ADD'L INFO RE 22e Form

What is the ADD'L INFO RE 22e

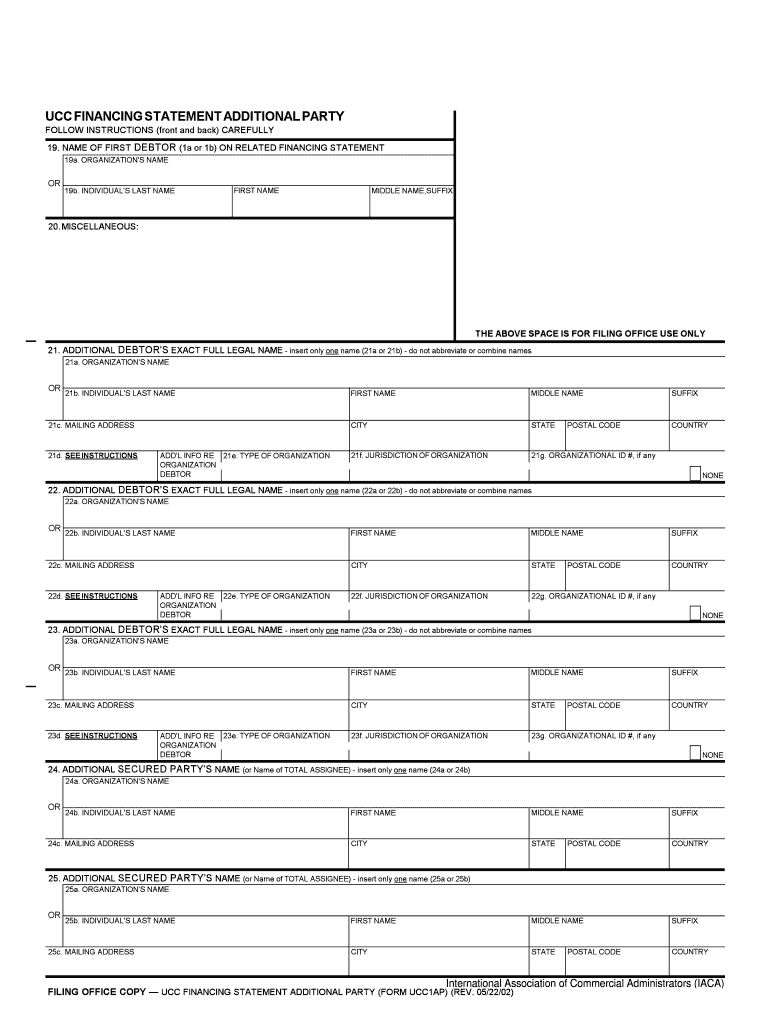

The ADD'L INFO RE 22e form is a supplemental document used primarily in the context of tax filings. It provides additional information required by the IRS to support the details submitted on the main tax return. This form is essential for taxpayers who may need to clarify specific aspects of their financial situation or provide further documentation related to deductions, credits, or other tax-related matters. Understanding the purpose and requirements of this form can help ensure compliance with IRS regulations.

How to use the ADD'L INFO RE 22e

Using the ADD'L INFO RE 22e form involves several key steps. First, gather all necessary financial documents, including previous tax returns, W-2s, and any relevant receipts or statements. Next, accurately fill out the form, ensuring that all requested information is complete and correct. Once completed, the form should be submitted alongside your primary tax return to the IRS. It is crucial to keep a copy of the ADD'L INFO RE 22e for your records, as it may be needed for future reference or audits.

Steps to complete the ADD'L INFO RE 22e

Completing the ADD'L INFO RE 22e form requires careful attention to detail. Follow these steps to ensure accuracy:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation that supports the information you will provide.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide detailed explanations or additional information as required in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the ADD'L INFO RE 22e

The ADD'L INFO RE 22e form is legally recognized by the IRS as a valid document for providing additional information related to tax filings. To ensure its legal standing, it must be filled out correctly and submitted within the appropriate timeframe. Compliance with IRS guidelines is essential, as failure to provide accurate information can lead to penalties or delays in processing your tax return. It is advisable to consult with a tax professional if you have questions about the legal implications of this form.

Filing Deadlines / Important Dates

Filing deadlines for the ADD'L INFO RE 22e form align with the general tax return deadlines established by the IRS. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is important to submit the ADD'L INFO RE 22e form by this deadline to avoid penalties. If you need an extension, you must file for it separately, ensuring that you still submit the ADD'L INFO RE 22e form by the extended deadline.

Required Documents

To effectively complete the ADD'L INFO RE 22e form, several documents may be required. These typically include:

- Your most recent tax return.

- W-2 forms from all employers.

- 1099 forms for any additional income.

- Receipts or documentation for deductions or credits claimed.

- Any correspondence from the IRS regarding your tax situation.

Having these documents readily available will streamline the process of completing the form and ensure that all necessary information is included.

Quick guide on how to complete addl info re 22e

Complete ADD'L INFO RE 22e effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage ADD'L INFO RE 22e on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign ADD'L INFO RE 22e without hassle

- Locate ADD'L INFO RE 22e and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign ADD'L INFO RE 22e and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ADD'L INFO RE 22e in the context of airSlate SignNow?

ADD'L INFO RE 22e refers to the additional information regarding the legal and compliance aspects of using airSlate SignNow's eSignature solutions. It highlights the importance of adhering to regulations while ensuring that your documents are securely signed and stored.

-

How does airSlate SignNow enhance document security related to ADD'L INFO RE 22e?

airSlate SignNow incorporates enterprise-level security features to protect sensitive documents associated with ADD'L INFO RE 22e. This includes encryption, audit trails, and secure cloud storage, ensuring that your eSignature processes meet compliance standards.

-

What benefits does airSlate SignNow offer for businesses considering ADD'L INFO RE 22e?

With ADD'L INFO RE 22e, businesses can benefit from streamlined workflows, faster document turnaround times, and increased compliance. airSlate SignNow empowers teams to manage their eSigning needs efficiently while reducing operational costs.

-

What are the pricing plans available for airSlate SignNow that relate to ADD'L INFO RE 22e?

airSlate SignNow offers a variety of pricing plans that align with the needs of businesses focusing on ADD'L INFO RE 22e. These plans are designed to be cost-effective, providing flexible options based on the number of users and features required for compliance and security.

-

Can airSlate SignNow integrate with other tools to support ADD'L INFO RE 22e?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing the functionality related to ADD'L INFO RE 22e. This enables organizations to create a comprehensive digital workflow that supports compliance and efficiency.

-

How user-friendly is airSlate SignNow for implementing ADD'L INFO RE 22e?

airSlate SignNow is designed with user experience in mind, ensuring that implementing ADD'L INFO RE 22e is straightforward for all team members. The intuitive interface and easy onboarding process help users adopt eSigning quickly and effectively.

-

What features of airSlate SignNow assist with regulatory compliance tied to ADD'L INFO RE 22e?

Key features of airSlate SignNow, such as customizable templates, advanced authentication methods, and audit logs, assist businesses in maintaining regulatory compliance related to ADD'L INFO RE 22e. These elements ensure that all signatures are legally binding and verifiable.

Get more for ADD'L INFO RE 22e

- Emergency contact form save the children savethechildren

- Lefs follow up and discharge visit body mechanix physical therapy form

- Hamipatra in marathi format pdf

- Intel letterhead form

- Greenville news weddings form

- Utah tc 40 individual income tax return form

- International data transfer agreement template form

- Offer and acceptance contract template form

Find out other ADD'L INFO RE 22e

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast