Of PERSONAL REPRESENTATIVE Intestate Form

What is the OF PERSONAL REPRESENTATIVE Intestate

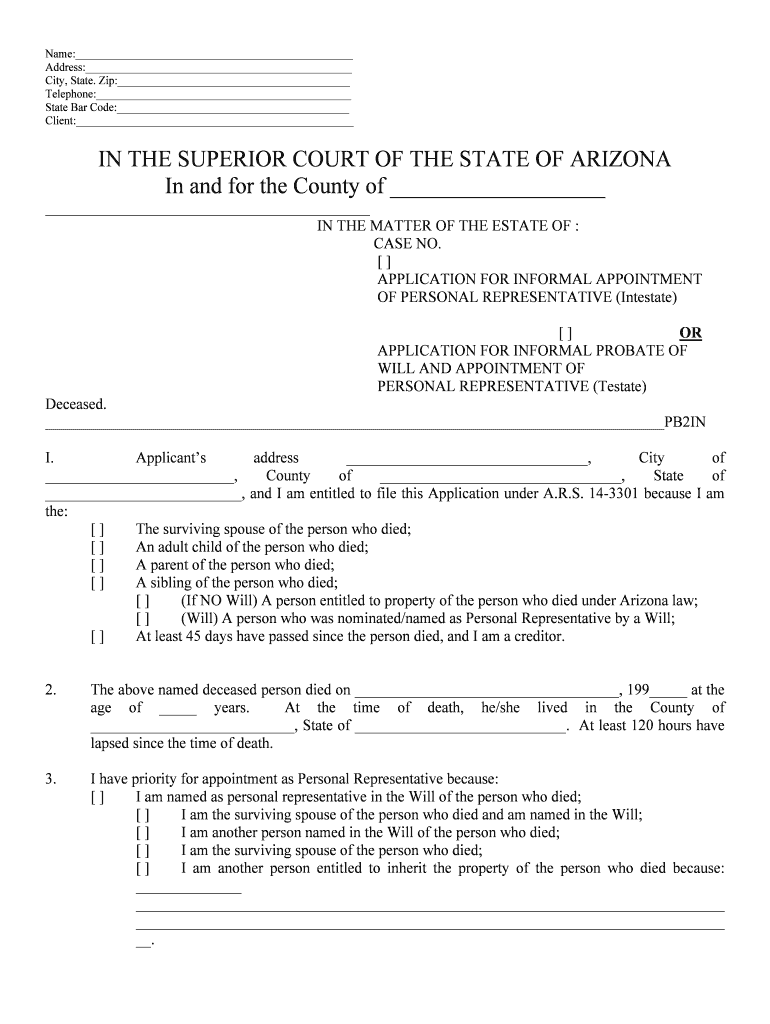

The OF PERSONAL REPRESENTATIVE Intestate form is a legal document used in the United States when an individual passes away without a valid will. This form is crucial for appointing a personal representative, also known as an executor, to manage the deceased's estate. The personal representative is responsible for settling debts, distributing assets, and ensuring that the estate is handled according to state laws. The form outlines the authority granted to the personal representative and may be required by the probate court to initiate the administration process of the estate.

Steps to complete the OF PERSONAL REPRESENTATIVE Intestate

Completing the OF PERSONAL REPRESENTATIVE Intestate form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information about the deceased, including their full name, date of birth, and date of death. Next, identify the heirs and beneficiaries of the estate, as this information will be needed for the form.

Once you have the required information, fill out the form carefully, ensuring that all details are correct. It is important to sign the form in the presence of a notary public, as notarization is often required for the document to be legally binding. After notarization, submit the completed form to the appropriate probate court in your state.

Legal use of the OF PERSONAL REPRESENTATIVE Intestate

The OF PERSONAL REPRESENTATIVE Intestate form serves a critical legal function in the probate process. It grants the personal representative the authority to manage the estate of the deceased, which includes paying off debts, filing taxes, and distributing assets to heirs. The legal use of this form ensures that the estate is administered according to state laws, providing a structured process for resolving the deceased's financial matters.

Failure to properly complete and submit this form can lead to delays in the probate process and potential legal complications. It is essential for the personal representative to understand their responsibilities and the legal implications of the form.

Required Documents

When completing the OF PERSONAL REPRESENTATIVE Intestate form, several documents may be required to support the application. These documents typically include:

- A certified copy of the death certificate of the deceased.

- Identification of the proposed personal representative, such as a driver's license or state ID.

- A list of the deceased's heirs and beneficiaries, including their contact information.

- Any existing wills or codicils, if applicable.

Gathering these documents in advance can streamline the process and help ensure that the form is completed correctly.

State-specific rules for the OF PERSONAL REPRESENTATIVE Intestate

Each state in the U.S. has its own laws and regulations regarding the appointment of a personal representative for intestate estates. It is important to familiarize yourself with the specific rules in your state, as they can vary significantly. Some states may require additional documentation or have different procedures for filing the OF PERSONAL REPRESENTATIVE Intestate form.

Additionally, the qualifications for who can serve as a personal representative may differ by state. Understanding these nuances can help avoid potential legal issues and ensure compliance with state laws.

Examples of using the OF PERSONAL REPRESENTATIVE Intestate

Using the OF PERSONAL REPRESENTATIVE Intestate form is essential in various scenarios. For instance, if an individual passes away without a will, their family members may need to file this form to appoint a personal representative who can manage the estate. Another example is when a long-term partner or friend of the deceased seeks to be appointed as the personal representative, highlighting the importance of the form in ensuring that the deceased's wishes are honored, even in the absence of a will.

These examples illustrate the practical applications of the form and underscore its importance in the probate process.

Quick guide on how to complete of personal representative intestate

Accomplish OF PERSONAL REPRESENTATIVE Intestate effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without holdups. Handle OF PERSONAL REPRESENTATIVE Intestate on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign OF PERSONAL REPRESENTATIVE Intestate without hassle

- Obtain OF PERSONAL REPRESENTATIVE Intestate and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign OF PERSONAL REPRESENTATIVE Intestate and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a personal representative intestate named in airSlate SignNow?

A personal representative intestate is an individual appointed to manage the estate of someone who dies without a valid will. Using airSlate SignNow, you can streamline the process of designing and signing vital documents that appoint a personal representative, ensuring all legal requirements are met efficiently.

-

How does airSlate SignNow help with documentation for a personal representative intestate?

airSlate SignNow provides user-friendly templates and document automation to help you create necessary paperwork for a personal representative intestate. This feature simplifies the task of generating legal documents like deeds and affidavits, ensuring that you can manage these responsibilities with ease.

-

What are the pricing options for using airSlate SignNow for personal representative intestate tasks?

airSlate SignNow offers various pricing plans to fit different needs when managing documents related to personal representative intestate duties. Each plan is designed to provide users with essential features tailored to assist in legal documentation, making it a cost-effective solution for individuals and businesses alike.

-

Can airSlate SignNow integrate with other software for personal representative intestate forms?

Yes, airSlate SignNow can seamlessly integrate with various business software, enhancing your experience in managing personal representative intestate forms. This integration capability allows for better collaboration and ensures you have all necessary tools at your disposal for efficient estate management.

-

What benefits does airSlate SignNow provide for handling intestate affairs?

Using airSlate SignNow for handling intestate affairs allows for reduced paperwork stress and faster processing times. The platform ensures that all documents related to appointing a personal representative intestate are legally compliant, which saves time and reduces the risk of errors.

-

Is airSlate SignNow secure for managing personal representative intestate documents?

Absolutely, airSlate SignNow prioritizes the security of your data. The platform uses advanced encryption and security protocols, ensuring that all documents related to a personal representative intestate are protected and handled with the utmost confidentiality.

-

What types of documents can I prepare for a personal representative intestate using airSlate SignNow?

With airSlate SignNow, you can prepare a variety of documents needed for a personal representative intestate, including forms for asset distribution, authority to act, and notices to creditors. The platform offers customizable templates that make it easy to create these important legal documents.

Get more for OF PERSONAL REPRESENTATIVE Intestate

- History from the dawn of civilization to the present day pdf form

- Cdpas form

- Advantage prior authorization form bridgeway health solutions

- Dd form 2477 3

- Allstate wellness claim form

- Real estate deposit receipt template form

- 480 2 corp 07 21 480 2 corp 07 21 form

- Pediatric sleep center referral form outpatient history and physical millerchildrenshospitallb

Find out other OF PERSONAL REPRESENTATIVE Intestate

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA