, 20, between the Assignor and the Assignee the "Loan Agreement", the Assignee Has Form

What is the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

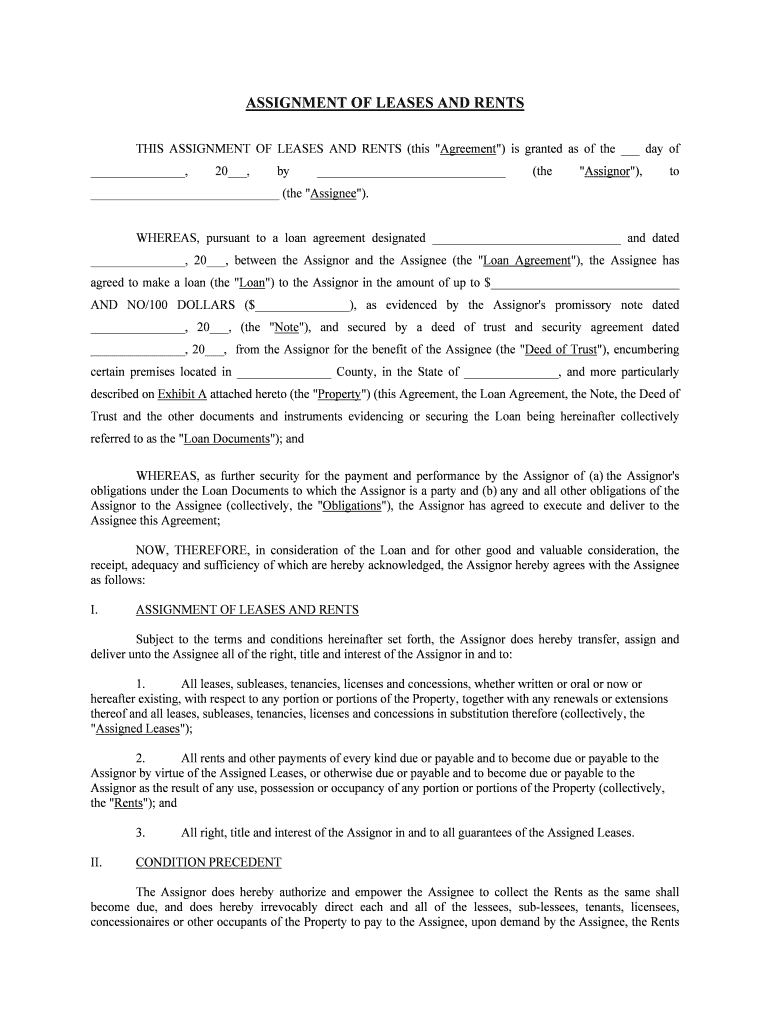

The 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has is a legal document that outlines the terms and conditions under which a loan is transferred from one party, known as the assignor, to another, known as the assignee. This agreement is crucial for clarifying the rights and obligations of both parties involved in the loan transaction. It typically includes details such as the principal amount, interest rate, repayment terms, and any collateral involved. Understanding this document is essential for both parties to ensure compliance with legal standards and to protect their financial interests.

Steps to Complete the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

Completing the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has involves several important steps:

- Gather necessary information: Collect all relevant details about the loan, including the amount, interest rate, and repayment schedule.

- Draft the agreement: Use a clear format to outline the terms of the loan transfer, ensuring all parties understand their responsibilities.

- Review legal requirements: Ensure that the agreement complies with state and federal laws regarding loan transfers.

- Obtain signatures: Both the assignor and assignee must sign the document to make it legally binding.

- Store the document securely: Keep a copy of the signed agreement in a safe place for future reference.

Legal Use of the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

The legal use of the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has is fundamental in ensuring that the transfer of the loan is recognized by law. This document serves as proof of the assignment, protecting the rights of both the assignor and the assignee. It is essential that the agreement meets all legal requirements, including proper identification of the parties involved and adherence to state-specific regulations. Failure to comply with these legal standards may result in disputes or the invalidation of the agreement.

Key Elements of the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

Several key elements must be included in the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has to ensure its validity:

- Identification of parties: Clearly state the names and addresses of both the assignor and the assignee.

- Description of the loan: Include details about the loan amount, interest rate, and repayment terms.

- Signatures: Both parties must sign the agreement to confirm their acceptance of the terms.

- Date of agreement: Specify the date when the agreement is executed.

- Governing law: Indicate which state’s laws will govern the agreement.

How to Use the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

Using the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has effectively involves understanding its purpose and ensuring proper execution. Once the agreement is completed and signed, it should be distributed to all parties involved. Each party should retain a copy for their records. This document may also need to be presented to financial institutions or legal entities if required. Proper use of this agreement helps maintain transparency and accountability in the loan transfer process.

Examples of Using the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

Examples of using the 20 Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has include:

- Personal loans: When an individual transfers their loan obligations to another person.

- Business loans: A company may assign its loan to another entity as part of a restructuring process.

- Real estate transactions: When a property owner assigns their mortgage to a new buyer as part of a sale.

Quick guide on how to complete 20 between the assignor and the assignee the quotloan agreementquot the assignee has

Complete , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has effortlessly

- Locate , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of the 'Loan Agreement' between the Assignor and the Assignee?

The 'Loan Agreement' between the Assignor and the Assignee outlines the terms of the loan, safeguarding the interests of both parties. It ensures clarity on repayment terms, interest rates, and obligations. With airSlate SignNow, you can easily create, send, and eSign your Loan Agreement for a seamless process.

-

How does airSlate SignNow simplify the eSigning process for the 'Loan Agreement'?

airSlate SignNow offers a user-friendly platform that allows you to eSign your 'Loan Agreement' with just a few clicks. The tool is designed for efficiency, enabling both the Assignor and the Assignee to complete their documents quickly. Plus, it provides real-time notifications and tracking, ensuring transparency throughout the agreement process.

-

What are the pricing options for using airSlate SignNow for the 'Loan Agreement'?

airSlate SignNow provides various pricing plans to accommodate different business needs. Whether you're a small business or a large enterprise, there's a plan that fits your budget while ensuring you can effectively manage your 'Loan Agreement' between the Assignor and the Assignee. Visit our pricing page for detailed information on our cost-effective solutions.

-

Can I integrate airSlate SignNow with other tools for managing my 'Loan Agreement'?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your workflow for 'Loan Agreements'. Connect with popular platforms such as Google Drive, Dropbox, and CRM systems. This integration allows for streamlined document management and enhances the efficiency between the Assignor and the Assignee.

-

What security features does airSlate SignNow offer for 'Loan Agreements'?

airSlate SignNow prioritizes your security by implementing advanced encryption and compliance with global security standards. When signing your 'Loan Agreement', both the Assignor and the Assignee can trust that their sensitive information is protected. Our platform also includes features like audit trails for additional peace of mind.

-

Is mobile access available for managing 'Loan Agreements' with airSlate SignNow?

Absolutely! airSlate SignNow provides a mobile-friendly interface that allows you to manage your 'Loan Agreement' on the go. Both the Assignor and the Assignee can easily access, review, and eSign documents from any device, ensuring flexibility and convenience.

-

What support is available if I encounter issues with my 'Loan Agreement' on airSlate SignNow?

Our dedicated support team is available to assist with any issues you may encounter regarding your 'Loan Agreement'. We offer various support channels, including live chat, email, and an extensive knowledge base. airSlate SignNow is committed to providing excellent customer service to enhance your experience.

Get more for , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

Find out other , 20, Between The Assignor And The Assignee the "Loan Agreement", The Assignee Has

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed