Beneficiarys Property Be Placed in Trust Form

What is the Beneficiary's Property Be Placed In Trust

The Beneficiary's Property Be Placed In Trust form is a legal document that allows individuals to designate property to be held in trust for the benefit of a specific beneficiary. This arrangement can help manage assets, protect them from creditors, and ensure that the property is distributed according to the grantor's wishes. Trusts can vary in structure and purpose, but they generally serve to provide financial security and clear instructions for asset management.

How to Use the Beneficiary's Property Be Placed In Trust

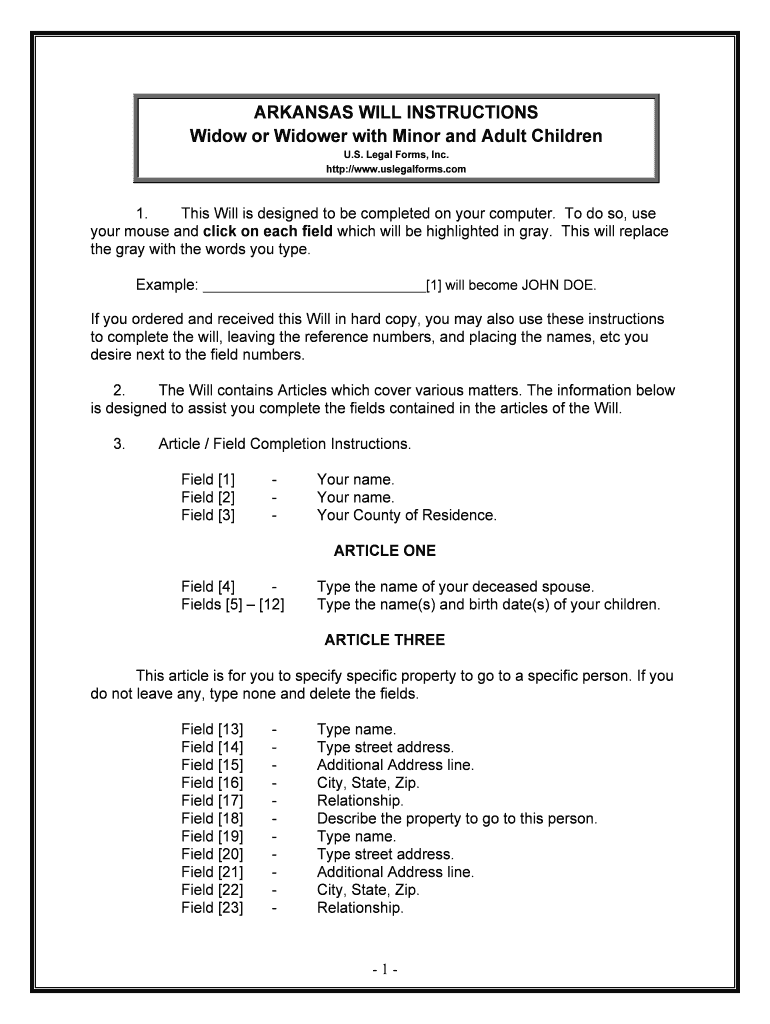

Using the Beneficiary's Property Be Placed In Trust form involves several steps to ensure that the document is filled out correctly and legally binding. Start by gathering all necessary information about the property and the beneficiary. This includes details such as the legal description of the property, the name and address of the beneficiary, and any specific terms you wish to include in the trust. Once you have this information, complete the form carefully, ensuring that all sections are filled out accurately.

Steps to Complete the Beneficiary's Property Be Placed In Trust

Completing the Beneficiary's Property Be Placed In Trust form requires careful attention to detail. Follow these steps:

- Identify the property you wish to place in trust, including its legal description.

- Provide the full name and contact information of the beneficiary.

- Specify the terms of the trust, including any conditions or limitations.

- Sign and date the form in the presence of a notary public, if required by state law.

- Keep a copy of the completed form for your records.

Legal Use of the Beneficiary's Property Be Placed In Trust

The legal use of the Beneficiary's Property Be Placed In Trust form is governed by state laws, which can vary significantly. It is essential to understand the legal implications of creating a trust in your state. This includes knowing the requirements for valid signatures, the necessity of a notary, and any specific language that must be included in the trust document. Consulting with a legal professional can provide clarity and ensure compliance with all applicable laws.

State-Specific Rules for the Beneficiary's Property Be Placed In Trust

Each state in the U.S. has its own regulations regarding the creation and management of trusts. These rules can affect how the Beneficiary's Property Be Placed In Trust form is completed and executed. Important considerations include:

- Requirements for notarization or witness signatures.

- Specific language that must be included in the trust document.

- State laws governing the distribution of assets held in trust.

Required Documents

When preparing to complete the Beneficiary's Property Be Placed In Trust form, certain documents may be required to support your application. These documents typically include:

- Proof of ownership of the property, such as a deed.

- Identification documents for the grantor and beneficiary.

- Any previous trust documents if applicable.

Quick guide on how to complete beneficiarys property be placed in trust

Complete Beneficiarys Property Be Placed In Trust effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Handle Beneficiarys Property Be Placed In Trust across any platform with airSlate SignNow Android or iOS apps and streamline any document-related task today.

The easiest way to edit and eSign Beneficiarys Property Be Placed In Trust without hassle

- Locate Beneficiarys Property Be Placed In Trust and click on Get Form to initiate the process.

- Leverage the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or share link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign Beneficiarys Property Be Placed In Trust and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean for a beneficiary's property to be placed in trust?

When a beneficiary's property is placed in trust, it means that the property is managed by a trustee for the benefit of the beneficiary. This ensures that the assets are protected and distributed according to the terms set out in the trust agreement, which can help in facilitating smoother transitions of property.

-

How can I ensure my beneficiary's property will be placed in trust correctly?

To ensure your beneficiary's property is placed in trust correctly, it's advisable to work with a qualified estate planning attorney. They can help you draft the necessary documents and ensure that all legal requirements are met, thereby safeguarding your beneficiary's interests effectively.

-

What are the benefits of placing a beneficiary's property in trust?

Placing a beneficiary's property in trust offers numerous benefits, including asset protection, tax advantages, and control over how assets are distributed. It can also provide peace of mind, as the trust outlines clear guidelines for managing the beneficiary's property.

-

What features does airSlate SignNow offer for managing trusts?

AirSlate SignNow offers features that streamline the process of creating and signing trust documents. With easy-to-use templates and secure eSignature capabilities, you can efficiently manage the documentation needed for placing a beneficiary's property in trust without any hassle.

-

Are there any costs associated with placing a beneficiary's property in trust using airSlate SignNow?

While airSlate SignNow provides an affordable eSigning solution, the costs associated with placing a beneficiary's property in trust may vary depending on legal fees and the complexity of the trust. However, using SignNow can help reduce costs by simplifying document management and eSigning processes.

-

Can I integrate airSlate SignNow with other tools for trust management?

Yes, airSlate SignNow offers various integrations with other software tools that assist in trust management, including document storage systems and CRM platforms. This allows for a seamless workflow when placing a beneficiary's property in trust and managing related tasks.

-

How does airSlate SignNow ensure the security of my trust documents?

AirSlate SignNow prioritizes the security of your trust documents through advanced encryption and secure data storage. This means that when you place a beneficiary's property in trust, you can be confident that your sensitive information is protected from unauthorized access.

Get more for Beneficiarys Property Be Placed In Trust

Find out other Beneficiarys Property Be Placed In Trust

- eSign Word for Legal Computer

- How To eSign Word for Legal

- eSign Word for Legal Mobile

- How Do I eSign PDF for Legal

- eSign PDF for Legal Myself

- eSign Word for Legal Later

- eSign Word for Legal Myself

- eSign PDF for Legal Simple

- eSign PDF for Legal Easy

- eSign Word for Legal Easy

- Can I eSign Word for Legal

- eSign Document for Legal Online

- eSign Document for Legal Computer

- How To eSign Document for Legal

- eSign Document for Legal Now

- How Do I eSign Document for Legal

- Help Me With eSign Document for Legal

- How Can I eSign Document for Legal

- eSign Document for Legal Myself

- eSign Form for Legal Online