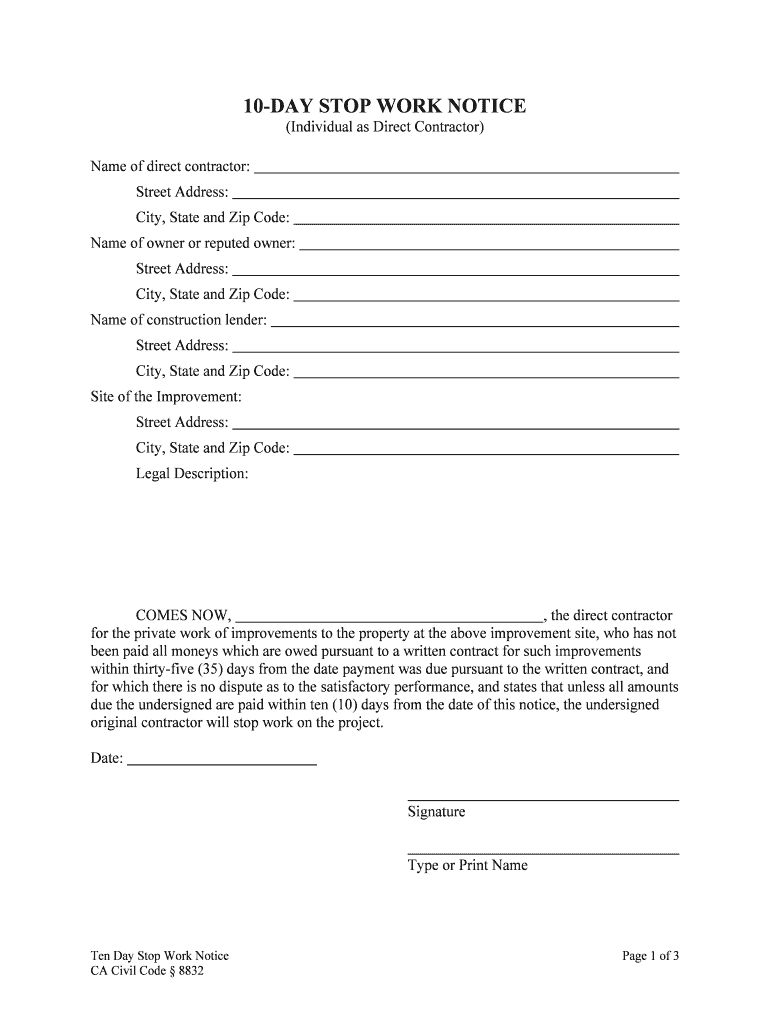

Individual as Direct Contractor Form

What is the Individual As Direct Contractor

The Individual As Direct Contractor form is a crucial document used in various business and tax contexts. It serves as a declaration that an individual is working as an independent contractor rather than an employee. This distinction is important for tax purposes, as it affects how income is reported and what deductions can be claimed. The form typically includes information about the contractor's services, payment terms, and other relevant details that define the working relationship.

Steps to complete the Individual As Direct Contractor

Completing the Individual As Direct Contractor form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details, the nature of the services provided, and payment arrangements. Next, fill out the form carefully, ensuring that all sections are completed. After completing the form, review it for any errors or omissions. Finally, sign the document electronically or in print, depending on the submission method chosen.

Legal use of the Individual As Direct Contractor

The legal use of the Individual As Direct Contractor form is governed by various federal and state regulations. It is essential for the form to meet specific legal requirements to be considered valid. This includes compliance with the IRS guidelines for independent contractors, ensuring that the contractor is not misclassified as an employee. Proper use of this form protects both the contractor and the hiring entity by clarifying the terms of the working relationship and establishing rights and responsibilities.

Key elements of the Individual As Direct Contractor

Several key elements must be included in the Individual As Direct Contractor form to ensure its effectiveness and legality. These elements typically encompass the contractor's full name, contact information, a description of the services provided, payment terms, and any applicable deadlines. Additionally, it may require the contractor's tax identification number and a signature to validate the agreement. Including these elements helps to create a clear and binding contract between the parties involved.

Examples of using the Individual As Direct Contractor

Examples of using the Individual As Direct Contractor form can be found across various industries. For instance, a freelance graphic designer may use this form when contracting with a business for design services. Similarly, a consultant providing expertise in a specific field might complete this form to outline the terms of their engagement with a client. These examples illustrate the versatility of the form in establishing clear working relationships in diverse professional settings.

IRS Guidelines

The IRS provides specific guidelines regarding the classification of independent contractors versus employees. Understanding these guidelines is essential for anyone using the Individual As Direct Contractor form. The IRS evaluates factors such as the degree of control the employer has over the worker, the financial aspects of the relationship, and the nature of the work performed. Adhering to these guidelines helps to ensure compliance and avoid potential penalties associated with misclassification.

Required Documents

When completing the Individual As Direct Contractor form, certain documents may be required to support the information provided. These documents can include proof of identity, such as a driver's license or Social Security card, as well as any relevant business licenses or permits. Additionally, having a copy of previous contracts or agreements can help clarify the terms of the current engagement. Gathering these documents in advance can streamline the completion process and enhance the form's credibility.

Quick guide on how to complete individual as direct contractor

Complete Individual As Direct Contractor seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Individual As Direct Contractor on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Individual As Direct Contractor effortlessly

- Locate Individual As Direct Contractor and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Individual As Direct Contractor and guarantee effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit an Individual As Direct Contractor?

airSlate SignNow is an efficient solution that empowers an Individual As Direct Contractor to easily send and eSign documents. It streamlines workflows, saves time, and reduces paperwork, enabling contractors to focus on their core tasks while enhancing their professional image.

-

How much does airSlate SignNow cost for an Individual As Direct Contractor?

Pricing for airSlate SignNow varies based on the chosen plan, but it remains cost-effective for an Individual As Direct Contractor. With flexible pricing options, you can select a plan that best fits your budget without compromising on essential features.

-

What key features does airSlate SignNow offer for someone working as an Individual As Direct Contractor?

airSlate SignNow offers robust features such as customizable templates, real-time tracking, and automatic notifications. These tools make it easier for an Individual As Direct Contractor to manage their documents efficiently and maintain timely communication with clients.

-

Is airSlate SignNow easy to use for an Individual As Direct Contractor?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it perfect for an Individual As Direct Contractor. The intuitive interface allows users to navigate the platform effortlessly, reducing the learning curve and promoting quick adoption of the service.

-

Can an Individual As Direct Contractor integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow allows an Individual As Direct Contractor to integrate seamlessly with numerous applications such as Google Drive, Dropbox, and CRM systems. This interoperability enhances document management and improves overall workflow efficiency.

-

How does airSlate SignNow ensure document security for an Individual As Direct Contractor?

airSlate SignNow prioritizes data security for an Individual As Direct Contractor by implementing advanced encryption and compliance protocols. This ensures that your sensitive documents are protected and shared securely, giving you peace of mind while conducting business.

-

What are the benefits of using airSlate SignNow for an Individual As Direct Contractor?

Using airSlate SignNow provides an Individual As Direct Contractor with increased efficiency and professionalism. The platform reduces the turnaround time for document signing while providing a clear audit trail, which is essential for maintaining records and ensuring accountability.

Get more for Individual As Direct Contractor

Find out other Individual As Direct Contractor

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast