are Married And The Parents Of The Following Living Child seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle The Trustors Are Married And The Parents Of The Following Living Child on any platform with airSlate SignNow's Android or iOS applications and simplify any documentation process today.

The easiest way to edit and eSign The Trustors Are Married And The Parents Of The Following Living Child effortlessly

- Obtain The Trustors Are Married And The Parents Of The Following Living Child and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign The Trustors Are Married And The Parents Of The Following Living Child and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow, and how does it relate to the Trustors?

airSlate SignNow is an electronic signature solution that allows users to send and eSign documents easily. For those who are navigating family legal matters, such as when 'The Trustors Are Married And The Parents Of The Following Living Child,' having a reliable eSigning tool can streamline the process of executing necessary legal documents.

-

How can airSlate SignNow help in legal documentation for families?

With airSlate SignNow, families can efficiently manage their legal documentation, especially in situations where 'The Trustors Are Married And The Parents Of The Following Living Child.' The platform offers templates and customizable documents, making it easier to draft and eSign important papers.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans designed to fit different needs, including a free trial to explore features. This is particularly beneficial for those in unique family situations such as 'The Trustors Are Married And The Parents Of The Following Living Child,' as it allows users to assess the platform's effectiveness without commitment.

-

What features does airSlate SignNow offer for seamless eSigning?

airSlate SignNow includes features like template library, cloud storage, and real-time tracking, which are essential for timely document processing. For families where 'The Trustors Are Married And The Parents Of The Following Living Child,' these features ensure that all signatories can access and review documents conveniently.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various business tools such as Google Workspace, Salesforce, and more. These integrations can be particularly useful in scenarios involving legal documents for families where 'The Trustors Are Married And The Parents Of The Following Living Child,' ensuring all related workflows are connected.

-

Is airSlate SignNow secure for signing sensitive documents?

Absolutely! airSlate SignNow adheres to stringent security measures to protect your documents, including encryption and secure data storage. This focus on security is vital for families managing important matters, especially ones like 'The Trustors Are Married And The Parents Of The Following Living Child.'

-

Can multiple parties easily sign documents with airSlate SignNow?

Yes, airSlate SignNow allows for multiple signatories to eSign documents seamlessly, which is especially beneficial in family agreements or trust documents. In cases where 'The Trustors Are Married And The Parents Of The Following Living Child,' this feature helps streamline collaboration among all parties involved.

Get more for The Trustors Are Married And The Parents Of The Following Living Child

- Dmv01 form

- Printer friendly foot evaluation form hrsa hrsa

- Printable blank ohio eviction or leavepremises notice form

- Ny medicaid change of address form

- Form 1012 570736649

- Cooking equipment exhaust ventilation exemption guide for form

- Nonresidential compliance forms nrcc california energy energy ca

- Kansas city planning and development department mo form

Find out other The Trustors Are Married And The Parents Of The Following Living Child

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney