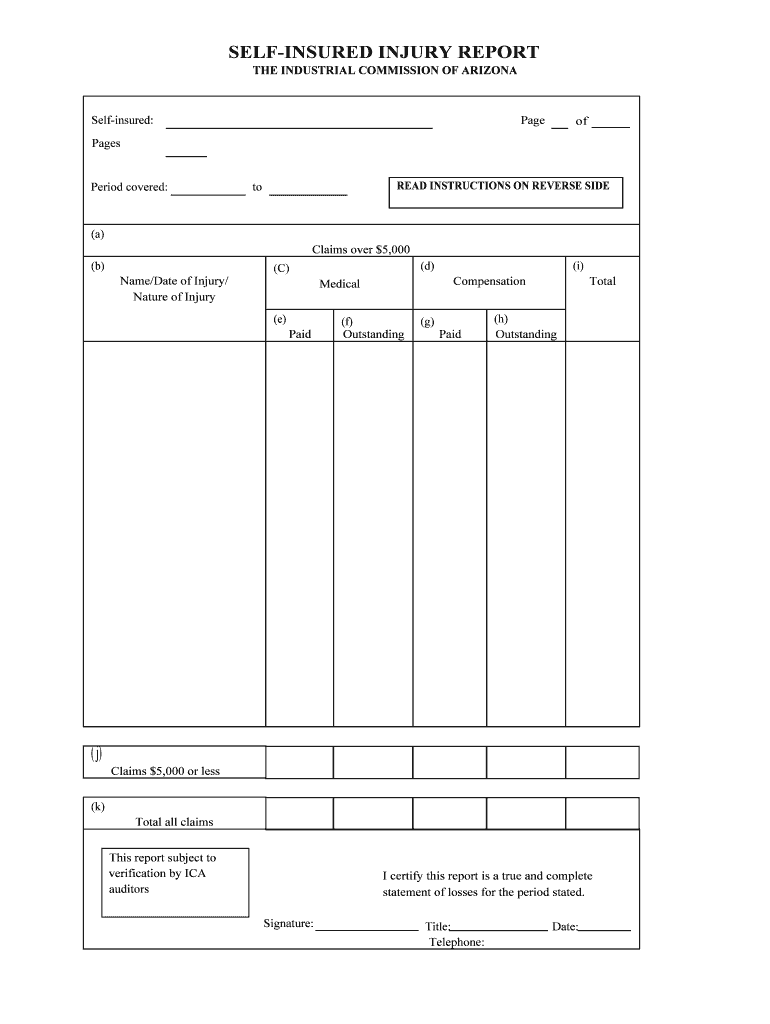

SELF INSURED INJURY REPORT Form

What is the self insured injury report?

The self insured injury report is a crucial document used by businesses and individuals to formally document workplace injuries. This report serves to outline the details of the incident, including the nature of the injury, the circumstances surrounding it, and any immediate actions taken. It is particularly important for self-insured employers who manage their own workers' compensation claims. By accurately completing this form, employers can ensure compliance with legal requirements and facilitate appropriate follow-up actions.

How to use the self insured injury report

Using the self insured injury report involves several key steps. First, gather all relevant information about the injury, including the employee's details, the date and time of the incident, and any witnesses. Next, complete the form by providing a clear and concise description of the event. It is essential to include any medical treatment received and to document any follow-up actions. Once completed, the report should be submitted to the appropriate internal department or insurance provider to initiate the claims process.

Steps to complete the self insured injury report

Completing the self insured injury report requires careful attention to detail. Follow these steps for accuracy:

- Begin by entering the employee's name, job title, and contact information.

- Document the date, time, and location of the injury.

- Provide a thorough description of the incident, including how the injury occurred.

- List any witnesses present during the incident.

- Include details of any medical treatment received immediately after the injury.

- Sign and date the report to confirm its accuracy.

Legal use of the self insured injury report

The legal use of the self insured injury report is vital for ensuring compliance with workers' compensation laws. This report must be completed accurately and submitted promptly to avoid potential penalties. The information contained within the report can be used as evidence in case of disputes or claims. It is essential for employers to understand the legal implications of this document and to maintain thorough records of all incidents and reports.

Key elements of the self insured injury report

Several key elements must be included in the self insured injury report to ensure its effectiveness. These elements include:

- Employee identification information

- Date and time of the incident

- Detailed description of the injury and circumstances

- Witness statements, if applicable

- Medical treatment details

- Signature of the reporting individual

State-specific rules for the self insured injury report

Each state may have specific rules and regulations regarding the completion and submission of the self insured injury report. It is important for employers to familiarize themselves with their state's requirements, including deadlines for submission and any additional documentation that may be necessary. Compliance with these state-specific rules helps to ensure that the report is legally valid and can be used effectively in the claims process.

Quick guide on how to complete self insured injury report

Prepare SELF INSURED INJURY REPORT effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the required form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files swiftly without delays. Handle SELF INSURED INJURY REPORT on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign SELF INSURED INJURY REPORT without any hassle

- Find SELF INSURED INJURY REPORT and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign SELF INSURED INJURY REPORT and guarantee exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a SELF INSURED INJURY REPORT?

A SELF INSURED INJURY REPORT is a crucial document used by businesses to track and manage workplace injuries effectively. It helps organizations maintain compliance with legal requirements while simplifying the claims process. By utilizing airSlate SignNow, you can create and sign these reports easily and securely.

-

How can airSlate SignNow facilitate the creation of a SELF INSURED INJURY REPORT?

airSlate SignNow offers a user-friendly platform that allows you to customize and generate a SELF INSURED INJURY REPORT swiftly. With our drag-and-drop editor, you can add necessary fields, upload relevant documents, and ensure all signatures are collected. This simplifies the reporting process and improves efficiency.

-

Is there a cost associated with using airSlate SignNow for SELF INSURED INJURY REPORTs?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for creating SELF INSURED INJURY REPORTs. Our plans are designed to be cost-effective, ensuring you get maximum value while helping you manage your documents effortlessly. You can choose a plan based on your document volume and features required.

-

What features does airSlate SignNow provide for SELF INSURED INJURY REPORT management?

airSlate SignNow provides several features for effective SELF INSURED INJURY REPORT management, including customizable templates, eSignature capabilities, and audit trails. These features ensure that your reports are not only compliant but also secure and easily traceable. This enhances accountability and reduces risks associated with workplace injuries.

-

Can I integrate airSlate SignNow with other tools for handling SELF INSURED INJURY REPORTs?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to streamline your processes for managing SELF INSURED INJURY REPORTs. Popular integrations include CRM systems, project management tools, and cloud storage services, enabling you to connect your workflows and enhance efficiency.

-

What are the benefits of using airSlate SignNow for SELF INSURED INJURY REPORTs?

Using airSlate SignNow for your SELF INSURED INJURY REPORTs brings multiple benefits, including reduced processing time and increased accuracy. Our platform enhances collaboration by allowing multiple stakeholders to review and sign documents seamlessly. Moreover, the digital nature of these reports means easier tracking and management.

-

Is it easy to train employees to use airSlate SignNow for SELF INSURED INJURY REPORTs?

Yes, training employees to use airSlate SignNow for SELF INSURED INJURY REPORTs is straightforward due to our intuitive interface. Users can quickly learn how to navigate the platform, create reports, and gather signatures. We also provide resources and customer support to assist with the onboarding process.

Get more for SELF INSURED INJURY REPORT

- Mcmap certificate template form

- Tennessee bus 424 form

- Skilsmisse blanket til print form

- Os ss 89 form

- Dd form 2628 24427438

- Patient information form patient information form what is your main dental complaint or concern

- Steak n shake employee benefits form

- Business development agreement template form

Find out other SELF INSURED INJURY REPORT

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit