Receive This Property Form

What is the Receive This Property

The Receive This Property form is a legal document used to facilitate the transfer of property ownership. It serves as a formal acknowledgment that the recipient has received the property, which can include real estate, personal belongings, or other assets. This form is essential for maintaining clear records of ownership and ensuring that all parties involved understand the terms of the transfer. It is commonly utilized in various transactions, including sales, gifts, or inheritance of property.

How to use the Receive This Property

Using the Receive This Property form involves several straightforward steps. First, gather all necessary information regarding the property being transferred, including its description, value, and any relevant legal details. Next, ensure that both the giver and receiver of the property understand the terms of the transfer. Once the details are confirmed, fill out the form accurately, including signatures from both parties. After completion, retain copies for personal records and ensure that any required filing is done according to state regulations.

Legal use of the Receive This Property

The legal use of the Receive This Property form hinges on compliance with local and federal laws governing property transfers. This document must be signed by both parties to be considered valid. Additionally, it is crucial that the form meets any specific state requirements, which may include notarization or witness signatures. By adhering to these legal stipulations, the form can serve as a binding agreement that protects the rights of both the giver and the receiver.

Steps to complete the Receive This Property

Completing the Receive This Property form involves a series of methodical steps to ensure accuracy and compliance. Start by obtaining the form, which can typically be found online or through legal offices. Fill in the required information, including the names of both parties, property details, and the date of transfer. Review the document for any errors or omissions. Finally, both parties should sign the form in the presence of a notary or witness if required, and make copies for their records.

Key elements of the Receive This Property

Several key elements must be included in the Receive This Property form to ensure its effectiveness and legality. These elements typically include:

- Names of the parties involved: Clearly state the full names of both the giver and receiver.

- Description of the property: Provide a detailed description of the property being transferred.

- Date of transfer: Indicate the date on which the transfer is taking place.

- Signatures: Both parties must sign the form to validate the agreement.

State-specific rules for the Receive This Property

Each state may have its own specific rules and requirements regarding the Receive This Property form. It is essential to consult local laws to ensure compliance. Some states may require additional documentation, such as proof of ownership or tax forms, while others might mandate notarization or witness signatures. Familiarizing oneself with these regulations can help avoid potential legal issues and ensure a smooth property transfer process.

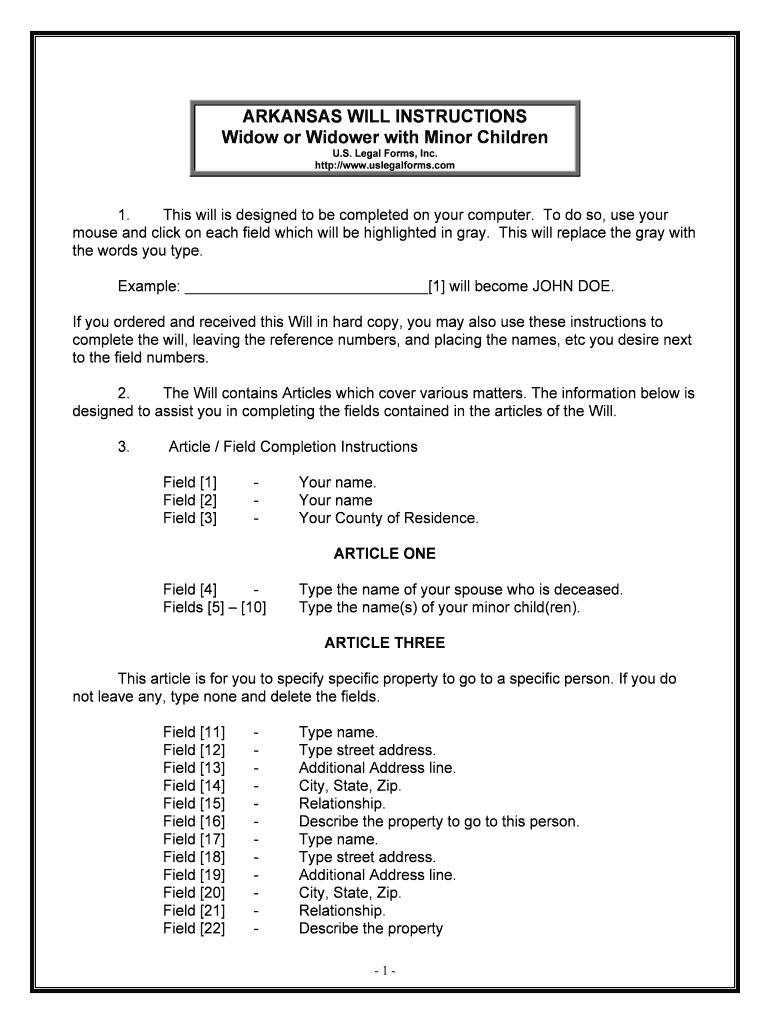

Quick guide on how to complete receive this property

Prepare Receive This Property effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the suitable form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Receive This Property on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Receive This Property with ease

- Obtain Receive This Property and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Receive This Property and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to receive this property using airSlate SignNow?

To receive this property, simply upload the necessary documents within the airSlate SignNow platform. After that, you can add recipients, set signing orders, and electronically sign. The entire process is streamlined to ensure you can receive this property swiftly and securely.

-

How does airSlate SignNow ensure the security of my documents when I receive this property?

airSlate SignNow utilizes advanced encryption technologies to protect your documents. Each eSignature is secured with multi-factor authentication, ensuring that when you receive this property, your sensitive information remains confidential and tamper-proof.

-

Are there any hidden fees when I choose to receive this property with airSlate SignNow?

No, airSlate SignNow prides itself on transparency. There are no hidden fees when you choose to receive this property, and our pricing plans are straightforward, allowing you to manage your budget with ease.

-

Can I integrate airSlate SignNow with other tools to assist in receiving this property?

Absolutely! airSlate SignNow offers integrations with a wide range of business applications, which helps streamline your workflow. By integrating your favorite tools, you can enhance the process of receiving this property, making it even more efficient.

-

What are the key features of airSlate SignNow that help when I receive this property?

Key features include customizable templates, automated workflows, and real-time tracking. These functionalities allow you to prepare, send, and monitor documents effectively, making it easier to receive this property without any hassle.

-

Is airSlate SignNow suitable for businesses of all sizes when looking to receive this property?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you are a small startup or a large enterprise, our scalable solution ensures you can efficiently receive this property as your business grows.

-

What benefits will I gain from using airSlate SignNow for receiving this property?

Using airSlate SignNow offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. This efficient method allows you to receive this property faster while maintaining a professional touch in your transactions.

Get more for Receive This Property

- Sponsorship template for an airline form

- Find the slope and y intercept for each equation answer key form

- Odm online registration form

- Mankind episode 1 answers form

- Conceptual framework template editable form

- Da form 1954

- Clayton county dispossessory form

- Company credit card agreement template form

Find out other Receive This Property

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now