Fields 31 32 Form

What is the Fields 31 32

The Fields 31 32 form is a specific document used primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to accurately disclose income, deductions, and other relevant financial data. Understanding the purpose of this form is crucial for compliance with U.S. tax laws, as it ensures that all necessary information is reported correctly to avoid penalties.

Steps to complete the Fields 31 32

Completing the Fields 31 32 form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary financial documents, such as income statements and records of deductions.

- Begin filling out the form by entering your personal information, including your name and Social Security number.

- Input the financial data as required in the designated fields, ensuring that all amounts are accurate and correspond to your records.

- Review the completed form for any errors or omissions, as accuracy is vital in tax reporting.

- Sign and date the form to validate your submission.

How to use the Fields 31 32

Using the Fields 31 32 form effectively requires an understanding of its intended purpose and the information it collects. This form is typically used in conjunction with other tax documents to provide a comprehensive view of your financial situation. It is essential to follow the IRS guidelines closely to ensure that the information reported is complete and accurate. This form can be filled out electronically or manually, depending on your preference and the requirements of your tax filing.

Legal use of the Fields 31 32

The legal use of the Fields 31 32 form is governed by IRS regulations, which stipulate how financial information must be reported. To ensure compliance, it is important to understand the legal implications of the information you provide. The form must be completed truthfully and submitted by the designated deadlines to avoid potential penalties. Additionally, maintaining accurate records that support the information reported on the form is crucial for legal compliance.

Who Issues the Form

The Fields 31 32 form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is important to refer to the official IRS website or documentation for the most current version of the form and any updates regarding its use.

Filing Deadlines / Important Dates

Filing deadlines for the Fields 31 32 form are critical to avoid late fees or penalties. Generally, the form must be submitted by April fifteenth of the tax year following the income being reported. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to keep track of any changes in deadlines announced by the IRS and to plan your filing accordingly to ensure timely submission.

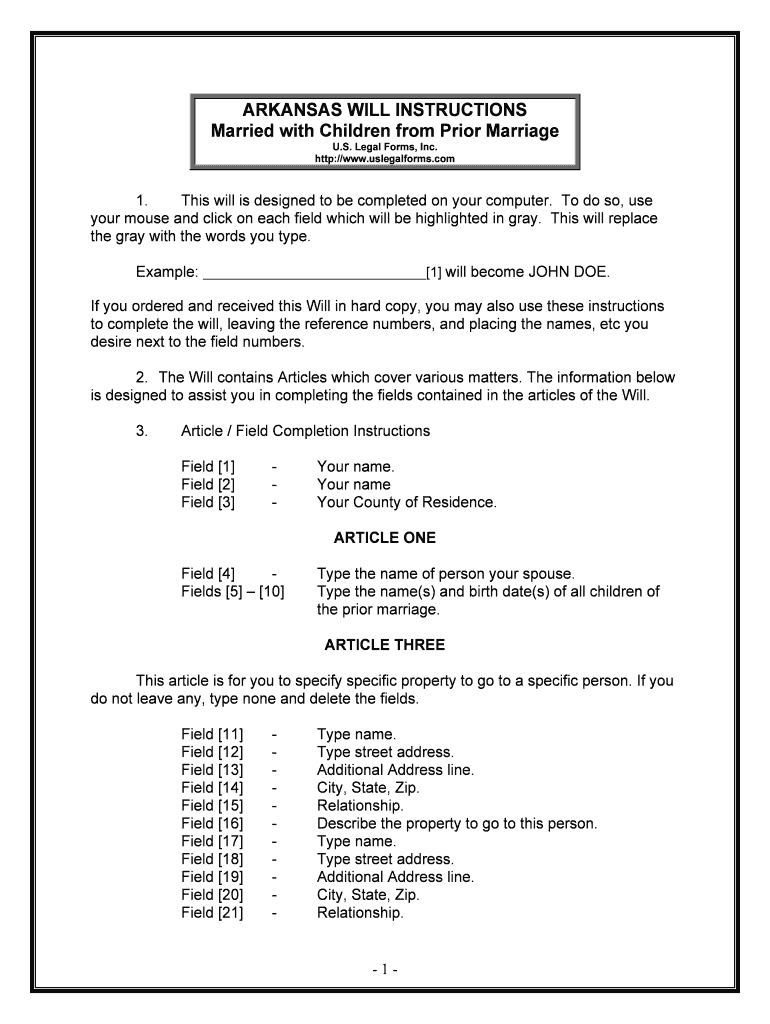

Quick guide on how to complete fields 31 32

Effortlessly Prepare Fields 31 32 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Fields 31 32 on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-oriented procedure today.

How to Edit and Electronically Sign Fields 31 32 with Ease

- Obtain Fields 31 32 and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Fields 31 32 to ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Fields 31 32 in airSlate SignNow?

Fields 31 32 in airSlate SignNow refer to specific data entry points within your documents. These fields can be customized to collect essential information from signers, ensuring that your documents are filled out accurately and efficiently.

-

How do I create and customize Fields 31 32?

To create and customize Fields 31 32 in airSlate SignNow, simply access the document editor and add the fields where needed. You can adjust their properties, such as labels and required statuses, to tailor the signing experience according to your requirements.

-

Are there any costs associated with using Fields 31 32?

airSlate SignNow offers various pricing plans that include the use of Fields 31 32 at no additional cost. Depending on your selected plan, you can leverage these fields alongside other advanced features to enhance your document workflow.

-

What are the benefits of using Fields 31 32?

Using Fields 31 32 enhances accuracy and completeness in your documents. By ensuring that specific data is captured before completion, you improve the integrity of your transactions and speed up the signing process.

-

Can Fields 31 32 be integrated with other applications?

Yes, Fields 31 32 in airSlate SignNow can be seamlessly integrated with various applications. This enables you to automate data transfer and streamline workflows, enhancing overall productivity for your business.

-

Is there support available for setting up Fields 31 32?

Absolutely! airSlate SignNow provides extensive support for users needing assistance with setting up Fields 31 32. You can access detailed tutorials and signNow out to customer support for personalized help.

-

How do Fields 31 32 improve document compliance?

Fields 31 32 help ensure document compliance by collecting necessary information upfront. By making certain fields mandatory or conditional, you lower the risk of incomplete documents, which is crucial for legal and regulatory adherence.

Get more for Fields 31 32

- Prepaid card offer certificate tailbase form

- Employment application educational grimmway farms form

- Copyright transfer form template

- Form viii u

- Town of lexington malexington county school district onelexington school district two lex2 orglexington school district two form

- Company agreement template form

- Company buyout agreement template form

- Company buy sell agreement template form

Find out other Fields 31 32

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement