Please Read All Instructions Prior to Submitting Section J Forms

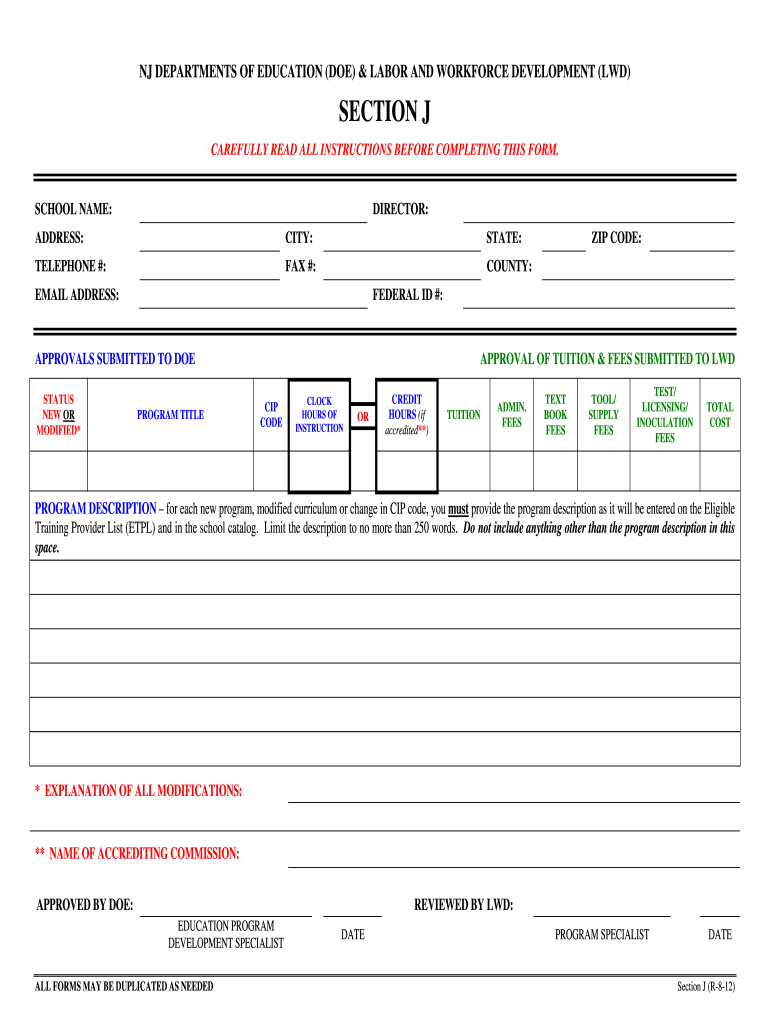

Understanding the Section J Form

The Section J form is essential for various administrative and legal processes, particularly in educational settings. It serves as a declaration of personal information, financial status, and other relevant details required by institutions or organizations. Understanding its purpose is crucial for accurate completion and compliance with regulations. This form is often utilized by teachers and educational staff to provide necessary disclosures related to their employment and financial circumstances.

Steps to Complete the Section J Form

Filling out the Section J form involves several key steps to ensure accuracy and compliance. Begin by gathering all required personal and financial information. This may include your full name, address, employment details, and any relevant financial disclosures. Carefully read each section of the form, ensuring you understand the requirements. Fill in the information accurately, double-checking for any errors before submission. It is advisable to consult with a supervisor or legal advisor if you have questions about specific sections.

Legal Use of the Section J Form

The Section J form must be completed in accordance with applicable laws and regulations. It is essential to understand that the information provided is legally binding and may be subject to verification by the requesting organization. Compliance with laws such as the Family Educational Rights and Privacy Act (FERPA) ensures that personal information is handled appropriately. Failure to adhere to these legal standards can result in penalties or issues with employment status.

Required Documents for Submission

When submitting the Section J form, certain documents may be required to support the information provided. Commonly required documents include proof of identity, employment verification letters, and any financial statements that may be relevant. It is important to check the specific requirements of the institution or organization requesting the form, as these can vary. Having all necessary documents ready will facilitate a smoother submission process.

Form Submission Methods

The Section J form can typically be submitted through various methods, including online platforms, mail, or in-person delivery. Online submission is often the most efficient, allowing for quick processing and confirmation. If mailing the form, ensure it is sent to the correct address and consider using a trackable method for security. In-person submissions may require scheduling an appointment or adhering to specific office hours.

Examples of Using the Section J Form

Examples of situations where the Section J form is utilized include employment applications for teaching positions, annual disclosures for educational staff, and compliance checks for financial aid eligibility. Understanding these contexts can help individuals better prepare their submissions and ensure they meet all necessary requirements. Each example highlights the importance of accuracy and thoroughness in completing the form.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines associated with the Section J form. Many educational institutions have specific timelines for submission, particularly during hiring seasons or fiscal year-end reviews. Missing these deadlines can result in delays in processing or potential denial of employment or benefits. Always check with the relevant institution for the most current deadlines and plan accordingly to ensure timely submission.

Quick guide on how to complete nj section j form

Complete Please Read All Instructions Prior To Submitting Section J Forms effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your paperwork swiftly without any holdups. Manage Please Read All Instructions Prior To Submitting Section J Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Please Read All Instructions Prior To Submitting Section J Forms without hassle

- Find Please Read All Instructions Prior To Submitting Section J Forms and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document administration needs in just a few clicks from your device of choice. Alter and eSign Please Read All Instructions Prior To Submitting Section J Forms while ensuring superb communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

What will be the appropriate section to choose while filling out the ITR 1 form online?

Please find details of return filed under sectionSection 139(1) – Original return filed before the last due date for filing returnOriginal returnfiling for the first time in an assessment yearSection 139(4) – Belated returnOriginal returnFiling for the first time after the due date of filing the return for the assessment yearSection 139(5) – Revised returnRevised return filed subsequent to original returnThis will be revised returnVoluntarily filing the revised returnInfo needed is:Acknowledgement numberdate of filing originalSection 139(9) – Defective returnWhen due to an error, the return is considered as defective (as if no return has been filed)The department may issue notice to correct the errors and file the returnSo the return filed subsequent to the intimation u/s 139(9) will be original returnYou have to provide following info while filing the return in response to noticeReceipt No: i.e Acknowledgement number of Original (Defective in this case) returnDate of filing the original (Defective in this case) returnNotice no. (Eg. CPC/1415/G5/1421417689)Date of NoticeSection 142(1) – Notice to assessee for filing the returnWhen a person has not filed the return, he may receive notice u/s 142(1) asking him to file the returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 142(1)Section 148 – Issue of notice for reassessment (Income escaping assessment)Department can issue a notice to a person for filing the income tax return u/s 148This will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 148Section 153A – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153A to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153ASection 153C – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153C to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153CBe Peaceful !!!

-

Are final year students eligible to fill out the Railway Recruitment Board (RRB) Senior Section Engineer form?

you have to complete your Degree first to give Railway Recruitment Board (RRB) Senior Section Engineer Exam.As the Indian Railways is one known to be as one of the biggest employers in India. It releases it a high number of vacancies every year for a various number of fields. One amongst them is the RRB Senior Section Engineer.Eligibility CriteriaMust be in age between 20-34 years.Educational Qualification RequiredDegree in Civil Engineering from a recognized university or Institution.For more information you can also read here, RRB Recruitment Notification, Jobs, ExamsCheck Here, RRB(Railway Recruitment Board) latest Notification.

Create this form in 5 minutes!

How to create an eSignature for the nj section j form

How to make an eSignature for the Nj Section J Form online

How to generate an eSignature for the Nj Section J Form in Chrome

How to create an eSignature for putting it on the Nj Section J Form in Gmail

How to create an electronic signature for the Nj Section J Form right from your mobile device

How to create an electronic signature for the Nj Section J Form on iOS devices

How to create an electronic signature for the Nj Section J Form on Android

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a powerful e-signature solution that empowers businesses to send and eSign documents easily and efficiently. With its user-friendly interface, you can streamline your document management process. It's essential to Please Read All Instructions Prior To Submitting Section J Forms to ensure compliance and accuracy in your submissions.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans to suit different business needs, making it a cost-effective solution. You can choose from monthly or annual subscriptions, and each plan includes features that facilitate document signing. To get the most value from your plan, be sure to Please Read All Instructions Prior To Submitting Section J Forms.

-

What features does airSlate SignNow offer?

airSlate SignNow comes packed with features such as customizable templates, real-time tracking, and secure cloud storage. These tools enhance productivity and keep your documents organized. Remember to Please Read All Instructions Prior To Submitting Section J Forms to maximize the benefits of these features.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various third-party applications like Google Drive, Salesforce, and more. This integration helps streamline your workflow and enhances productivity. To fully utilize these integrations, please ensure you Please Read All Instructions Prior To Submitting Section J Forms.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, employing encryption and compliance with industry standards. This ensures that your sensitive information is protected throughout the signing process. Always remember to Please Read All Instructions Prior To Submitting Section J Forms to maintain data integrity.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore its features and capabilities. Before making any submissions, be sure to Please Read All Instructions Prior To Submitting Section J Forms to ensure you understand the platform’s functionalities.

-

What support options are available for airSlate SignNow users?

airSlate SignNow offers a variety of support options, including a comprehensive knowledge base, live chat, and email support. These resources are designed to assist you with any questions or issues you may encounter. For the best experience, please remember to Please Read All Instructions Prior To Submitting Section J Forms.

Get more for Please Read All Instructions Prior To Submitting Section J Forms

- Financial responsibility affidavits tngov form

- Da 348 form 267000

- Application for a premiumpolicy review form worksafe qld

- Medicare enrolment form ms004

- Application form for approval as an approved authorised treatment

- Vtg15 form

- Get the application for an environmental permit part b65 form

- Form application to discharge up to 15m3 a day into ground

Find out other Please Read All Instructions Prior To Submitting Section J Forms

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT