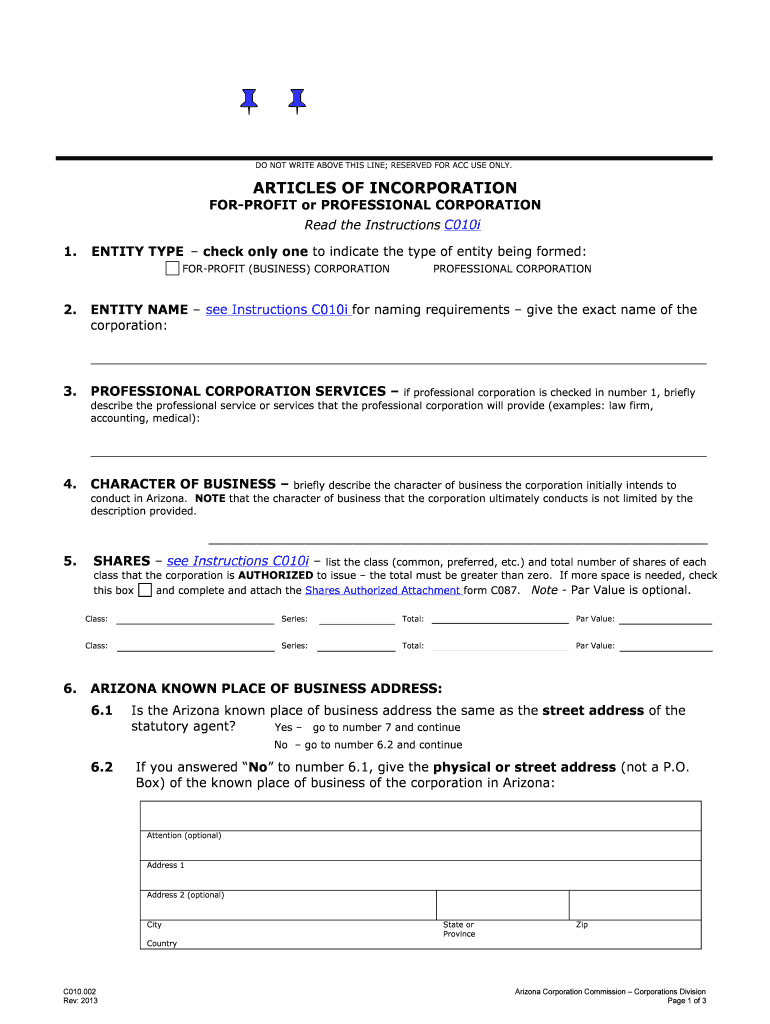

For PROFIT BUSINESS CORPORATION Form

What is the for profit business corporation?

A for profit business corporation is a legal entity formed to conduct business for profit. This type of corporation is designed to generate income for its shareholders, who may receive dividends based on the corporation's profitability. In the United States, a for profit business corporation is governed by state laws, which dictate its formation, structure, and operational requirements. These corporations can be structured as either C corporations or S corporations, each with distinct tax implications and operational guidelines.

Steps to complete the for profit business corporation

Completing the for profit business corporation involves several key steps to ensure compliance with legal requirements. First, choose a unique name for your corporation that complies with state naming rules. Next, prepare and file the Articles of Incorporation with the appropriate state agency, which typically includes details such as the corporation's name, purpose, and registered agent. After filing, create corporate bylaws that outline the governance structure and operational procedures. Finally, obtain any necessary licenses and permits to operate legally in your industry.

Legal use of the for profit business corporation

The legal use of a for profit business corporation is essential for protecting the interests of shareholders and ensuring compliance with applicable laws. This type of corporation must adhere to state regulations regarding governance, reporting, and taxation. Corporations are required to hold annual meetings, maintain accurate records, and file necessary documents with the state. Additionally, they must comply with federal regulations, including those set by the Internal Revenue Service (IRS), to avoid penalties and maintain their corporate status.

Key elements of the for profit business corporation

Several key elements define a for profit business corporation. These include:

- Limited Liability: Shareholders are typically not personally liable for the corporation's debts, protecting their personal assets.

- Perpetual Existence: A corporation continues to exist independently of its owners, allowing for continuity even if ownership changes.

- Transferability of Shares: Ownership can be easily transferred through the sale of shares, facilitating investment and liquidity.

- Formal Structure: Corporations have a defined management structure, including a board of directors and officers responsible for day-to-day operations.

How to use the for profit business corporation

Using a for profit business corporation involves understanding its operational framework and legal obligations. Corporations can engage in various business activities, enter contracts, and sue or be sued in their own name. To effectively utilize this structure, business owners should maintain compliance with state and federal laws, keep accurate financial records, and file annual reports as required. Additionally, corporations can raise capital by issuing stock, attracting investors who seek to benefit from the company's growth and profitability.

Filing deadlines / Important dates

Filing deadlines for a for profit business corporation vary by state and can include important dates for annual reports, tax returns, and other compliance documents. Typically, corporations must file their annual reports within a specific timeframe after the end of their fiscal year. It's essential to stay informed about these deadlines to avoid penalties and maintain good standing with state authorities. Corporations should also be aware of tax filing deadlines set by the IRS to ensure timely submission of corporate tax returns.

Who issues the form?

The for profit business corporation form is typically issued by the Secretary of State or a similar state agency responsible for business registrations. Each state has its own requirements and forms for incorporating a business, and these forms can often be accessed online through the state agency's website. It is crucial for business owners to use the correct form and follow the specific instructions provided by their state to ensure successful incorporation.

Quick guide on how to complete for profit business corporation

Effortlessly Prepare FOR PROFIT BUSINESS CORPORATION on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Work with FOR PROFIT BUSINESS CORPORATION on any gadget using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and eSign FOR PROFIT BUSINESS CORPORATION with Ease

- Locate FOR PROFIT BUSINESS CORPORATION and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether it be by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign FOR PROFIT BUSINESS CORPORATION to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a FOR PROFIT BUSINESS CORPORATION?

A FOR PROFIT BUSINESS CORPORATION is a legal entity created to conduct business activities with the goal of generating profit for its shareholders. This type of corporation can enter into contracts, incur debts, and perform various business operations. Understanding this structure helps businesses effectively utilize tools like airSlate SignNow for efficient document handling and eSigning.

-

How can airSlate SignNow benefit my FOR PROFIT BUSINESS CORPORATION?

airSlate SignNow offers an easy-to-use platform for your FOR PROFIT BUSINESS CORPORATION to send and eSign important documents quickly. This enhances your operational efficiency, reduces turnaround time, and lowers paper usage, allowing your business to focus on growth and profitability.

-

What features does airSlate SignNow offer for FOR PROFIT BUSINESS CORPORATIONS?

airSlate SignNow provides various features tailored for FOR PROFIT BUSINESS CORPORATIONS, including document templates, real-time tracking, and customizable workflows. Integration with popular applications streamlines processes, while robust security measures ensure your data remains protected.

-

Is airSlate SignNow cost-effective for a FOR PROFIT BUSINESS CORPORATION?

Yes, airSlate SignNow is designed to be a cost-effective solution for FOR PROFIT BUSINESS CORPORATIONS. With flexible pricing plans, you can choose an option that aligns with your budget while gaining access to essential eSigning features that streamline your document processes.

-

Can I integrate airSlate SignNow with other tools my FOR PROFIT BUSINESS CORPORATION uses?

Absolutely! airSlate SignNow offers seamless integration with a wide range of applications, helping your FOR PROFIT BUSINESS CORPORATION boost productivity. Whether you use CRM systems, project management tools, or cloud storage, integration is straightforward and enhances your workflow.

-

What types of documents can my FOR PROFIT BUSINESS CORPORATION sign electronically?

Your FOR PROFIT BUSINESS CORPORATION can electronically sign various documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, ensuring you can handle any necessary documentation without hassle.

-

How does airSlate SignNow ensure compliance for my FOR PROFIT BUSINESS CORPORATION?

airSlate SignNow ensures compliance by adhering to industry standards such as ESIGN and UETA, making it a secure choice for your FOR PROFIT BUSINESS CORPORATION. The platform also offers audit trails and secure storage, so you can easily demonstrate compliance during audits.

Get more for FOR PROFIT BUSINESS CORPORATION

- Newsletter rubric xls form

- Blue dental claim form

- Nps contribution slip pdf form

- Wps medicare part b redetermination request form wps medicare part b redetermination request form

- Renovation application form

- 69 117 cigarette and tobacco products retail employee modisoft form

- Purolator dangerous goods form

- Confidentiality non disclosure agreement template form

Find out other FOR PROFIT BUSINESS CORPORATION

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast