NJ 1040 V Resident Income Tax Payment Voucher 2024-2026

What is the NJ 1040 V Resident Income Tax Payment Voucher

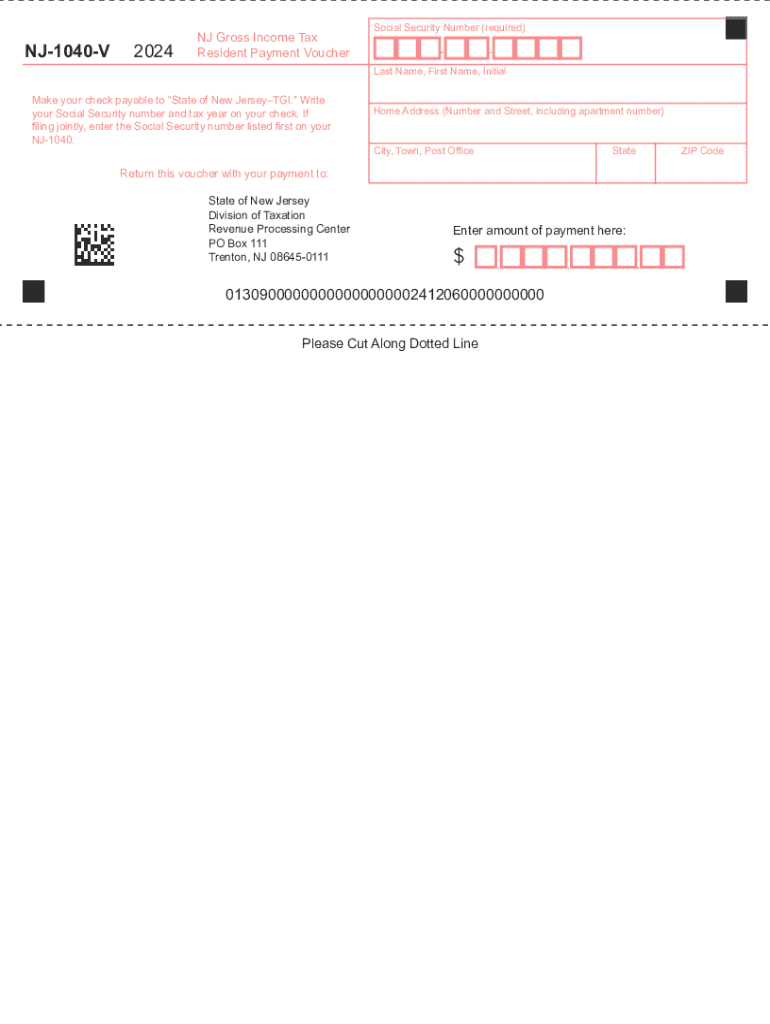

The NJ 1040 V Resident Income Tax Payment Voucher is a form used by New Jersey residents to submit their state income tax payments. This voucher is particularly important for individuals who owe taxes and are filing their returns. It serves as a record of payment and ensures that the state receives the correct amount owed in a timely manner. The NJ 1040 V is typically used in conjunction with the NJ 1040 form, which is the primary income tax return for residents of New Jersey.

How to use the NJ 1040 V Resident Income Tax Payment Voucher

To use the NJ 1040 V Resident Income Tax Payment Voucher, taxpayers should first complete their NJ 1040 tax return. Once the total tax liability is determined, the voucher can be filled out with the amount due. It is essential to include personal information such as name, address, and Social Security number to ensure proper processing. After completing the voucher, it can be submitted along with the payment to the New Jersey Division of Taxation.

Steps to complete the NJ 1040 V Resident Income Tax Payment Voucher

Completing the NJ 1040 V involves several key steps:

- Obtain the NJ 1040 V form, which can be downloaded from the New Jersey Division of Taxation website or filled out online.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the amount of tax owed, which should match the amount calculated on your NJ 1040 tax return.

- Choose your payment method, whether by check or electronic payment.

- Sign and date the voucher to certify that the information provided is accurate.

Key elements of the NJ 1040 V Resident Income Tax Payment Voucher

The NJ 1040 V includes several key elements that are crucial for proper submission:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Payment Amount: The total amount of tax owed for the filing period.

- Payment Method: Options for submitting payment, including check or electronic transfer.

- Signature: The taxpayer must sign and date the voucher to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the NJ 1040 V are typically aligned with the federal tax deadlines. For most taxpayers, the deadline to file and pay taxes is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to stay informed about any changes to deadlines, especially in light of special circumstances or state-specific announcements.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040 V can be submitted in several ways:

- Online: Taxpayers can submit their payment electronically through the New Jersey Division of Taxation's online portal.

- Mail: The completed voucher can be mailed to the appropriate address provided on the form, along with a check or money order for the payment.

- In-Person: Payments can also be made in person at designated state tax offices, where taxpayers can submit their voucher and payment directly.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 v resident income tax payment voucher

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 v resident income tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj 1040v form and why is it important?

The nj 1040v form is a payment voucher used for submitting payments with your New Jersey income tax return. It is essential for ensuring that your payment is properly credited to your tax account. Using the nj 1040v helps avoid delays in processing your tax return and ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the nj 1040v form?

airSlate SignNow simplifies the process of completing and eSigning the nj 1040v form. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. With airSlate SignNow, you can easily send the completed nj 1040v form directly to the appropriate tax authorities.

-

Is there a cost associated with using airSlate SignNow for the nj 1040v?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your nj 1040v forms without breaking the bank. You can choose a plan that fits your budget while enjoying all the features necessary for efficient document management.

-

What features does airSlate SignNow offer for managing the nj 1040v?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage for your nj 1040v forms. These tools streamline the process, making it easy to manage and track your tax documents. Additionally, our user-friendly interface ensures that you can navigate the platform with ease.

-

Can I integrate airSlate SignNow with other software for the nj 1040v?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for the nj 1040v form. Whether you use accounting software or CRM systems, our platform can seamlessly connect, allowing for efficient document handling and management.

-

What are the benefits of using airSlate SignNow for the nj 1040v?

Using airSlate SignNow for the nj 1040v provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible. Additionally, the ability to eSign documents speeds up the process, allowing you to focus on other important tasks.

-

Is airSlate SignNow secure for handling the nj 1040v?

Yes, airSlate SignNow prioritizes security and compliance when handling the nj 1040v form. We utilize advanced encryption and secure data storage to protect your sensitive information. You can trust that your documents are safe while using our platform.

Get more for NJ 1040 V Resident Income Tax Payment Voucher

- Trust property investopedia form

- Invitation to bachelor party form

- Disclmr trust qtip minors 00204283doc business law form

- Letter to congressperson advocating purchasing prescription drugs from canada form

- Addressing envelopespackagesmail centerluther college form

- Letter to college from student concerning accreditation of college program form

- This letter is to confirm your telephone conversation with my legal assistant name form

- This trust agreement dated the agreement is by and form

Find out other NJ 1040 V Resident Income Tax Payment Voucher

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online