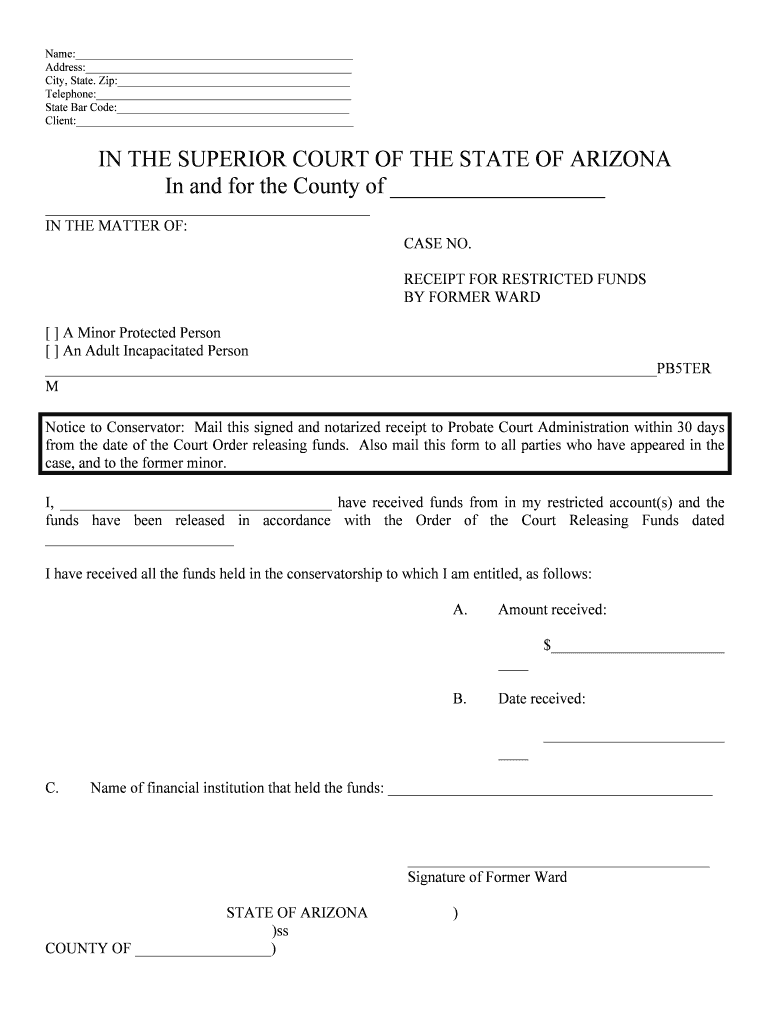

RECEIPT for RESTRICTED FUNDS Form

What is the receipt for restricted funds?

The receipt for restricted funds is a formal document that acknowledges the receipt of funds that are designated for a specific purpose and cannot be used for general expenses. This form is commonly utilized by nonprofit organizations, educational institutions, and other entities that manage funds with specific restrictions. It serves as proof of the transaction and outlines the conditions under which the funds can be utilized, ensuring transparency and accountability in financial management.

Key elements of the receipt for restricted funds

When completing a receipt for restricted funds, certain key elements must be included to ensure its validity and clarity. These elements typically encompass:

- Donor Information: Name and contact details of the individual or organization providing the funds.

- Amount Received: The total sum of money received, clearly stated.

- Purpose of Funds: A detailed description of the specific use for which the funds are intended.

- Date of Receipt: The date on which the funds were received.

- Signature: The signature of the authorized representative acknowledging the receipt.

Steps to complete the receipt for restricted funds

Completing the receipt for restricted funds involves several straightforward steps to ensure accuracy and compliance. Here’s a guide to help you through the process:

- Gather necessary information, including donor details and the amount of funds received.

- Clearly define the purpose of the funds to avoid any ambiguity.

- Fill out the receipt form with the gathered information, ensuring all fields are completed accurately.

- Review the document for any errors or omissions before finalizing it.

- Obtain the necessary signatures from authorized personnel to validate the receipt.

Legal use of the receipt for restricted funds

The receipt for restricted funds holds legal significance as it serves as an official record of the transaction. It is essential for compliance with financial regulations and can be used in audits or legal proceedings to demonstrate proper handling of funds. Organizations must ensure that the receipt is filled out correctly and retained for record-keeping purposes, as failure to do so may lead to legal complications or loss of funding.

How to use the receipt for restricted funds

Using the receipt for restricted funds effectively involves several considerations. Once the receipt has been completed and signed, it should be distributed to relevant parties, including the donor and the organization’s financial department. It is also advisable to maintain a copy for internal records. This document can be referenced in future financial reports, grant applications, or audits to provide evidence of fund management and compliance with donor restrictions.

Examples of using the receipt for restricted funds

There are various scenarios in which a receipt for restricted funds may be utilized. For instance:

- A nonprofit organization receiving donations earmarked for a specific project, such as building a community center.

- An educational institution collecting tuition fees that are designated for a scholarship fund.

- A research entity receiving grants that must be allocated to a particular study or initiative.

In each case, the receipt serves as a critical document to ensure that funds are used according to the stipulations set forth by the donor or funding agency.

Quick guide on how to complete receipt for restricted funds

Effortlessly Prepare RECEIPT FOR RESTRICTED FUNDS on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the proper format and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage RECEIPT FOR RESTRICTED FUNDS on any platform using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

Your Ultimate Guide to Modify and Electronically Sign RECEIPT FOR RESTRICTED FUNDS with Ease

- Find RECEIPT FOR RESTRICTED FUNDS and click Get Form to begin.

- Make use of the available tools to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign option, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about losing or misplacing documents, boring form searches, or errors necessitating the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign RECEIPT FOR RESTRICTED FUNDS and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a RECEIPT FOR RESTRICTED FUNDS?

A RECEIPT FOR RESTRICTED FUNDS is a document that certifies the receipt of money which is designated for a specific purpose. In the context of airSlate SignNow, it ensures that funds are tracked and managed correctly, providing transparency and accountability for your transactions.

-

How does airSlate SignNow help in generating RECEIPT FOR RESTRICTED FUNDS?

airSlate SignNow simplifies the process of creating a RECEIPT FOR RESTRICTED FUNDS with customizable templates. Users can easily input necessary details and send the document for electronic signature, ensuring a quick and efficient process.

-

Is there a cost associated with generating RECEIPT FOR RESTRICTED FUNDS using airSlate SignNow?

While there is a subscription cost for using airSlate SignNow, the ability to generate RECEIPT FOR RESTRICTED FUNDS is included in all our pricing plans. This means you can create, send, and manage your restricted funds receipts at no additional charge, maximizing your investment.

-

What features are available for managing RECEIPT FOR RESTRICTED FUNDS?

With airSlate SignNow, you can store, track, and retrieve RECEIPT FOR RESTRICTED FUNDS easily. The platform offers features like cloud storage, real-time tracking of document status, and email notifications when documents are signed, all designed to streamline document management.

-

Can I integrate airSlate SignNow with other financial tools for RECEIPT FOR RESTRICTED FUNDS?

Yes, airSlate SignNow offers integrations with a variety of financial software tools. This helps streamline workflows involving RECEIPT FOR RESTRICTED FUNDS, making it easier to sync data and maintain accurate financial records across platforms.

-

What are the benefits of using airSlate SignNow for RECEIPT FOR RESTRICTED FUNDS?

Using airSlate SignNow for generating RECEIPT FOR RESTRICTED FUNDS saves time and enhances accuracy. The platform ensures that documents are signed electronically and stored securely, which reduces paperwork and minimizes the chances of errors.

-

How secure is the information in my RECEIPT FOR RESTRICTED FUNDS using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including RECEIPT FOR RESTRICTED FUNDS. With advanced encryption and strict compliance with industry security standards, you can trust that your sensitive information is well-protected during the eSigning process.

Get more for RECEIPT FOR RESTRICTED FUNDS

Find out other RECEIPT FOR RESTRICTED FUNDS

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement